Sprint eyes T-Mobile, but pitfalls abound

Sprint is reportedly working on a bid for T-Mobile, but a potential merger would be littered with potholes.

According to the Wall Street Journal, Sprint is looking at the regulatory issues surrounding a bid for T-Mobile. A deal would be valued at about $20 billion.

If a Sprint-T-Mobile merger actually happened the U.S. would be dominated by three major carriers---Verizon, AT&T and Sprint. Softbank acquired Sprint and T-Mobile bought MetroPCS. And just about two years ago, AT&T was thwarted in a bid to buy T-Mobile. Regulators' biggest beef is that four major carriers were better for competition.

How exactly would a Sprint-T-Mobile merger help consumers? That regulatory scrutiny is one reason this merger may never happen.

Previously: T-Mobile, MetroPCS are dead; long live T-Mobile | Sprint-SoftBank $21.6B deal scheduled to close

Nevertheless, there are other issues that make a Sprint-T-Mobile merger less of a slam dunk. Here's a look at the key hurdles:

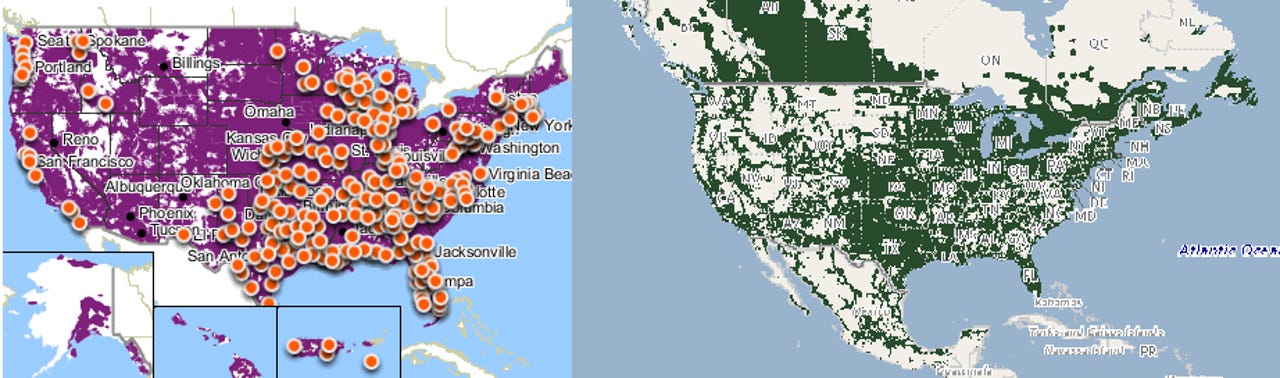

A hodge-podge of networks. Sprint just got around to consolidating its network by shutting down Nextel. Sprint has CDMA, WiMax and LTE technology behind its network and the latter footprint is trailing AT&T and Verizon. T-Mobile has GSM and LTE as well as HSPA/HSPA+. All you need to know about the network integration of Sprint and T-Mobile is that none of these acronyms really match. It would take years to consolidate these networks and make sense of them unless everything is jettisoned for LTE at some point.

King of prepaid stinks for profit margins. Both Sprint and T-Mobile have big prepaid subscriber bases. Prepaid customers are the least lucrative and least creditworthy. Joy. The Journal put postpaid customers for the combined entity at 53 million, a distant third to AT&T and Verizon.

Brands don't scream domination. T-Mobile hasn't been known for the best network coverage. Sprint has fixed its customer service issues, but still pays the price for bonehead moves years ago. Both companies appear to be headed in the right direction, but T-Mobile Sprint isn't likely to be seen as a juggernaut. The combination of No. 3 and No. 4 still is just a No. 3. There's no leapfrog here.

I'm sure there will be some lovely PowerPoint slides highlighting why T-Mobile and Sprint would rock, but don't get carried away.