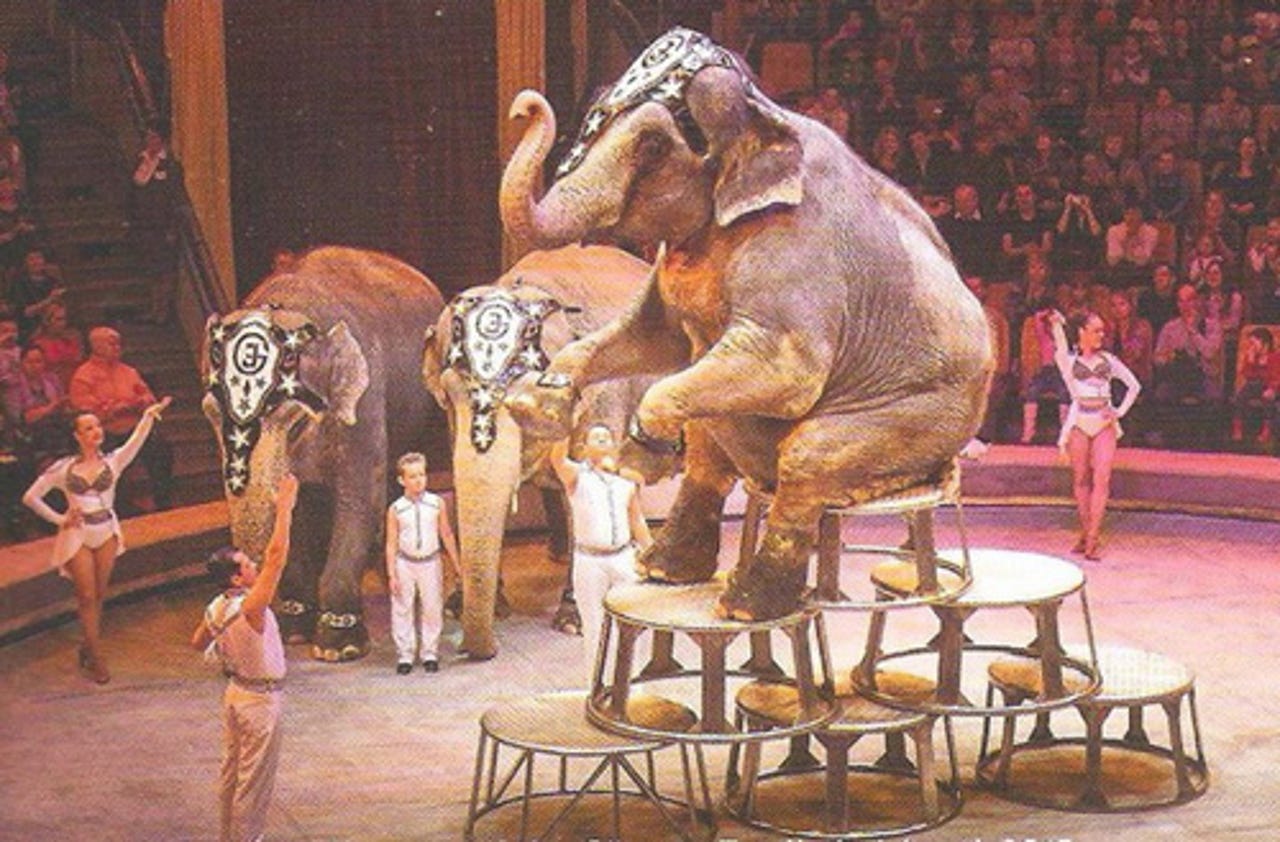

The enterprise conference circus is in town!

Spring has sprung in the fertile world of enterprise software marketing and like many others on the client/end user side, I tuned into multiple tech conferences on Tuesday morning to try and divine true directions amongst all the gush and hyperbole.

With SAP's cornerstone event Sapphire streaming video from Orlando, Netsuite's Suiteworld streaming from San Jose and the news today that Microsoft is showing its hand as a possible Salesforce acquirer in a financial market sideshow from their Chicago Ignite event, this has to be one of the busiest weeks so far this year on the calendar. And that was just the main three ring circus; there were other vendor events happening simultaneously.

