Square, Match IPO flubs: Can they thrive after face palm moments?

If the Square and Match initial public offerings were supposed to be some litmus test for the overall tech sector you can just break out the face palm emojis now.

The Square IPO priced at $9 a share, which is well below the $11 to $13 range expected. Square was supposed to be an indicator of how hot tech startups were. Simply put, tech startups are now on ice. Unicorns may be somewhat laughable.

Now Square isn't a bad company, but the playbook for a publicly-traded rival is somewhat obvious. You allow Square to go public, watch its valuation fall after a few bad quarters and then it's a division of something larger, say PayPal.

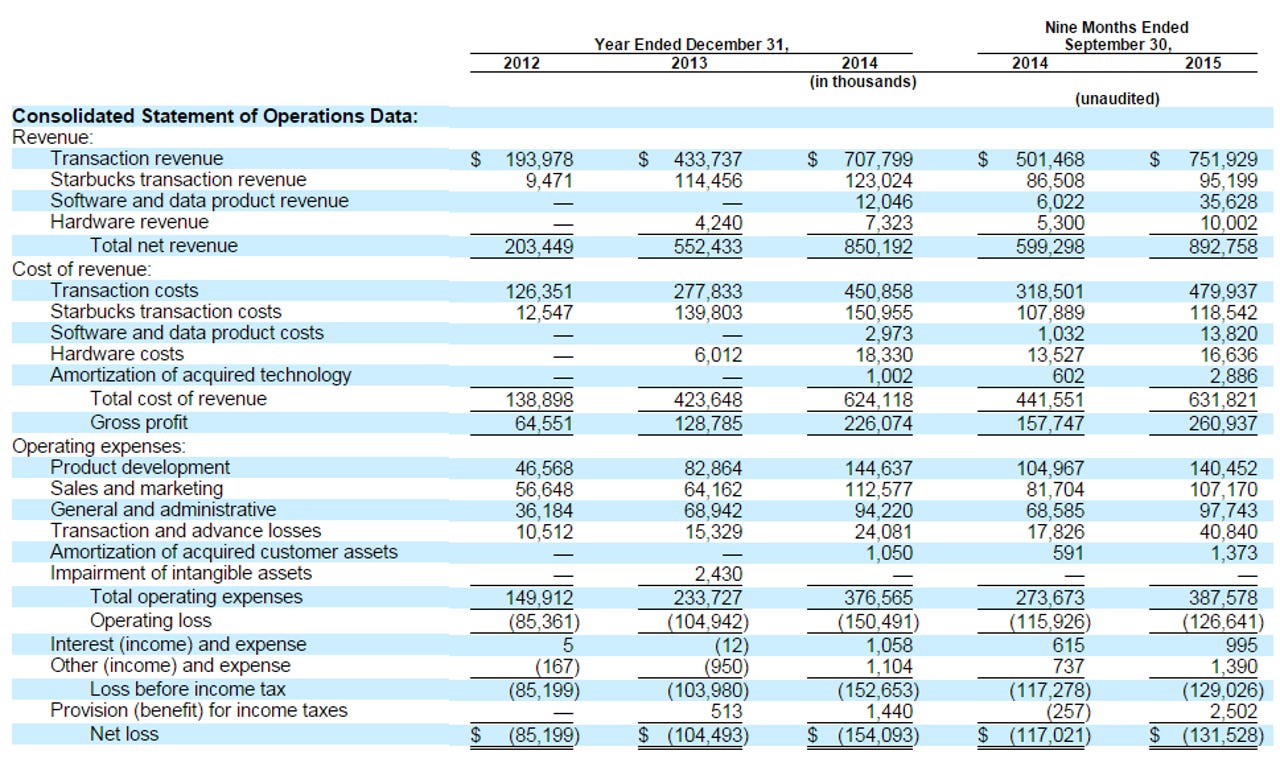

Square went from commanding a $6 billion valuation as a private market to $4.2 billion as the IPO revved up to $2.9 billion when it priced. The growth of Square is impressive. The company lost $131.5 million on revenue of $892.7 million for the nine months ended Sept. 30. That sales tally is up from $599.3 million in sales for the same period a year ago.

And then there's Match, which priced at $12 a share at the low end of its range. As I noted before Match is an interesting company, especially from a data perspective. Unfortunately, all the proceeds from the IPO are going to pay off debt to Match parent IAC.

Tinder CEO Sean Rad should have be listed as a risk factor in the Match filings. Maybe he will be in future quarterly releases. Fortunately, Rad won't be leading the earnings conference call.

In an interview with the London Evening Standard, Rad broke two key rules. First, he was yapping before an IPO in what equates to a regulatory blunder. And then he embarrassed his company.

Rad was such a poop show in the Evening Standard interview that Match had to swipe left on him in an SEC filing. The filing is outright comical.

On November 18, 2015, the Evening Standard (the "Standard"), an online and print news service, published an article based on an interview with Sean Rad, the Chief Executive Officer of Tinder, a subsidiary of the Company. The article is described in relevant part in the following paragraph and the full article is attached hereto.

The article was not approved or condoned by, and the content of the article was not reviewed by, the Company or any of its affiliates. Mr. Rad is not a director or executive officer of the Company and was not authorized to make statements on behalf of the Company for purposes of the article. The article noted that "Analysts believe the [Tinder] app, which launched in 2012, has around 80 million users worldwide and records 1.8 billion "swipes" a day." While these statements were not made by Mr. Rad, the Company notes that they are inaccurate and directs readers to the Preliminary Prospectus, which states that for the month of September 2015, Tinder had approximately 9.6 million daily active users, with Tinder users "swiping" through an average of more than 1.4 billion user profiles each day.

Evening Standard routinely publishes articles and is unaffiliated with the Company and all other offering participants, and, as of the date of this free writing prospectus, none of the Company, any other offering participant and any of their respective affiliates have made any payment or given any consideration to Evening Standard in connection with the article described in this free writing prospectus.

The statements by Mr. Rad were not intended to qualify any of the information, including the risk factors, set forth in the Registration Statement or the Preliminary Prospectus and are not endorsed or adopted by the Company. You should consider statements contained in this free writing prospectus, including those in the attached transcription, only after carefully evaluating all of the information in the Registration Statement and any final preliminary prospectus relating to the offering filed pursuant to SEC Rule 424(b) (the "Final Preliminary Prospectus"), including the risk factors described therein.

Translation: Match is run by grownups. The market will ultimately judge.