Tidemark launches Storylines: Can UI bring analytics, visualization to the masses?

Tidemark, a performance management startup, has launched Storylines, a feature designed to bring analytics to more employees and build a narrative around a company's forecasts and financials. Combined with a new try before you buy approach, Tidemark is likely to garner more momentum.

The Storylines concept is notable since Tidemark is trying to build its reputation on mobile and cloud analytics with a heavy focus on a user interface that's digestible. The ultimate goal is to make analytics for the masses.

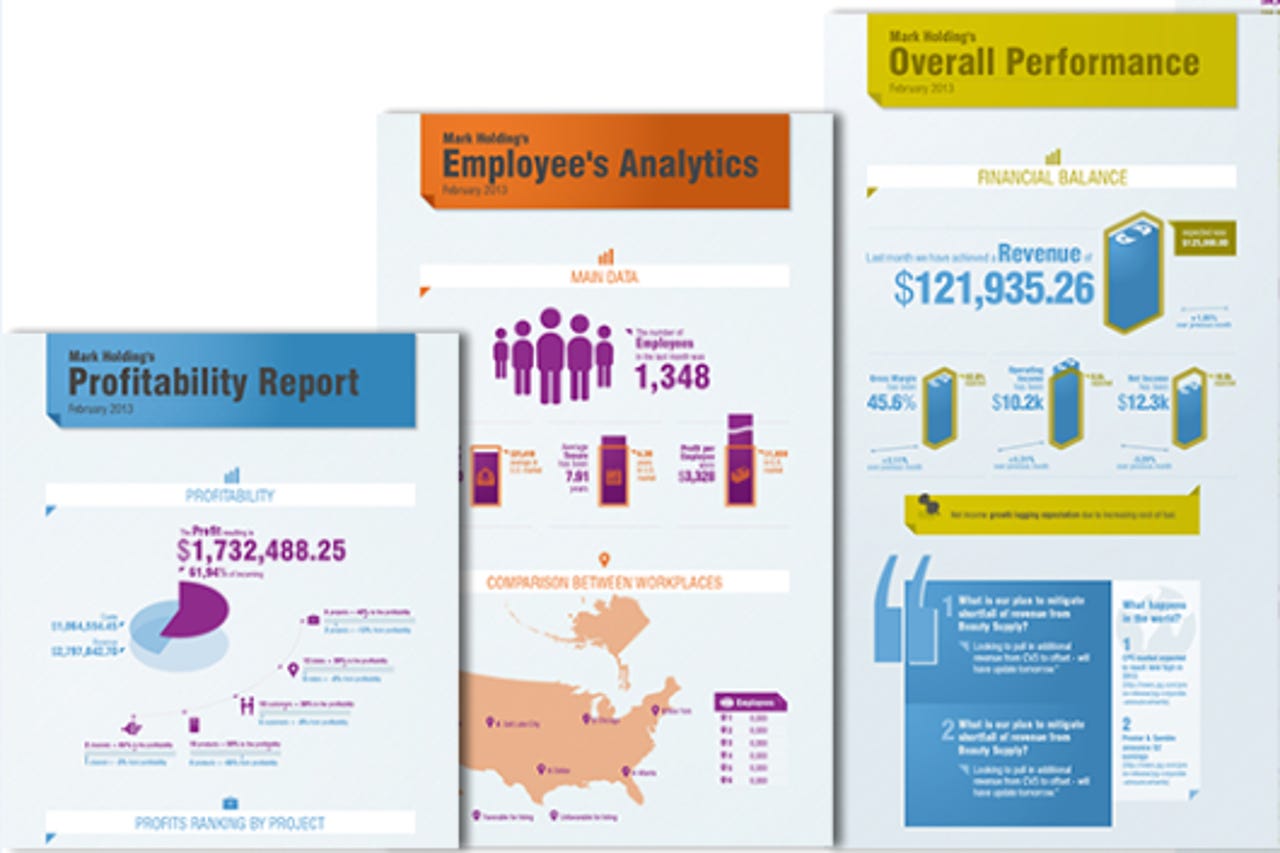

In Tidemark's latest release (as of Spring in the U.S.), Storylines is an effort to replace dashboards and reports with visualizations based on company health, scenarios, forecast variances, people and profitability.

According to Tidemark CEO Christian Gheorghe, business reporting is fundamentally broken. If analytics is going to become a cultural institution at companies, it has to become easier to digest. The solution is to turn traditional dashboards into interactive info graphics that tell the financial tale of a company. "Dashboards have been created for print and they aren't telling you the story," said Gheorghe.

In an interview, Gheorghe demonstrated Storylines. Overall, the UI was handy. The mental exercise I went through is whether I'd use these dashboards as a liberal arts type who gets edit budget and forecast spreadsheets thrown at me from above regularly. Typically, I get a Google Doc among dozens I largely ignore or a spreadsheet that usually makes me cringe.

The verdict: Tidemark's approach could work well. These Storyline interfaces are being taken for a spin at companies like Chuck E Cheese, a restaurant chain, and G&K, which provides uniforms. Tidemark, which targets enterprises with more than $500 million in revenue, now has 14 customers and $15 million in total contract value for fiscal 2014.

"Forecasting is the new money ball," said Gheorghe, who is betting that lining up an entire company behind forecasting and profitability is a game changer. Gheorghe's theory is that all employees will be invested in meeting forecasts if they come in a digestible format.

More notable is what G&K is doing with Tidemark's systems. The company changed its model for its sales force. Instead of being paid on contract size and revenue, sales people now focus on profitability of each deal.

Gheorghe's goal is to get to 25 customers and then hit scale with revenue. Tidemark, which has raised $35 million in venture capital funding so far, averages $120 per user per month in three year contracts with customers. Discounts are given if companies pay upfront. In many deals, Tidemark rides shotgun with Workday. In the latest release, the two companies tightened integration with bidirectional data. Tidemark also partnered with Box for disclosure and document management, said Gheorghe. "The goal is to put analytics on the edge," said Gheorghe.

To spread the word on this analytics user interface, Tidemark is taking a new model for a spin. Customers, who pay $150 per user per month on average, will automatically get Storylines. However, there will be a try before buying system. Under this model, companies can hook into Tidemark to get the story of their company's financials and forecasting free. To interact with the data, however, will cost them $29.99 per month per user. Gheorghe's experiment is based on the idea that Storylines will land new customers.

This try before you buy approach isn't necessarily freemium because it's not easy to take Tidemark for a spin. It will take a few weeks to hook processes into Tidemark. Companies will also need a core minimum of employees to try Tidemark. However, if an enterprise is evaluating business intelligence and forecasting tools, it may be a part of due diligence to give Tidemark a spin.

Other notable features added by Tidemark include:

- Tidemark also noted that it has more tightly integrated its software with Workday for planning and forecasting. The two companies now share more data in their applications. There's also support for Workday's Worktags.

- Collaboration and annotation tools to enable mobile commenting in financial data.

- Better financial and operational modeling designed to offer continuous forecasting.

- Contextual assumptions that expose the underlying theories behind forecasting.

- Big data correlation to loop in unstructured data from outside sources.

Related: