TI profit warning spurs Kindle Fire demand worries

Texas Instruments cut its revenue and earnings outlook for the first quarter, cited weakness in its wireless business and set off a series of supply chain sleuths.

By the numbers, TI projected earnings of 15 cents a share to 19 cents a share for the first quarter. TI's previous range was 16 cents a share to 24 cents a share. The company added that its first quarter revenue will be $2.99 billion to $3.11 billion, down from its previous range of $3.02 billion to $3.28 billion.

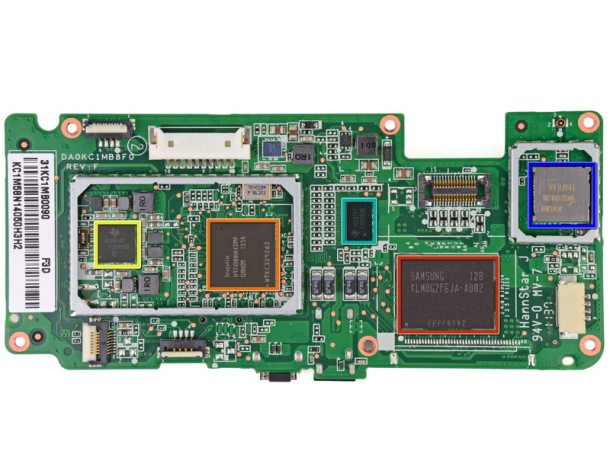

Inside the Kindle Fire.

TI blamed the cuts on "lower demand for wireless products." Naturally, that comment made for an interesting yet frustrating conference call with analysts. TI's Ron Slaymaker, vice president of investor relations, said wireless demand was off. Analysts tried to pin Slaymaker down on what customer was off the most.

Analysts weren't successful on getting a definitive comment from Slaymaker, but all signs point to an inventory correction for Amazon's Kindle Fire, which uses TI's OMAP processor.

Slaymaker said:

We had strong growth in OMAP in the fourth quarter, and that was really as we benefited from new product introductions across multiple customers. And as you know, whenever there's a new product introduction by a customer, there's also an associated one-time surge of revenue as those customers fill their channels with product.

So, although we had anticipated lower sequential revenue associated with that non-recurrence of the fourth quarter channel fill, demand for OMAP is lower than what we had originally expected, as our customers are now rationalizing both their expectations for ongoing demand, as well as the associated inventory.

And what customers are rejiggering inventory? Slaymaker was asked whether one customer was the issue or multiple. Slaymaker said it was a combination of customers.

I'll let those customers report their own business when they report. I'll kind of stay focused more on what we're seeing directly in combination, as opposed to breaking out customer by customer. But that being said, I think it's probably a combination.

Analysts pegged TI's weakness to the Kindle Fire and Amazon's inventory adjustments. Macquarie analyst Shawn Webster said in a research note:

We believe a majority of the shortfall is from order cuts for the Amazon Kindle Fire from which the company saw robust growth in Q4 as they won both the application processor and the Wifi sockets (among other chips).

Other analysts also blamed Amazon's Kindle Fire, but noted that Research in Motion and Nokia sales weren't so hot either. TI's Wi-Fi chips are also used in multiple products. Morgan Stanley analyst Sanjay Devgan said:

Most weakness was in OMAP as customers drew down inventories because of lower demand. We think lower sales of Amazon’s Kindle Fire drove OMAP weakness. Moreover, we believe weakness at RIM and Nokia drove reduced revenue expectations for connectivity.

Is this a long-term worry? Jefferies analyst Mark Lipacis didn't think so. He said he expects customer to rebuild inventory in the first quarter and that could mean more OMAP processors for the Kindle Fire.

However, there's a reality that TI will have to confront: It has the wrong customers. Mobile chip makers that aren't tied to Apple or Samsung are going to see volatile results. The other smartphone and tablet players are too iffy. "We see this volatility in OMAP as further evidence of the challenges that face chip companies in the highly competitive mobile apps processor space, particularly if not aligned to Apple or Samsung," said Ross Seymore, an analyst at Deutsche Bank.