Perfectly presented SAP CEO Bill McDermott kicked off the day looking like a TV morning show host as he eloquently articulated a surprisingly light and abbreviated talk about nothing of much substance. ('The only thing more beautiful than business is life itself'). Many were surprised the opening high level keynote didn't contain more detail or vision. S4/Hana is the future for SAP but today their core business remains supporting multiple generations of their Enterprise Resource Planning and associated technologies.

HFS Research conservatively calculated that spending on maintaining corporate SAP ecosystems including in-house staff in 2013 totaled $156 Billion "and this continues to increase at a 5% clip." SAP's vast ecosystem of stand up and integrate partners are obviously out in force this week to fight over these incredibly lucrative "keep the plumbing working" contracts, while also keeping an eye out on what their future might look like, which is predictably all about data and cloud/business networks.

Read more

SAP have had missteps in the past - past cloud business suite effort Business byDesign is still barely alive (probably to avoid embarrassment) after being touted as the new foundation for SAP's ERP software and the subject of much past Sapphire "this is the future" proclamations, with early customers introduced etc. Today the 370 Hana customers are being paraded as early harbingers of SAP's future. (to be fair BbyD has been migrated to HANA).

Given all the continuing pain around enterprise maintenance costs, there is an element of chutzpah in SAP's 'Run Simple' messaging, with Total Cost of (cloud) Ownership a primary feature of the 'One Service' portfolio concept .

Way back last decade, Web 2.0 threatened the monolithic on-premise enterprise vendors with cost destruction and the now much abused words "agility" and "disruption". Back then Google had half baked lightweight, free productivity cloud tools with "beta" written all over them. Today SAP announced partnering with Google on Android for Work 'enabling employees to securely bring their own Android devices to the workplace and conveniently switch between work and personal activities without relinquishing control of personal data' and a vaguer partnership with Facebook.

All mildly interesting, but for those of us on the strategic planning client side of the table, attendance at these events is a lot more about trying to figure out how, if and when the expensive, brittle previous generation technologies can be cost effectively updated to improve business performance, and this is where SAP is arguably running into problems as the incumbent in some firms.

Figuring out which developments will go on to change the world forever and which will be successfully absorbed by legacy vendors remains an important perspective as innovation waxes and wanes.

For all the talk of the ever more connected "business network" -- which has been the central thrust of business strategic planning for years under past terms such as Digital Transformation, SMAC etc. -- there seems little enthusiasm so far for moving to S4/HANA unless the cost factor is attractive, the business use case compelling and the technology being fit for purpose.

Netsuite's CEO Zach Nelson took to a stage in the center of the San Jose Suiteworld audience looking like a school headmaster - his tailor and shirt supplier is clearly not in the same league as SAP's McDermott. Tiny as a contender in comparison to the SAP juggernaut (the world's largest business software company), the prize they are both going for is the "transforming the customer journey" schtick which is currently seen as the Holy Grail for software companies to break out of the IT silo. (Angela Ahrendts, now at Apple on a salary package close to one hundred million dollars a year after her CEO tenure at Burberry, is the highest paid female in the US and was 2012 winner of the Financial Times Golden Flannel Award for her proficiency and fluency with customer journey buzz words.)

This customer-centric perspective is also why Salesforce is possibly in play for a takeover, and why SAP today announced their new subscription cloud "Digital for Customer Engagement" product - "Simple but powerful CRM ready to grow with your business."

For all the hype about customer journeys, however, it's been pretty apparent from my experiences that most firms are reticent about taking product marketing guidance from ERP software firms they are already paying out large sums of money to for IT infrastructure they are struggling to make more efficient and cost effective. This reality is apparent across the board as client firms pressure their technology support partners to understand their future commercial business needs and support them accordingly. This is more a race to catch up with the speed digital business is moving at these days than it is a triumphant debut of innovative technologies. Tech firms that are too slow and expensive are going to suffer, and the larger vendors have less headroom to react while seeking ever greater returns for their financial market masters.

This in theory creates a sweet spot for companies like NetSuite, room to grow and mutate to better fit market needs as they evolve without the pressures of legacy support and SAP's huge commitments with HANA and data handling. It's early in the week so it would be premature to comment until this incredibly busy week has played out.