The Other Debt Crisis

Naomi Bloom, HR guru, and I traded emails today re: IT or technical debt. This refers to the amount of backlogged maintenance & upgrading that IT professionals need to do on their application portfolio but haven't due to time, budget or other constraints. Like most types of debt, too much of this can be a really bad thing.

When you look at technical debt and software vendors, the view gets scary there, too. When you license (or subscribe to) application software, your firm generally wants the vendor to continue to maintain, enhance and bulletproof the code. Your total investment in the software is often a form factor of the license (or subscription) fee and you don't need the headache of fixing, patching or rebuilding someone else's software especially when your IT department is swamped as it is.

However, not all vendors are the same when it comes to technical debt. Some are fastidious and continue to keep their products not only current but ahead of the market. They innovate and delight customers - customers that sometime complain that there are too many updates coming forth from the vendor. Other vendors see all of this patching and updating activity as a cost that drains potential dividend funds from the shareholders.

What got Naomi and I talking was the whether a certain software vendor was doing anything to reduce the debt level they possess. Much of this vendor's technical debt is the result of their acquisitions of many other software companies, each with their own technical architectures, code base and upgrade challenges. (Naomi's got a couple of good blogs on the technical debt issue at here and here.)

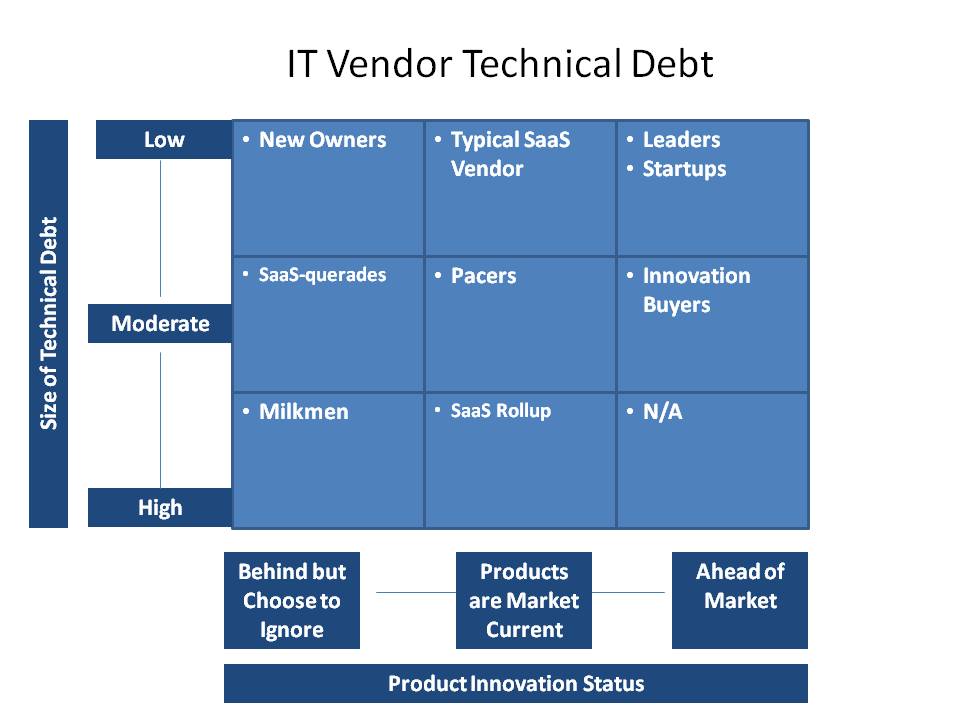

To understand the technical debt crisis within software vendors, I've prepared the following matrix:

Companies with low amounts of IT Technical Debt are often one product or one product line software firms. By their relative newness, they can't have much IT debt unless they made the mistake of creating or buying a technically obsolete product. Many SaaS vendors are in this spot for now but it is becoming clear that SaaS vendors that lack killer PaaS (platform as a service) capabilities like Saleforce's Force.com or NetSuite's NS-BOS are about to fall way behind technically. Likewise, SaaS vendors without solid mobile, social and integration capabilities are already accumulating IT debt whether they know it or not.

