Tech mergers: Are the giants just fighting the last war?

The technology mergers are about to get more interesting as today's titans---IBM, HP, Microsoft and Oracle---attempt to morph into new models where cloud services matter the most. The big question revolves around whether tech giants will waste too much time fighting the last war?

At a panel of Gartner analysts at the research firm's Symposium powwow in Orlando that question was front and center. So-called IT generalists, which try to sell you a stack of everything, will be forced to make a bunch of moves to futureproof their businesses.

Among the key points:

- Cloud computing, mobile, social networking and globalization will change the way buyers acquire technology.

- Applications will be delivered as Web apps. These apps will perform as if they were natively written.

- Mobile will pervade all technologies.

- Social networking will replace email for 20 percent of workers by 2014.

The natural inclination here is to figure the big guys will gobble up players in those aforementioned categories. The reality is quite different. Some big vendors won't understand the shift and get whacked.

Related: IT supervendors: They can buy innovation, but can't maintain it

Indeed, Gartner's analysts said that IT vendors are fighting the last war. Oracle buying Sun, Dell buying Perot Systems, HP buying 3Par and IBM gobbling up Netezza and Sterling Commerce are all old-school deals that don't change the conversation at all.

In the presentation by Eric Knipp, Ray Valdes and David Mitchell Smith, the analysts said:

There are a number of possibilities for acquisition as the last war rages on. Hardware suppliers will continue to look for opportunities to become more vertically integrated and break into the software and services game. By the same token, we should anticipate software companies making efforts to gain better control over the pieces of the value chain they do not control, securing hosting and hardware capabilities in order to better deliver integrated cloud services. Finally, consumer plays will enter into the thinking of an increasing number of IT firms seeking cloud scale as traditional margins erode.

Gartner has a point. The big money is betting on the last war. However, there are signs that big vendors are thinking ahead. IBM's acquisition of Lombardi and Cast Iron projects forward thinking as does SAP's purchase of Sybase. Finally, VMware's acquisition of SpringSource as well as its Salesforce.com partnership is another sign that vendors are preparing "for waves of IT industry disruption."

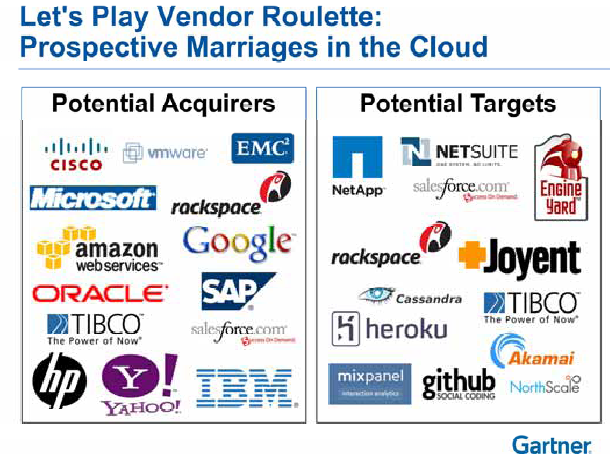

This disruption will play out in the cloud. Gartner put up the following slide:

That slide tells the tale. It would be shocking if companies like Akamai, NetSuite and Rackspace stayed independent forever. NetApp, while pricey, is a fine acquisition target.

That scenario plays out elsewhere.

- In social, Jive and LinkedIn were notable acquisition targets. Twitter was another.

- In mobility, Foursquare, Placecast and Motricity were mentioned as targets.

You get the idea. The M&A dance is just starting, but the key point is dissecting what tech companies are fighting the last war instead of thinking ahead. Next time there's a big merger it's worth making a mental note about whether it falls into the last war category.