SAP: Is the worst over?

Analysts have been tripping over themselves trying to call the trough of demand for SAP applications.

SAP (detailed quote) has been upgraded twice in two days. Bank of America-Merrill Lynch upgraded SAP to buy from neutral on Thursday given "the low expectation level." Simply put, business isn't getting worse for SAP and that means the second half of 2009 should look better due to easier comparisons.

The latest upgrade echoes comments from Jeffries on Wednesday.

Also see: What should SAP do with its $5bn war chest?

What really happened with SAP Business ByDesign?

Jeffries analyst Ross MacMillan, who also upgraded SAP to a buy from a neutral, wrote in a research note:

Our checks suggest that SAP got through the tough 2Q09 quarter in OK shape. As a result we have slightly raised our 2Q09 license revenue estimate, but we'd point out that this new number still suggests a 45% Y/Y decline in license revenue. First, our SI contacts universally saw nothing out of the ordinary from the SAP sales force late in the quarter. Usually when things are tight at quarter end there is outreach from the direct sales organization to see what might be closeable or where consulting organizations may help get deals over the goal line. Second, we heard of decent sized deals across a number of verticals, but would highlight a number in the food processing, retail and financial services industries, whereas discrete manufacturing remains an area of weakness. We did not hear of any really large deals this quarter, but we think that reflects the structural change in customer buying patterns. Third, we are starting to hear about an improving pipeline for SAP and we think coverage relative to plan is beginning to pick up. In particular we heard of improving pipeline around CRM and HCM deals and we have heard of substantial new RFPs in retail, financial services and public sector. Fourth, on a regional basis we think the US outperformed EMEA, although the comps in the Americas were tougher than for EMEA. We think some parts of central EMEA remain soft, but that other such as the UK are showing surprising resiliency/ improvement.

That take is a mixed bag in the things are less worse camp. The biggest argument for SAP right now is that expectations are low and investors think that Oracle is taking share. If that's not the case, SAP has some easy expectations hurdles to clear.

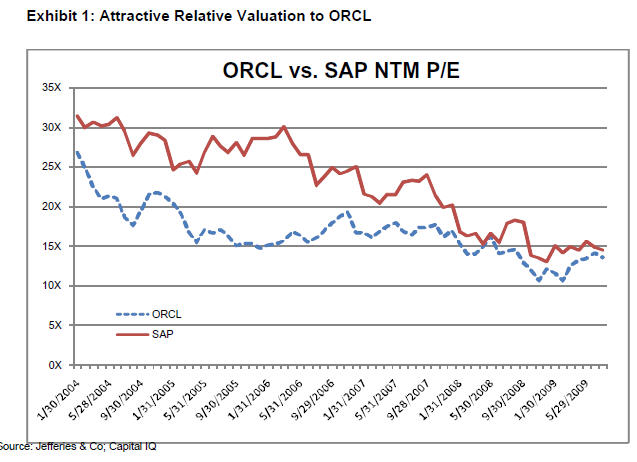

The other part of MacMillan's argument is that SAP is relatively cheap based on its historical valuation compared to Oracle (detailed quote). SAP historically has carried a premium to Oracle. The big question is whether that premium should last into the future. After all, Oracle has consistently delivered solid quarters.

Also see: Why Oracle bought Sun: 60% of enterprise software vendors rely on Java