Software vendors with moderate amounts of technical debt are in trouble despite the brave faces they put forth. These include vendors that market a SaaS product that is not multi-tenant, must be hosted and lacks a PaaS and IaaS. Sometimes, vendors with old, tired product lines attempt to lessen their average debt load (i.e., total debt/total applications) by acquiring a few small but really amazing products. These companies have all but given up trying to be innovative on their own. They choose to buy innovation rather than develop it internally.

The vendors with the highest debt loads are those firms that try to buy their way into large market share positions. They often end up as the janitorial service of the industry, sweeping up one old product line or company after another. Many of these firms buy products with little intention of reducing the IT debt load. On the contrary, these companies are counting on putting in the absolute minimum investment possible into their numerous disjointed product lines to keep you paying maintenance (or subscription fees). When vendors like this say one thing (e.g., "We will bring all 402 of our acquired code bases into a single code base" ) while fully intending to do something else (e.g., "We're redefining the concept of life support for old code"), it makes my skin crawl. Their massive, growing technical debt load is going to mean trouble for many customers as they will someday realize that the enhancements they have been expecting for years may still be years away from arriving, if they ever do.

Another kind of vendor with high IT debt is the SaaS rollup player. This is an emerging category of vendor that is buying best of breed solutions and stitching them together. Their debt service is somewhat manageable as SaaS products, generally, possess simpler, thinner technical architectures. While on-premise solutions often support countless combinations of DBMS, systems management tools, security products, server hardware, server operating systems, etc., cloud solutions have only one of each.

Buyer Implications

Smart software buyers would be best served if they understand that:

- An application in the bottom left of the matrix is probably a WYSIWYG (what you see is what you get) product. The product will likely remain unchanged for long periods of time.

- Vendors with large, stitched-together application portfolios aren't all the same. Some are working to reduce their IT debt and others just don't care about it. If you need and want a product that changes over time, find a vendor that's serious about reducing this debt service.

- Vendors that cobble together on-premise products will likely have a tougher time reducing their debt service than vendors that are building a coalition of SaaS solutions.

- When vendors start buying innovation, users should re-evaluate this vendor. This phenomenon doesn't always mean that the vendor's R&D capability is broken, but, it just might be.

- The kinds of vendors in each cell of the matrix above change over time. Today's Leader can become tomorrow's Milkmen product in a manner of months. Your IT portfolio should be re-assessed frequently to see where each vendor is now.

Definitions:

Milkmen - These vendors see the install base of acquired products as a cash cow that should be milked for all its worth. Often these vendors are more interested in teasing you with the promise of better future products while under-investing in the effort to create them.

SaaS-querades - Vendors that sell a software as a service (SaaS) solution that really is their on-premise product running in a hosted environment.

New Owners - These are vendors that just bought a hot product/vendor. The acquirer doesn't have a lot of IT debt as this may be their only acquisition to date.

SaaS Roll-up - This is a company that is growing by acquisitions except all of its acquisitions are SaaS firms. For the time, these products are market current and the technical issues they must conquer to fully integrate each solution to another are manageable.

Pacers - These are software firms that keep up with the market and its ever evolving changes.

Typical SaaS Firm - Most SaaS firms today have little IT Debt (for now) but could fall behind if they don't keep up with market changes. Will these firms stay relevant if they don't get a big data, in-memory database, PaaS and other capabilities in place fast?

Innovation Buyers - These are often large vendors that constantly snap up more innovative firms/products. Sometimes they can successfully integrate these into their existing products but sometimes they don't. If you expect these firms to remove their IT debt with one of these acquisitions, it's a crap shoot.

Leaders and Startups - These firms are generally in the top right matrix cell as their products are novel, ahead of the market and encumbered with little baggage from past IT architectures.