Supercomputers sell even in a recession; IBM gains

The high performance computing market took its lumps in 2009 with sales down 11.6 percent, but IBM came out with a slim market share lead when the duel with HP was done, according to research firm IDC. Why? Supercomputers---going for $500,000 and up---sell even when the economy stinks.

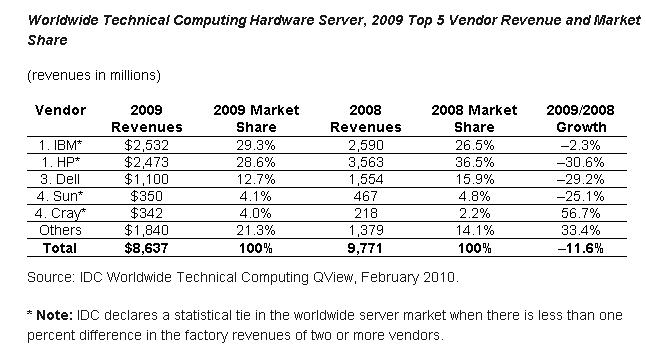

At a high level, factor revenue for high performance computing (HPC) technical server market---systems used for research and development and hard-core engineering---fell to $8.6 billion from $9.7 billion in 2008, said IDC. Unit shipments tanked 40 percent.

Here's a look at the standings (statement):

As you can see, IBM's share held steady even as the market fell. Turns out that the high-end HPC market held up nicely. Supercomputers, priced $500,000 and up, delivered revenue growth of 25 percent to hit $3.4 billion, reported IDC. HPC systems that run more than $3 million delivered revenue growth of 65 percent to $1 billion. Those high-end markets are IBM's sweet spot. In fact, IDC reports that IBM had a 45 percent market share in the supercomputer market.

The lower-end of the market took the hit. HPC systems priced below $100,000 fell 33 percent to $1.7 billion as orders were canceled. HP rules the sub-$500,000 HPC market with 33 percent revenue share. Dell, which focuses on the lower end of the market, also took its lumps.

Simply put, the big research and development guns---the oil and gas industry and government---don't count HPC as discretionary spending as much as the companies buying cheaper systems.

Looking ahead, IDC expects the HPC market to recover with annual revenue growth of 5 percent to 7 percent.