Square to scoop up Afterpay for AU$39 billion

Australian buy now, pay later success story Afterpay has entered into an arrangement with US payments player Square that will see it become part of the Jack Dorsey enterprise.

The pair announced the scheme implementation deed on Monday, under which Square has agreed to acquire all of the issued shares in Afterpay. The transaction has an implied value of approximately $29 billion -- AU$39 billion -- based on the closing price of Square common stock on 30 July 2021 and is expected to be paid in all stock.

Based on Square's closing price of $247.26 per share, this represents an implied transaction price of approximately AU$126.21 per Afterpay share, a premium of approximately 30.6% to Afterpay's latest closing price of AU$96.66.

Following completion of the transaction, Afterpay shareholders are expected to own approximately 18.5% of the combined company on a fully diluted basis.

Afterpay is touting the transaction as one highlighting the strength in the Australian tech scene and Square said the addition of Afterpay would allow it to add further features to its ecosystem, and more customers.

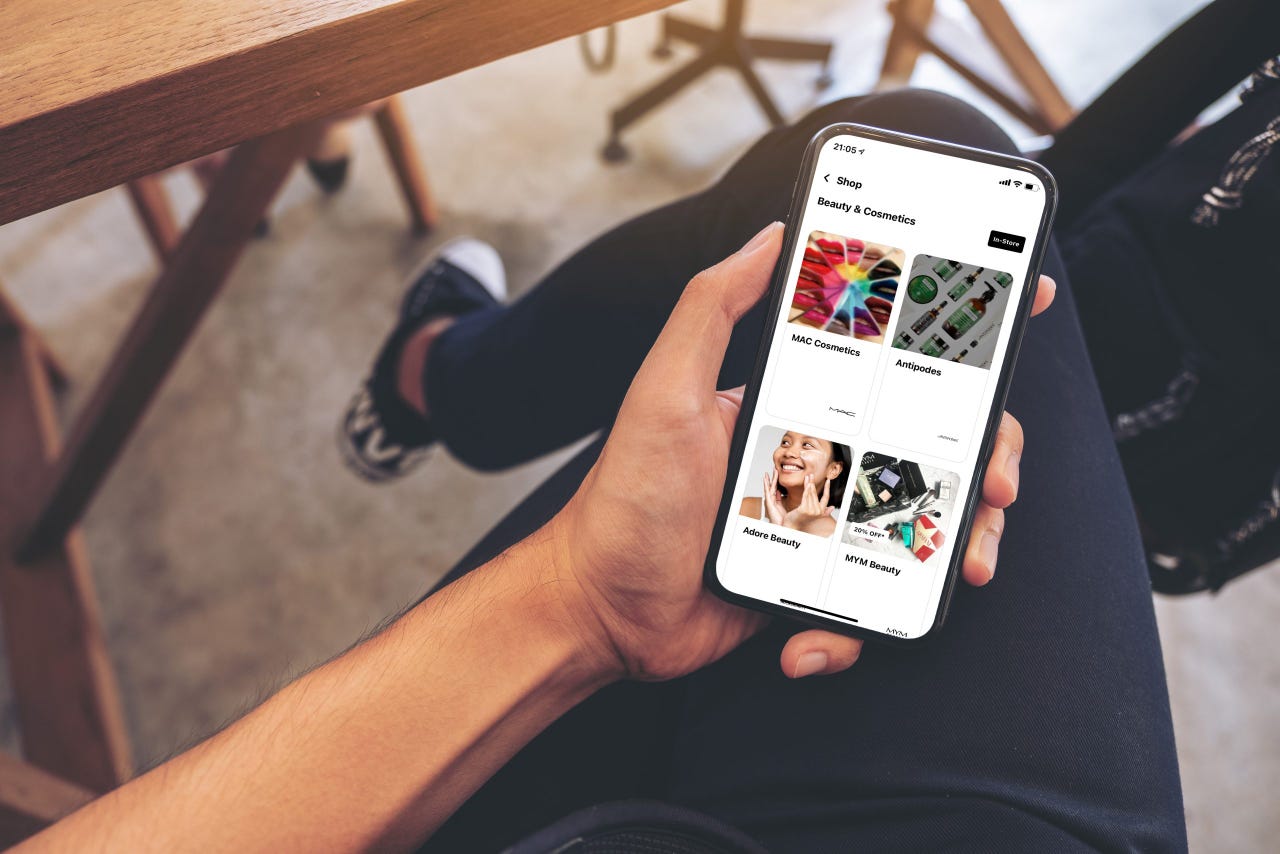

Square plans to integrate Afterpay into its existing Seller and Cash App business units, which it said would enable the smallest of merchants to offer a buy now, pay later function at checkout, give Afterpay consumers the ability to manage their instalment payments directly in Cash App, and give Cash App customers the ability to discover merchants and offers within the app.

"Square and Afterpay have a shared purpose," said Dorsey, co-founder and CEO of Square, and also CEO of Twitter.

"We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles.

"Together, we can better connect our Cash App and Seller ecosystems to deliver even more compelling products and services for merchants and consumers, putting the power back in their hands."

In a statement, Afterpay co-founders and co-CEOs Anthony Eisen and Nick Molnar said the acquisition would further accelerate growth, particularly in the US, allow the platforms to offer access to a new category of in-person merchants, and provide a broader range of new capabilities and services.

"We are fully aligned with Square's purpose and, together, we hope to continue redefining financial wellness and responsible spending for our customers," they said. "The transaction marks an important recognition of the Australian technology sector as homegrown innovation continues to be shared more broadly throughout the world. It also provides our shareholders with the opportunity to be a part of future growth of an innovative company aligned with our vision."

Afterpay in February reported its results for the first half of 2021, making a net loss after tax of AU$79.2 million at the end of the six-month period. As of June 30, Afterpay boasted more than 16 million consumers and nearly 100,000 merchants globally.

Releasing its FY21 results on the same day as the Square announcement, Afterpay said approximately 25,000 new customers are joining its platform globally per day. For the full year, Afterpay posted gross profit of AU$675 million, on revenue of AU$925 million.

Afterpay has its major base in Australia. It currently employs 600 local staff but has plans to grow that over the next year. It also has staff based in London, New York, San Francisco, and China.

Speaking previously, Einsen said while Australia has an innovative, "entrepreneurial spirit", given the population size, it often lacks the specific experience needed to build the global platforms needed for fintech businesses.

"Yes Australia has made some great progress, but so has everyone else. Many studies indicate our competitiveness as a location to base a fintech business has actually declined over the last decade, which means that other countries are moving quickly to take up these opportunities," he said in February.

The closing of the transaction is expected to occur in the first quarter of calendar year 2022 by way of a recommended court-approved scheme of arrangement, subject to certain conditions.

RELATED COVERAGE

Afterpay CEO believes Australia has an opportunity to be a tech talent exporter

The head honcho of Afterpay has described Australia's tech talent pool as 'very strong'.

Austrac gives Afterpay all-clear following anti-money laundering investigation

Austrac has decided not to pursue any further regulatory action against the 'buy now pay later' service.

Afterpay and Zip Co sign on to Australia's new buy now, pay later code of practice

Those accredited by the code vow to be transparent and focus on the needs of the customer.

Money by Afterpay pilot launches on Westpac infrastructure

The company's new money and lifestyle app, Money by Afterpay, is pencilled in for a public go-live in October.