Sybase: The next big target for acquisition?

Sybase announced its financial results today, calling it the best quarter and year in the company's 23-year history. Total revenue topped $295 million for Q407 and the full year exceeded $1 billion, an increase of 17 percent over 2006. Full-year GAAP operating income increased 26 percent to $168.6 million. Sybase also holds over $700 million in cash and investments.

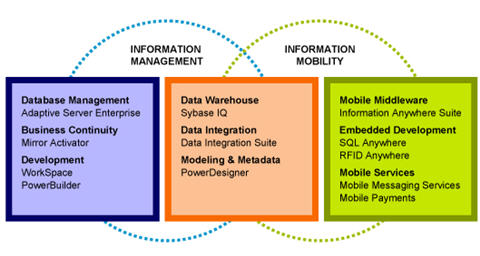

This is a company that is dwarfed by database rivals Oracle, Microsoft and IBM, but license revenues for the database division grew 16 percent year-over-year and accounts for about 70 percent of company revenues. The iAnywhere mobile middleware division makes up around 20 percent of revenues and the messaging services and payments 10 percent, according to Raj Nathan, chief marketing officer at Sybase.

With its database business under intense competitive pressure about a decade ago, Sybase diversified into mobile middleware, growing through acquisitions, such as Mobile 365, Extended Systems and XcelleNet. But the company also spends 17 to 18 percent of revenue on R&D annually, Nathan said. "These were the right things to do and have come to bear fruit," Nathan said.

The recent success for Sybase puts it in a spotlight. Now that BEA is gone to Oracle,Sandell Asset Management has accumulated 6 percent of Sybase shares and is urging the company to sell off the mobile vision or go the IPO route a la VMware, or sell the entire company.

"If someone offers a price in best interest of shareholders, we would have to consider it, but we are not running the company on a strategy to be sold," Raj said. That is the expected answer. The financial results demonstrate that Sybase is not shamelessly dressing itself up for a sale, but it is becoming a more attractive target as consolidation continues to be a major thrust of the tech sector.

Updated: I chatted with Merv Adrian, senior vice president of research at Forrester, about Sybase's future: "[Sybase CEO] John Chen looks like he is in it for the long haul," Adrian said. "He had a spectacular year, and took ten years to get there, and he has proven that focusing on value, supporting customers aggressively and keeping customers current can sustain the database business. The future looks bright on that side. Sybase can sustain that and the messaging business is just now proving itself. People are sending richer messages and Sybase makes money on that. You could see an enormous rise in the messaging business, which went from zero to $38.8 million last year."

Regarding Sybase getting acquired, Adrian said, "It's hard to see an acquisition. Sybase has a rich and fairly complex portfolio and obvious overlaps with IBM and Oracle, for example. The outside play would be somebody like EMC, where it would be additive and adjacent, but I've heard nothing on that front."He noted that a more likely acquisition would be HP buying Terradata, CEO Mark Hurd's former company.