Samsung 'hungry' for acquisitions, R&D for new growth

Samsung Electronics wants to invest more money for new growth technologies, and part of that will come from being more aggressive in mergers and acquisitions as well as R&D.

M&A will aim to reinforce current businesses, secure talent and find new opportunities, said Lee Sang-hoon, president and CFO of Samsung Electronics. The company has already spent about US$1 billion investing in 14 companies since 2010, which has been "somewhat conservative".

Lee was kicking off Samsung's first Analyst Day since 2005 in Seoul which was streamed live. The event is seen as a platform for the company to better communicate with investors and analysts, amid sagging share prices and returns.

Samsung currently has a cash pile of around US$50 billion, which is about 20 percent of its market capitalization and has attracted complaints from investors of being at a level too high at their expense. According to Lee, the war chest will now being prepared for "significant investment" in strategic technologies, mergers or acquisitions.

"We plan to allocate a significant portion of our annual cash flow into capex and R&D to secure future growth and shareholder return," Lee said.

Balancing growth vs dividends

Despite a more aggressive stance to invest more for growth, Samsung also announced a more generous dividend policy to distribute its free cash.

Samsung will double its dividend yield to around 1 percent of its share price, compared with 0.5 percent last year. This ratio would be reviewed every three years to reflect changes in business conditions, added the CFO.

The new approach is an interesting balance as many high growth mode companies, particularly in technology such as Google, typically shy away from offering dividends in favor of investing their spare cash.

Spending more on R&D

Samsung will invest US$14 billion on research and development by the end of 2013, compared with US$8 billion in 2010, said the CFO. A key area of focus will be beefing up its competencies in software to match its strengths in hardware.

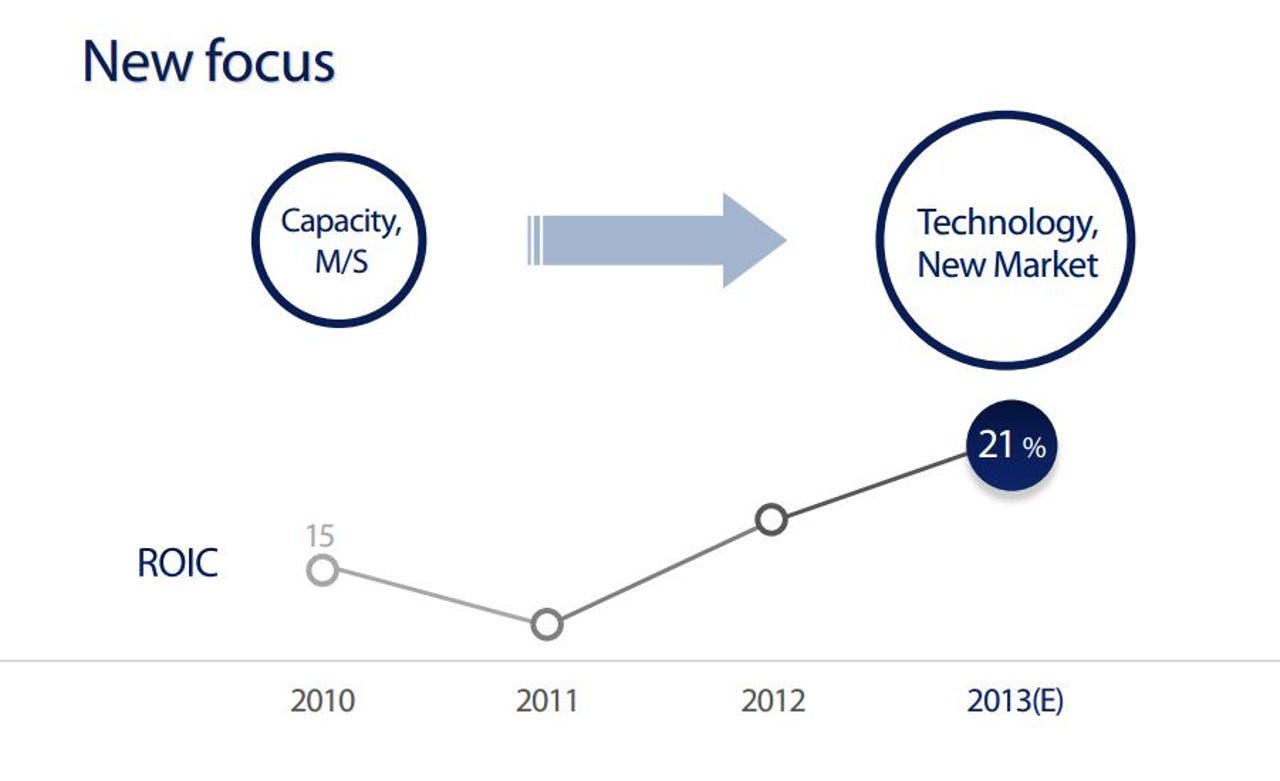

Lee noted the company has been gradually shifting its focus of investment from making gains in existing markets to "new market creation," and will "continue this strategy in the near future". This was highlighted in an example later brought up by JK Shin, president and CEO of IT and mobile communications, who pointed out Samsung created the "fonblet" market, also known as phablets.

In the mobile space, Samsung expects the rollout of LTE-Advanced (LTE-A) networks across the developed world to drive handset sales in markets that already have a high level of smartphone penetration.

Patent protection planning

Samsung has also been investing big on the patent front, said Lee. "As products become more complex, the number of patent disputes is on the rise, leading to greater exposure to patent risk."

In 2010, the company set up an intellectual property center to centralize its patent capability efforts, along with country-level IP centers worldwide. The CFO added Samsung now also ropes in its in-house team of patent experts, which number about 600, into the new product development cycle "at the planning stage."

Just last month, Samsung was among the Android handset makers along with Google who were sued by Rockstar patent consortium--owned by Microsoft, Apple, BlackBerry, Ericcson and Sony. This came just weeks after Samsung said it would no longer bring rivals to court over certain patent infringement cases for the next five years.