The maintenance renewal landscape

A small and therefore statistically dubious quarterly CIO survey undertaken by Kash Rangan's team at Bank of America Merrill Lynch published earlier this month makes revealing reading. On the general spending front, it should be no surprise that the survey believes CIO's are under spending relative to plan in 2009 albeit 2010 expectations are perhaps slightly firmer. The real interest to me though was 13 pages into the report where Ranagan's team provide an analysis of success in negotiating better maintenance prices.

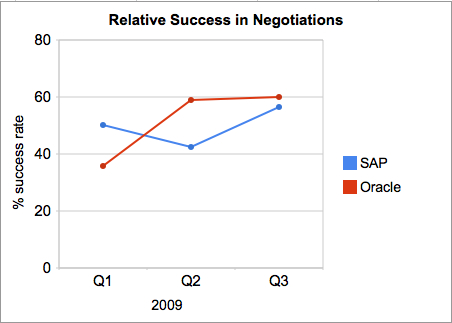

I've extracted the numbers for Oracle and SAP as these are the two companies where we see the greatest friction between buyers and sellers. The report included data for Microsoft and VMWare.

I was particularly interested in relative success rates between the two companies. It should be no surprise that success at Oracle increased dramatically between Q1 and Q2 as Oracle's year end is May 31st. As is well known, you always stand a better chance of getting a better deal as sales people seek to close out the year. I was slightly flummoxed by the Q1 comparison because this came after SAP's year end and so the same pressures should not have applied. Without more data it is difficult to assess the reason or for that matter whether it is a particularly accurate reflection of reality. What is more interesting though is that these respondents appear to be getting a consistent 58-60% success rate from both companies.

That's a surprise. The way the two companies spin their maintenance story to the street, you'd think they were paving the roads to their HQ's in maintenance gold.

As I said at the top of this post and which BOA/ML caution, the sample is small so one can't be certain the trends found in this data are reflective of the wider world. However, in a report from Peter Goldmacher's team at Cowen published in September (PDF), part of which was reproduced by Vinnie Mirchandani, it was said that:

“We believe that application software vendor maintenance fees are at risk. Our research indicates that companies continue to tighten their belts around IT spending, and ERP upgrades are not a priority. This is not a macro issue that we expect to diminish as the economy strengthens. We believe ERP upgrades, the primary motivation to pay maintenance fees, are on the wane because it’s a mature market. Vendor investments in R&D are on the decline, innovation is lagging and redeployment costs are multiples of the license fee. As a result, customers are increasingly questioning the value of paying annual maintenance fees of 20% of the cost of the original license for the occasional use of technical support. We believe that as the value proposition around maintenance fees diminishes, there is significant opportunity for third party service providers to offer low cost tech support. While there are only a small number of these third party providers today, we believe that as Apps sales continue to decline, there is a significant over capacity of consultants with ERP expertise looking for opportunities to leverage their skills. We believe these dynamics will result in the creation of a number of businesses designed to chip away at the exorbitant revenues and margins associated with vendor maintenance fees.”

[my emphasis added]

On yesterday's Enterprise Advocates webinar, we pointed out that maintenance is only one (albeit important) part of the TCO equation and that data center economics along with SI costs are equally worthy of review. However, BOA/Cowen's analysis should give the vendors pause for thought and encourage buyers to think positively about getting more balance into their vendor relationships.

Maintenance revenue is a huge contributor to bottom line profit. Both companies know it and are anxious to protect that revenue stream. However, it is that very reliance on super profitable revenue that renders them vulnerable. I have long said that it is unsustainable as a growing line item set against mature products and mature implementations.

SAP did not pre-announce Q3 results which are due October 28th, just as TechEd Vienna is in full swing. One can only assume they've no nasty surprises since SAP is pretty good at breaking bad news early and that hasn't happened this time around. That's in sharp contrast to last year's Q3 train wreck. That still leaves a tricky couple of months during which we'll see whether SAP is resilient to the pressures of change. If the lively Q&A on yesterday's webinar is anything to go by, there is plenty for both buyers and sellers to consider.