Smartphones: A look at the app count, market share disconnect

When it comes to global smartphone market share the numbers of apps a platform has doesn't necessarily translate to global domination.

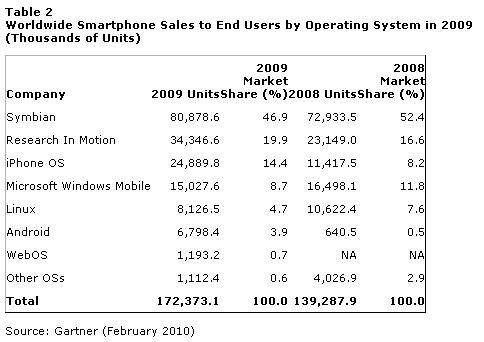

Gartner on Tuesday revealed the top smartphone operating systems for 2009. In a statement, Gartner noted:

In 2009, smartphone sales reached 172.4 million units, a 23.8 percent increase from 2008. In 2009, smartphone-focused vendors like Apple and Research In Motion (RIM) successfully captured market share from other larger device producers.

Here's a look at the stats on a global basis:

Now a few themes instantly jump out.

Apple's iPhone and Google's Android are the fastest growing platforms. Apple grew its market share by 6.2 percent in 2009 from 2008 to bump Windows Mobile out of third place. Android's market share surged 3.5 percent in 2009 from almost nil the year earlier.

Get email alerts on all breaking smartphone news and reviews

The natural conclusion is that Apple and Android are benefiting from the applications that are swarming to their platforms. Perhaps, but then there's the data from Distimo, via ReadWriteWeb. Distimo presented its app marketplace census at the Mobile World Congress.

Here's the money slide, which covers the U.S. mobile app market:

It's clear you could argue that Apple's App Store has translated to market share gains. It remains to be seen what develops with Android.

However, the dearth of apps on Windows Mobile hasn't led to a market share collapse. Sure, Microsoft is sucking wind, but it still has 8.7 percent of the global market. And the two global share leaders, Nokia and Research in Motion, have respectable app figures, but nothing that makes your jaw drop. Update: Microsoft says it has 1,245 apps available.

Also see: Smartphone Evolution 2.0: Who's the biggest loser?

And with Symbian plotting more competitive versions of its operating system Nokia can at least retain if not grow share.

Simply put, there's an app-market share disconnect in the land of smartphones. Perhaps this disconnect won't last through the next few years, but for now it appears to exist.

So what's going on? Overall, the app count-market share disconnect may be due to point that I mentioned last week about RIM, which reckons it has about 5,000 apps available on its App World store. The raw app count is a meaningless figure.

As long as a phone has the apps I want I'm good.

The big questions:

- What's the optimal number of mobile applications?

- What's the point of diminishing returns?

- Do custom ers really care about gaudy app counts and is it just more junk to wade through?

There are no ready answers for those questions, but I'd bet that the 50,000th app on the iPhone platform was a lot more important than the 140,000th. To wit: Earlier this month Wonder Bread touted its iPhone app. I just don't need a Wonder Bread mobile app to tell me how to make a sandwich. I mean really: How much does the Sandwich Wonder-izer really improve your life?

If you're seriously downloading the Wonder-izer perhaps it's time to go on an app diet.