SEC launches spoof cryptocurrency ICO scam website

SEC has launched a spoof Initial Coin Offering (ICO) website in a bid to educate and warn investors of the dangers posed by the ICO Wild West.

Security

As interest in cryptocurrencies continues to expand, this has sparked a new industry. When legitimate, ICOs are designed to give startups and -- generally -- cryptocurrency-related projects a cash injection and a chance to get off the ground without appealing to angel investors or traditional financial institutions.

ICOs are usually offered for a fixed time, and in return for investors handing over standard cryptocurrencies including Bitcoin (BTC) and Ethereum (ETH), they are given a form of branded cryptocurrency token.

However, the ICO scene is full to the brim with exit scams, data breaches, and criminal schemes which can leave investors seriously out of pocket.

SEC is currently pursuing a dozen companies for allegedly conducting ICO exit scams. However, the US agency is not content with dealing with fraudulent ICOs after the fact and instead hopes to educate investors to prevent such scams being successful in the first place.

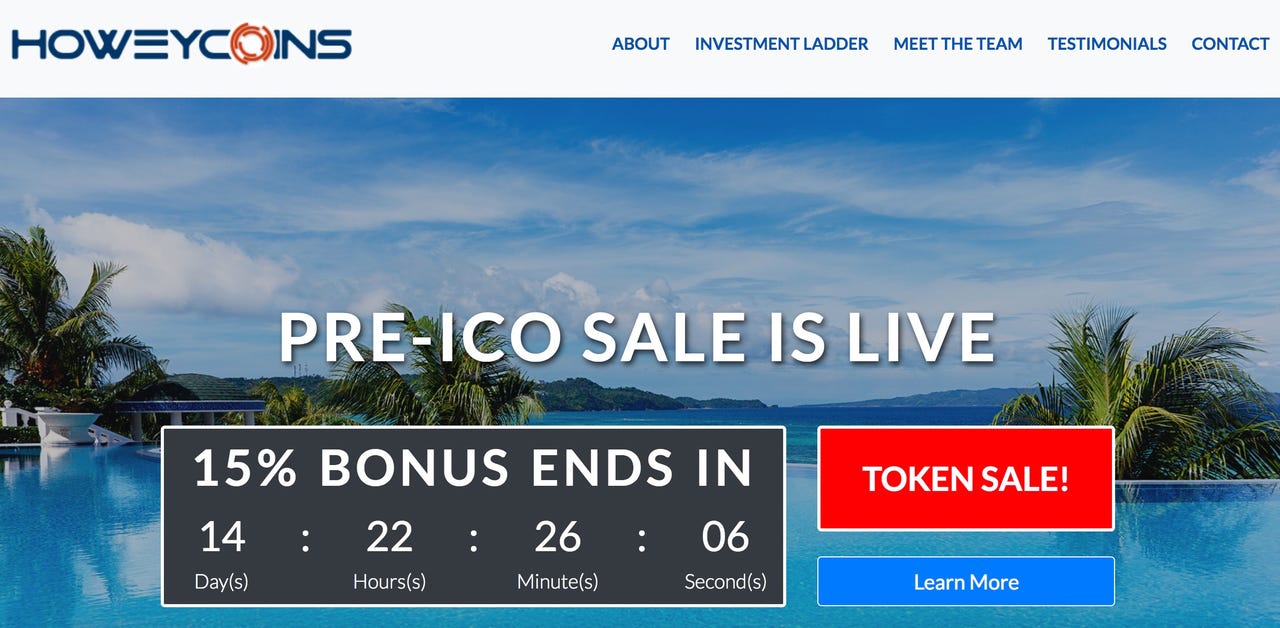

The US Securities and Exchange Commission (SEC) said on Wednesday that the new spoof website, dubbed HoweyCoins, is a mock ICO designed to "educate investors about what to look for before they invest in a scam."

SEC's website bears all the hallmarks of language and graphics used to entice investors to part with their cash, including a large countdown timer, promises to partner with established companies in other industries, promises to register with SEC itself, and, of course, high returns on original investments.

HoweyCoins says it combines the "blockchain and travel" to offer ICO participants massive discounts on travel expenses. The fake company claims to "capture the magic of coin trading profits AND the excitement and guaranteed returns of the travel industry."

"The rapid growth of the ICO market, and its widespread promotion as a new investment opportunity, has provided fertile ground for bad actors to take advantage of our Main Street investors," said SEC Chairman Jay Clayton. "We embrace new technologies, but we also want investors to see what fraud looks like, so we built this educational site with many of the classic warning signs of fraud."

In a white paper (.PDF), downloadable through the website, more indicators of a potential scam are present. Potential investors are lured with a pledge of holiday discounts and cost savings of 30 to 40 percent based on "projected" HoweyCoin future values as well as a mild warning that these savings will likely decrease after the ICO event.

Images of an expensive lifestyle and luxury, a "white paper" which shows convoluted research of some kind, a countdown clock, a bonus percentage for participating, and baseless promises of riches to come. This is a recipe that many fraudulent ICOs use -- and HoweyCoins mimics well.

However, anyone that clicks the "Buy Coins Now" link is instead diverted to an investor education page with advice from the US agency.

More often than not, ICOs promise future businesses and return on investment which appears to be too good to be true. Unfortunately for would-be investors, many of these events simply fleece them of cryptocurrency and gives back nothing in return.

HoweyCoins was so named as a reference to the Howey test, which is used to determine whether or not a transaction is an investment contract. The four-part test, established in 1946, ascertains whether or not a transaction is an investment contract or security.

See also: Cryptojacking attacks surge against enterprise cloud environments

If it is the latter, it is generally under SEC regulation.

If ICOs come under securities law, ICO traders must be vetted and offering companies and advisors need to have a strong, thorough knowledge of how to conduct securities events.

ICOs will often call their coins "utility tokens" to avoid these regulatory hurdles. The US agency is in the midst of tackling how best to regulate ICOs, but in the meantime, education might help stem the flow of fraudulent events.