Software buyers must preserve 3PM rights

Ray Wang provided me with a sneak preview of survey results on factors driving the trend towards third party maintenance.

It should come as no surprise that cost pressure is driving high levels of thought around the topic. But here's a surprise. Software vendors are cautiously talking up expectations for 2010. So why the sudden 63% relative jump in respondents who are no longer considering upgrades. Fatigue? Ferreting out shelfware? Or do they know something about the economy the software industry seems to have missed?

The 10% rise in those who are not seeing value in maintenance to over 80% must surely send out the clearest signal yet that this line item is overpriced at best and downright lousy value at worst. Yet the contradictions and tensions between customer needs on Main Street and investors listening to Wall Street don't go away. Here's my message to Wall Street: if you didn't like Hasso Plattner's mea culpa, how much will you like Larry Ellison's? No-one I speak with ever thought SAP would back down. No-one I speak with today predicts Oracle's day of reckoning. Perhaps one.

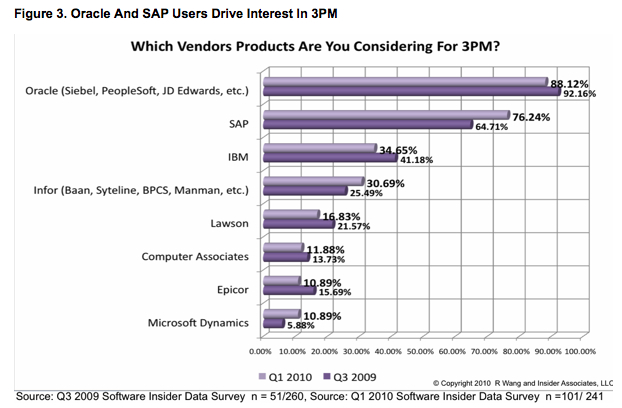

While it all makes great reading, Figure 3 (see above) mesmerises me. Ray attempted to put his qualitative finger on why one or other vendor seems to be faring better or worse. He argues that:

...some savvy software vendors retooled and restored the client -vendor relationship by:

- Offering more entry points and tiers to support options. The three pillars of software maintenance and support policies still apply. However, several vendors are now offering more tiers of support as lower entry points. Two vendors have finalized plans to offer just the bare bones legal and regulatory updates. Other vendors have made it easier to come back with maintenance amnesty plans.

- Providing flexible maintenance policies. Vendors who change rigid policies have experienced success among customers. Both Infor through Infor Flex and Microsoft Dynamics allow like for like swap credits to migrate between existing products.

- Renegotiating existing terms. Some vendors are helping clients meet the realities of the current market conditions. Big on the list is helping clients address shelf ware without repricing of contracts. For clients who paid full maintenance on software that’s at least 4 years old, some vendors are offering to reduce up to 20% of the overall licenses not in use. This leads to lower maintenance revenue but engenders good will among key clients. Further, several vendors have allowed clients to apply credit towards another module as an alternative.

- Delivering amnesty programs. Several vendors have allowed customers to return to maintenance programs after years of not paying. Such programs play a key role in helping customers upgrade but should be used sparingly as customers may become accustomed to this practice.

- Creating better peer forums to share information. Almost every vendor surveyed has a program to improve the online support capabilities. Applying Social CRM use cases, user generated content in peer forums tops the list of initiatives. Other plans focus on sharing data on benchmarks, operational metrics, and best practices.

- Assisting with vendor financing. Clients seek access to financing, especially many in the mid-market who’s credit lines have been zapped. Microsoft has led the charge by providing 0% financing for its Microsoft Dynamics ERP and Microsoft Dynamics CRM Customers. Other vendors such as IBM, Infor, Oracle, SAP, Sage also offer vendor led financing programs that include hardware, implementation, training, and other services.

- Lowering cost of usage and ownership. Though tops on the list as a conceptual practice, most vendors will need to roll out such initiatives over the next 24 months. A few notable exceptions include Agresso with its VITA architecture which allows customers to rapidly make business and UI changes, Microsoft Dynamics customers who report back significantly lowered implementation and training costs compared to most vendors, and Epicor customers who report significant productivity gains with Service Connect. SaaS customers already experience such gains.

Here's my much shorter stab at some of the findings:

You might surmise in the last six months, Oracle has done a better job of convincing customers that its offering is worthwhile. How does Oracle continue to defy gravity in this way even though they are top of the poll for those considering a switch? I hear it is because of great field sales execution. But then grumblings on the ground among user group members suggests otherwise. Enterprise Advocates plan on exploring that topic in an upcoming webinar.

You might equally surmise that adverse publicity around SAP's botched Enterprise Support price hike is driving customers away. Or that Rimini is doing a great job in pre-sales. Epicor seems to have done a good job convincing customers that the Version 9 non-forced march is worth the effort, despite the relatively low take up. Despite Ray's observations, it's no surprise that Infor seems to be losing its mojo what with its continued SOA insistence or that Microsoft seems to be losing its way. I see Dynamics VARs scrambling towards SaaS as they see orders plummet by as much as 50%. IBM? Quietly transitioning to services anyway? How did Lawson manage to do relatively well given CEO Harry Debes staggering statements around SaaS?

As always with these kinds of survey, we end up with more questions than answers. What do you think? Is the bell finally tolling for vendors that insist on 20-22% maintenance at 90-95% margin?

Disclosure: Ray and I are founding members of Enterprise Advocates, along with Vinnie Mirchandani, Frank Scavo and Oliver Marks.