Business

Tech M&A activity in 2012: Five things to know

More than 2,000 private technology companies were acquired in 2012. Here's a look at the trends.

CB Insights, the startup-focused American market research firm, has released a new report on how the mergers and acquisitions market in the global technology sector fared in 2012, and it's an interesting way to connect the dots on the year.

Five things to know:

- Exactly 2,277 private companies were acquired worldwide last year; Google and Facebook led the pack in scooping up promising smaller firms, with 12 apiece. A total of $46.8 billion was spent (and disclosed); the top third of those companies acquired represented 80 percent of the money spent.

- Bootstrapping is popular. Most -- 76 percent, in fact -- of the tech companies acquired in 2012 did not raise institutional investment (either venture capital or private equity) prior to acquisition. That means many tech startups are running on their own profits, financing or "angel" -- that's friends & family -- investment.

- It's a "long tail" market. Just 2.5 percent of all private tech acquisitions in 2012 were billion-dollar deals. In contrast, more than half of them were for less than $50 million. And an additional 30 percent were between $50 million and $200 million.

- In the U.S. and abroad, California is king. The West Coast state perenially leads the pack in number of deals and dollars spent, and that continued in 2012 with 455 deals. Its lead is so large that it tops the next five U.S. states on the list -- New York (138), Texas (91), Massachusetts (87), Illinois (54), and an unspecified fifth -- combined. But the action is more interesting downstream: New York and Texas surged ahead of Massachusetts this year.

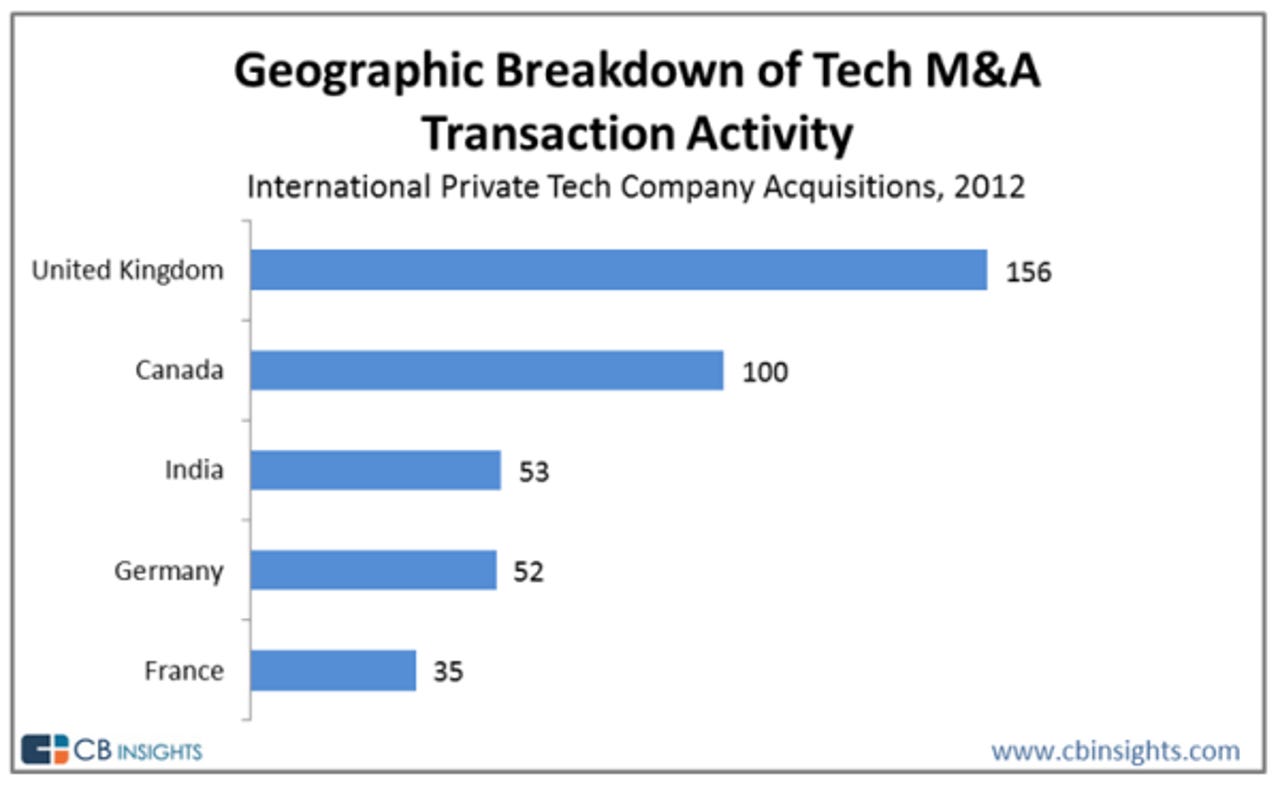

- In the rest of the world, the U.K. is queen. Behind the U.S. comes the U.K., Canada and India, followed by Germany and France. (That's in terms of number of acquisitions.) CB Insights noted that Canada has shown particular "momentum" as of late.