Twitter's Q2 not nearly as bad as expected; bolstered by World Cup

Twitter stock has taken a turn for the worse since a smashing public debut last fall. All eyes were on the social network as it reported second quarter earnings after the bell on Tuesday.

Tech Earnings

The San Francisco-headquartered company delivered a net loss of $145 million, or 24 cents per share (statement).

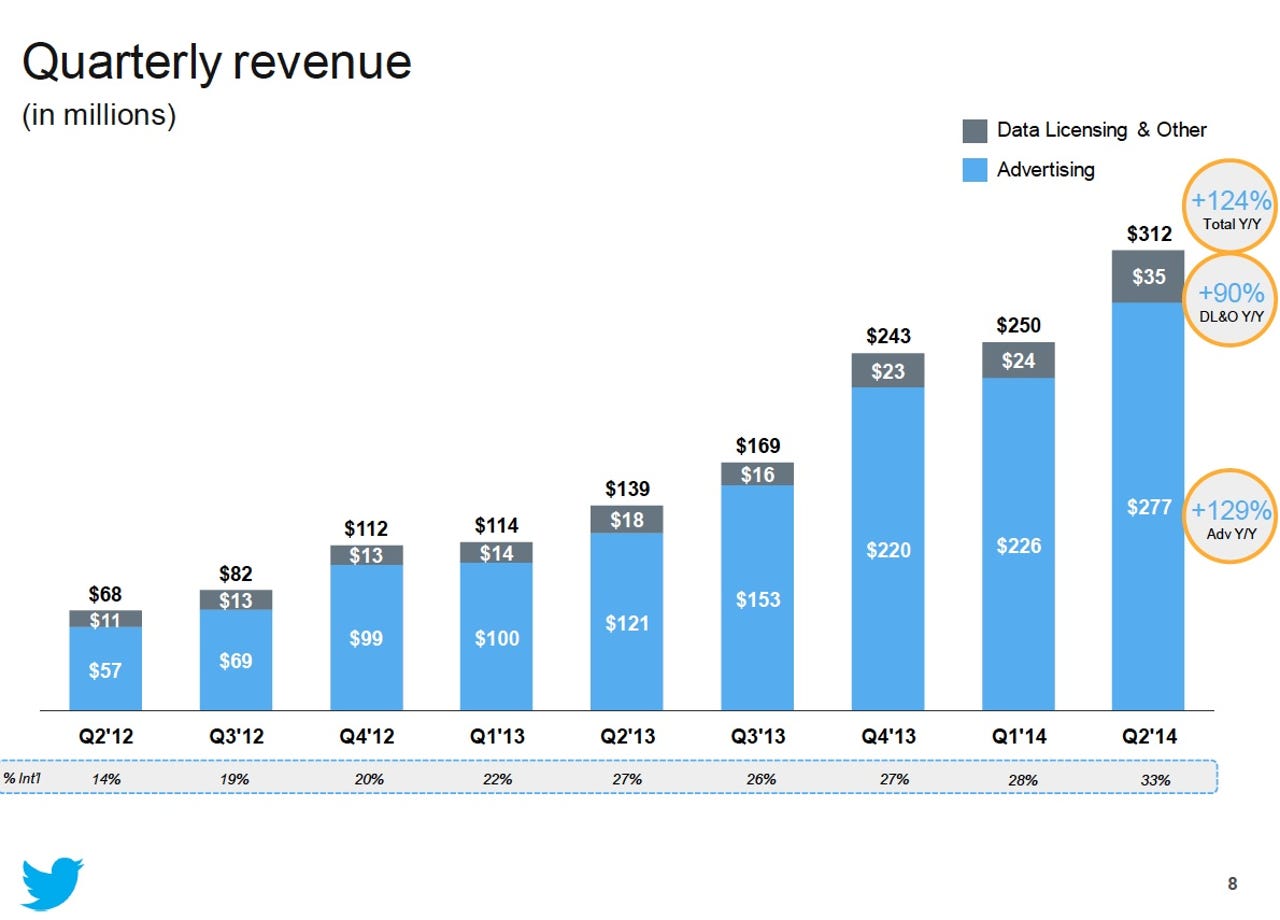

However, non-GAAP earnings were two cents per share on a revenue of $312 million, up 124 percent year-over-year.

Wall Street was braving for a loss of a penny per share on a revenue of $283.07 million.

Twitter stock owners must have been chipper from the news. Shares were up by as much as 20 percent in after-hours trading.

Highlighting Twitter's continued strategy around live television and global events, CEO Dick Costelo touted the stronger-than-expected results in prepared remarks:

We remain focused on driving increased user growth and engagement, and by developing new product experiences, like the one we built around the World Cup, we believe we can extend Twitter's appeal to an even broader audience.

By the end of the quarter, Twitter's monthly active user base stood at roughly 271 million, up nearly a quarter from the same time last year.

The uptick is even stronger over on mobile as monthly active users on that channel reached 211 million, up 29 percent year-over-year. Mobile MAUs now represent approximately 78 percent of all monthly active users.

In reflection of its user base, mobile advertising revenue took up 81 percent of total advertising revenue.

As for what could be the most important metric for Twitter shareholders, advertising revenue per thousand timeline views reached $1.60, an increase of 100 percent year-over-year.

Looking forward, Wall Street expect Twitter's loss to flatten out to zero cents a share on a revenue of $323.93 million in Q3.

Twitter followed up with a higher revenue guidance range of $330 million to $340 million.

Slides via Twitter Investor Relations