T-Mobile's rebrand: will it move the wireless needle?

And I couldn't help but think: there's no way this is going to work.

A bit of background first. Smarting (celebrating?) after the AT&T's failed bid to acquire the company, T-Mobile is, like a spurned lover, moving to dust itself off and return to fight another day.

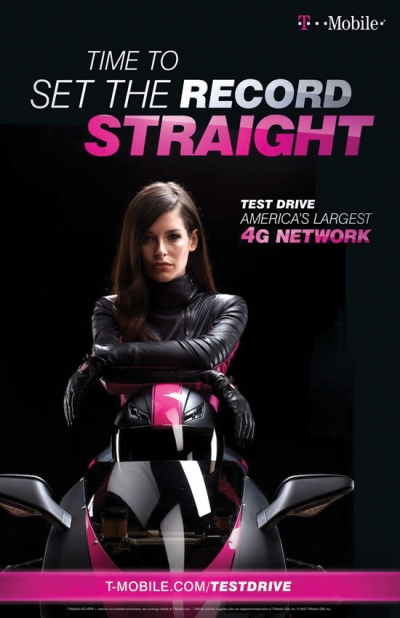

To do so, the No. 4 U.S. carrier is turning its latest batch of ad spots -- pink, white and all-around cheery, thanks to Carly Foulkes' cute-as-a-button turn as the "T-Mobile girl" -- dark. The new spots replace the white with black, the A-line skirts with leather jackets and the girl-next-door smile with an I'll-leave-you-in-my-dust scowl that says, "The only pink I see around here is the embarrassment in your flushed cheeks, kiddo."

True, there's no denying the age-old adolescent male appeal of a model in skin-tight biker leathers. But the campaign -- which will appear nationwide on TV and in print -- smacks of self-reassurance. Consumers don't need another look for T-Mobile; T-Mobile does.

Make no mistake; a change in a recognizable ad campaign will certainly get consumers to notice. But T-Mobile's problem was never storytelling. It was closing the sale.

FINDING THE RIGHT TALE TO TELL

The new campaign's motorcycle imagery intends to equate T-Mobile with "fast," a.k.a. 4G. T-Mobile wants you to know that it's spending $1.4 billion on next-generation wireless infrastructure. But I don't think any consumers care. Speed is a story carriers want to tell, but consumers don't want to hear.

I left T-Mobile for AT&T last year, upon upgrading to an iPhone. Speed had nothing to do with it; both networks were sufficient for me. (And in fact, AT&T a step down only because I'm in New York, land of still-balky connections.) Coverage for both was sufficient for me. Customer service for both was sufficient for me. AT&T was demonstrably more expensive. But it had the iPhone.

This isn't about Apple; this is about seeing things from the consumer's point of view. Consumers have three primary interests: the phone, the coverage and the price. T-Mobile has been losing customers -- me, among the 802,000 it lost in 4Q11 -- because it doesn't have the hardware that many consumers want. It's not customer service. It's not good girl-versus-bad girl. Surprisingly, it's not even the price. And it's definitely not network speed.

FINDING LEVERAGE

Part of T-Mobile's frustration, rightly justified, is that it continues to offer hardware that's no better or worse than the best on the market. Android phones? Check. 4G? You got it. Still, the offerings fail to draw consumers' attention.

Why? That's a difficult question to answer. Quarterly reports on U.S. market share for mobile devices show that, iPhone aside, most consumers are keen to preserve the status quo and stay with their carriers, just upgrade to a different phone. (Note: don't confuse that with loyalty. This isn't a matter of affinity.) T-Mobile's problem is that most of those people have historically been its rivals' customers.

In other words, T-Mobile has been mostly successful in keeping up with its rivals -- but it's never quite gotten ahead of the pack for long enough to sap customers from them. And so it's stuck in gear: T-Mobile may get the most advanced smartphone for a couple of months, but with customers locked into contracts, few see the need to jump. Their carrier will have something by the time they need to re-up.

It's clear that T-Mobile needs to offer something so ahead-of-the-game that consumers can't help but switch. Which would take the appetite to agree to an enormously lopsided deal with a hardware manufacturer -- much like AT&T and Apple in 2007 -- and may no longer be possible, given the cutthroat nature of the rapidly maturing smartphone market as a whole.

(Perversely, you've got to feel for the company: it offers infrastructure, not hardware. It is, by definition, a middleman. And it's getting squeezed on both sides.)

AD SUCCESS: AWARENESS, OR ACCOUNTS?

T-Mobile's new ad campaign will get consumers' attention because of its novelty, ubiquity and clarity of message. But I'll wager that message won't be enough, and will fail to spur consumers to open their wallets to the company unless T-Mobile's actual offerings change. That could be an iPhone; that could be something else. Whatever it is, it's got to be what consumers wan -- and there needs to be enough leverage over rivals, for a long enough duration, to get consumers to defect.

Oddly, T-Mobile's current ad campaign -- the pink, cheery one by Seattle's Publicis -- has done a great job putting a face on the company, but not a phone in consumers' pockets. We remember T-Mobile's ad spots and forget AT&T's, Verizon's and Sprint's -- yet we remember the phones those carriers offer, and forget those offered by T-Mobile. In succeeding to brand the company, T-Mobile has failed at branding its hardware lineup. Which from T-Mobile's point of view makes sense: why would it spend money to give its partners all the glory? Alas, here we are.

It certainly hasn't helped that T-Mobile has courted the price-sensitive consumer. Usually that's a sound business strategy, risky only because the lowest price wins, turning the market into a race to the bottom, with ever-thinning margins on commoditized products. (See exhibit A: Windows-based laptops.) But the mobile market has been a different beast: much like with cable television or electricity, consumers have demonstrated that they're willing to pay premiums for service, even when the product offerings from rivals are largely the same and priced more competitively. The status quo is a powerful thing.

NEXT STEPS

What should T-Mobile do? It will certainly proceed with this ad campaign, but without the most popular handset, the iPhone -- which would at least bring it in line with its rival carriers -- it will continue to bleed customers. A competitive product lineup will only stem the bleeding and keep current customers happy; it won't be a source of growth. (To wit: if T-Mobile offered an iPhone tomorrow, would I go back? Probably not, short of a major price difference -- I'm already entrenched with AT&T, at least for the remainder of my two-year contract.)

If Deutsche Telekom really wants to play ball in America, it's going to have to tilt the market (and sustain it) in such a way that consumers -- at least the millions in urban areas that T-Mobile serve best -- would be dumb not to switch. It's going to take a combination of price, hardware and pink steel cojones -- the kind of market-undercutting suicide gamble that would push the company to the brink in the short-term but set it up for success in two to three years.

With billions in the bank and additional spectrum from AT&T's failed bid, now is T-Mobile's chance to get truly aggressive: make the kind of deals with OEMs its profit-protecting rivals will not; offer prices that consumers can't refuse; and acquire some smaller players to replenish the ranks.

And perhaps hire Steven Tyler. "Yeah pink, it's like red but not quite..."