SAP Q3: sales down, profit up

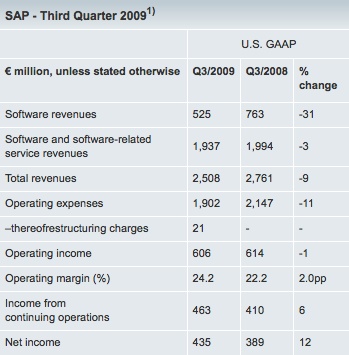

SAP's Q3 results demonstrate continuing softening in the enterprise software sales market. Revenues were down year on year by 31% to €525 million ($787 mill) from €763 million ($1.144 bn) in the same period 2008. Software and software related service revenues declined 3% or €57 million ($85 mill) year on year. In a pre-prepared statement, the company said it is tracking software and software related service revenues down 6-8% for the full year. It is perhaps an indication of the lack of clarity in seeing the market forward that in July, SAP thought this number would track down 4-6%.

SAP is close to achieving its planned 3,000 headcount reduction for 2009 by year end. This together with other savings measures means SAP has improved operating margins from 22.2% to 24.2%. However, the scale of decline on the top line means that net income fell from €614 million ($921 mill) to €606 million ($909 mill). Talking to SAP insiders, it is anticipated that there will be further restructuring in early 2010.

In a prepared statement that company said:

“Despite the continued tough spending environment, we are pleased to see further progress in the evolution of our volume business as a result of smaller deals,” said Léo Apotheker, CEO of SAP. “In addition, we are driving more multi-year agreements, where customers buy and consume software over many periods, which we believe is a positive transition for both SAP and our customers. We have the benefit of many years of experience in facilitating the purchase of our software in this manner, including the success we had in signing multi-year, Global Enterprise Agreements with our largest customers. We have now started to leverage this approach with a bigger group of customers. And, most importantly, our solutions are built on a highly flexible and modular architecture allowing us to easily adopt this model.”

SAP has been offering its largest customers an 'all you can eat' model which, for a fixed price, allows those customers access to all SAP tools and technologies. This is a form of subscription based model in that SAP recognizes revenue over the life of the agreement. It gives SAP revenue certainty over long periods, typically five years. The flip side is that customers have cost certainty plus the opportunity to consume technology at a pace that suits them without the constraints of long sales negotiation cycles. The extent to which this is a buyer win is not entirely clear. Senior managers I have spoken with say that SAP can only make these arrangements work successfully by ensuring that customers have quality access to the technologies, consultants and product roadmap such that customers can plan for adoption.

Apotheker is fielding a Q&A at 11am CET and an analyst call at 3pm CET.