Tale of two Dells: Enterprise strong, consumer demand weak

Dell's fiscal third quarter results highlighted the two sides of the company as corporate demand remained strong, but the consumer business was weak.

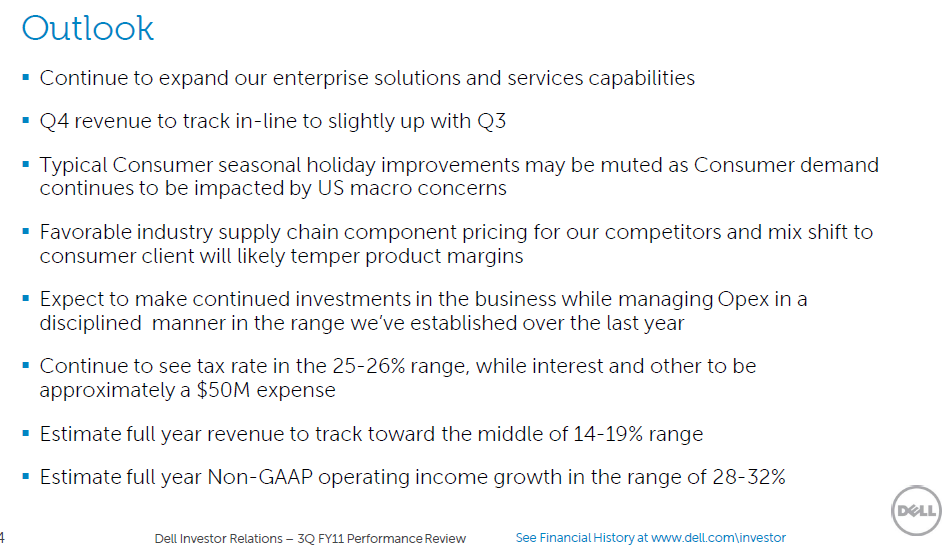

As a result, the quarter was a mixed bag. Meanwhile, Dell's outlook for the fourth quarter is weaker than expected.

The company reported third quarter earnings of $822 million, or 42 cents a share, on revenue of $15.4 billion, up 19 percent from a year ago. Non-GAAP earnings were 45 cents a share. Wall Street was expecting earnings of 32 cents a share on revenue of $15.75 billion.

Dell credited strong commercial demand and solid supply chain management for the better-than-expected earnings results. The catch: The consumer is sucking wind.

Indeed, Dell projected revenue that is slightly up to flat with the third quarter tally. Wall Street was expecting much better sales. In fact, analysts were looking for sales of $16.28 billion.

Simply put, Dell's consumer business is the weak link right now. Consumer revenue was $3 billion in the third quarter, up 4 percent from a year ago. The unit broke even.

Highlights from the Dell conference call:

- CFO Brian Gladden said the company had 20 percent gross margins due to "better supply chain execution, pricing discipline and broad component cost declines, which affected all of our lines of business from client hardware to services to software and peripherals."

- Those component price declines will filter through to PC prices. "As these components cost declines work themselves through the industry supply chain, we do expect the industry pricing environment to more fully reflect these changes," said Gladden.

- Steve Felice, head of Dell's consumer and small business unit, said "small businesses are beginning to see signs of strength."

In comparison to Dell's other units, the consumer business is clearly lagging despite the company's efforts to streamline brands, expand retail outlets and boost consumer loyalty.

To wit:

- Dell's large enterprise revenue was $4.3 billion, up 27 percent from a year ago. Operating income was $400 million.

- Public sector revenue was $4.4 billion, up 20 percent from a year ago including Perot Systems. Operating income was $451 million. In contrast to Cisco Systems, Dell was relatively upbeat about state and local government spending. However, Dell also noted that it had little exposure to local government customers.

- Small and medium business revenue was $3.7 billion, up 24 percent from a year ago. Operating income was $391 million.

- Revenue in Brazil, Russia, India and China was up 30 percent from a year ago.

In other words, Dell's quarter really only had one blemish---weak consumer spending. Dell had a few good data points on how the consumer business is improving, but it's still the weak link by far.