Teradata’s Q1 weak, outlook cut

Teradata’s first quarter fell short of expectations and delivered a weak outlook.

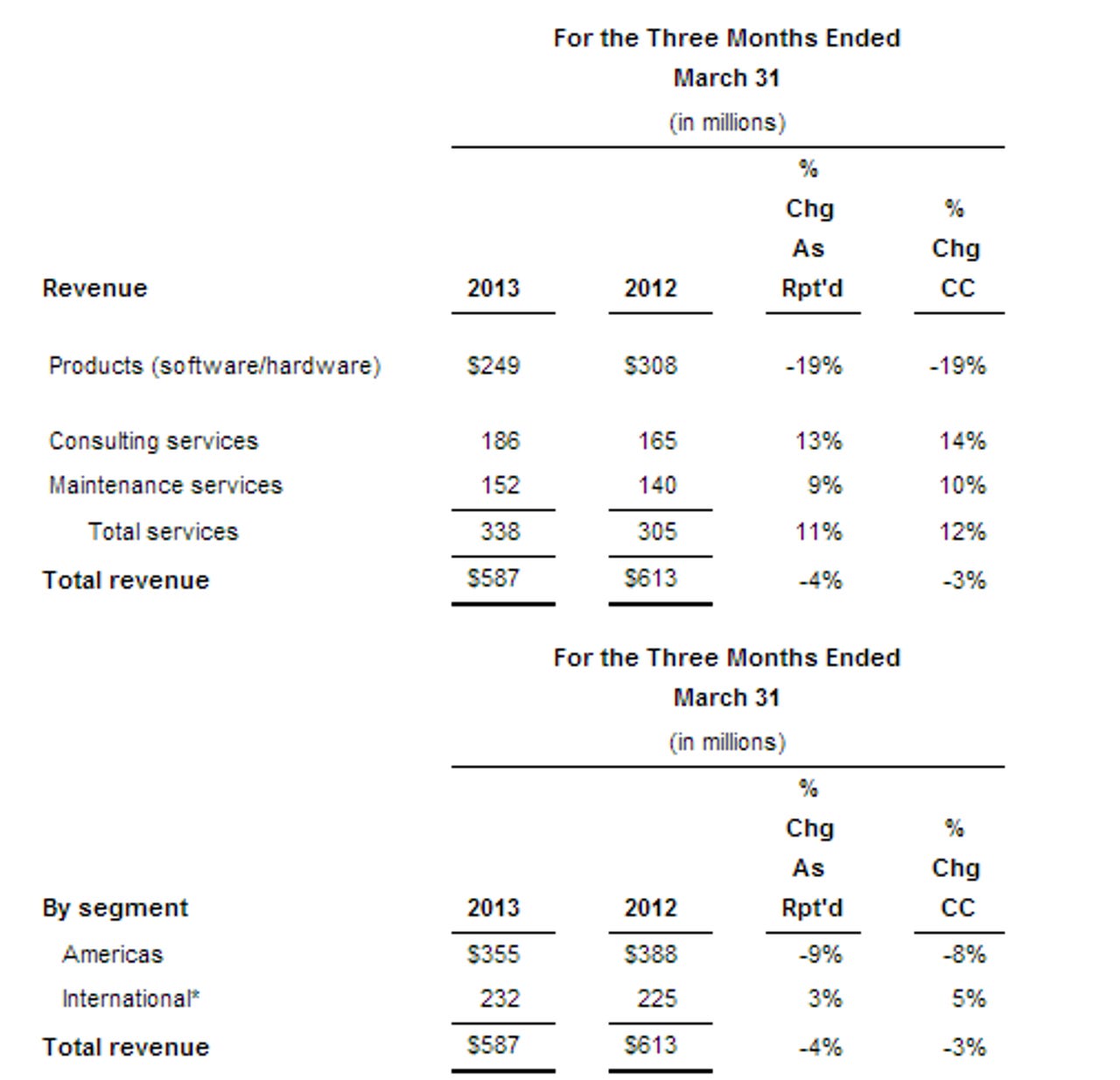

The company, which provides data warehousing systems and software and big data applications, reported first quarter earnings of $59 million, or 35 cents a share, on revenue of $587 million, down 5 percent from a year ago. Teradata added that non-GAAP earnings were 43 cents a share.

Wall Street was looking for a profit of 53 cents a share on revenue of $611.21 million.

In a statement, Teradata CEO Mike Koehler said the company saw large enterprises pull back on spending, but strength in its Aster big data analytics systems and software. Koehler added that Teradata will increase its R&D spending to better position itself for the future.

As for the outlook, Teradata said 2013 sales will be down 1 percent from 2012. The company previously projected revenue growth of 6 percent to 10 percent. Teradata said its 2013 earnings will be at the lower end of its previously guided range of $2.64 a share to $2.79 a share and $3.05 a share to $3.20 a share on a non-GAAP basis. Wall Street was looking for 2013 earnings of $3.07 a share on revenue of $2.88 billion.

In a nutshell, Teradata's integrated systems took a sales hit in the Americas. The Americas represent 60 percent of Teradata's sales.

On a conference call with analysts, Koehler said customers were pulling back on spending.

The challenge in the Americas continues to be the belt tightening in our customer base, which first surfaced in the third quarter last year. Customers continue to add capacity to their data warehouses in smaller increments, or delay purchases. The number and the size of large purchases the past three quarters have been well below our historical averages. We closely monitor the data warehouse opportunities that are greater than $5 million, because they often require C-level approvals.

Teradata will also cut back its spending on discretionary and non-customer facing items and invest in big data and marketing applications.