Texas Instruments beats expectations with $2.89B in revenue

Expectations were low for the first quarter earnings report from Texas Instruments, which was published after the bell on Monday. But the Dallas-based corporation toppled Wall Street forecasts, regardless.

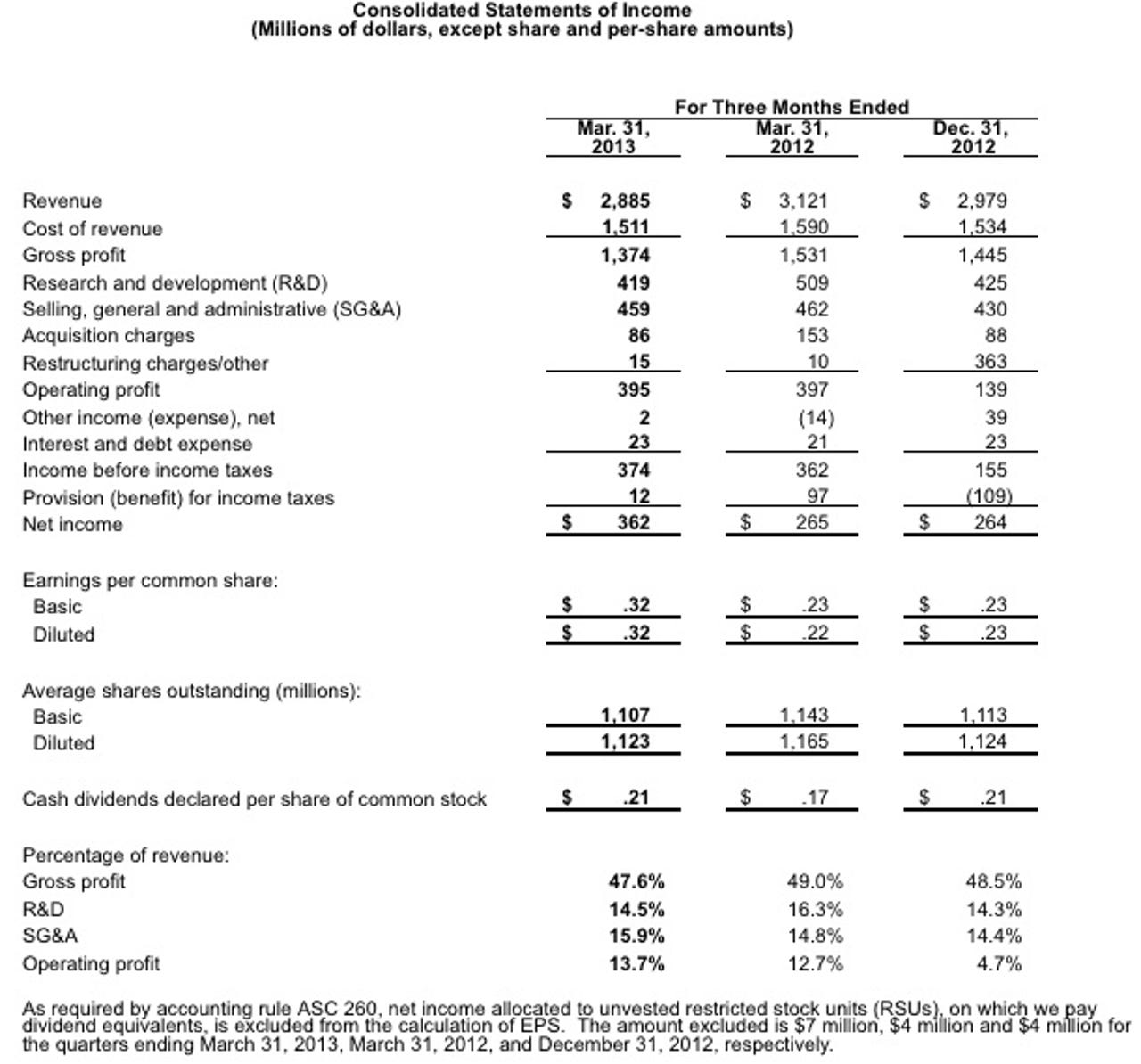

The semiconductor reported first quarter earnings of $362 million, or 32 cents a share (statement). Non-GAAP earnings were 32 cents a share on a revenue of $2.89 billion.

Wall Street was expecting Texas Instruments to report first quarter earnings of 30 cents a share on revenue of $2.85 billion.

CEO Richard Templeton commented in prepared remarks:

Our revenue and earnings ended the quarter at the high end of our expected range. Customers continued to operate in a real-time mode, maintaining minimal component inventory and ordering parts as they were needed. Our short product lead times, well-positioned inventory and ready manufacturing capacity allow us to respond rapidly to changes in demand.

Templeton also pointed out that TI is "now firmly rooted in Analog and Embedded Processing," which is especially clear given that these units accounted for 77 percent of Q1 revenue.

For the second quarter, Wall Street is expecting earnings of 38 cents a share on revenue of $3.04 billion.

TI's own outlook relatively matches up with a projected revenue range of $2.93 billion to $3.17 billion with earnings falling between 37 and 45 cents per share.

However, TI stipulated in the Q1 report that revenue stemming from "legacy wireless products" is expected to decline by roughly $60 million sequentially at the middle of this range, adding that the company already warned it is reducing investments for consumer smartphones and tablets.

TI is scheduled to update its second-quarter outlook on June 10.

Screenshot via Texas Instruments Investor Relations