Twitter's Q4 a mixed bag of usage, but revenue growth, data licensing solid

Twitter's fourth quarter results were better than expected, but the first quarter outlook was a bit light. The company's data licensing and other revenue surged to $425 million for 2018.

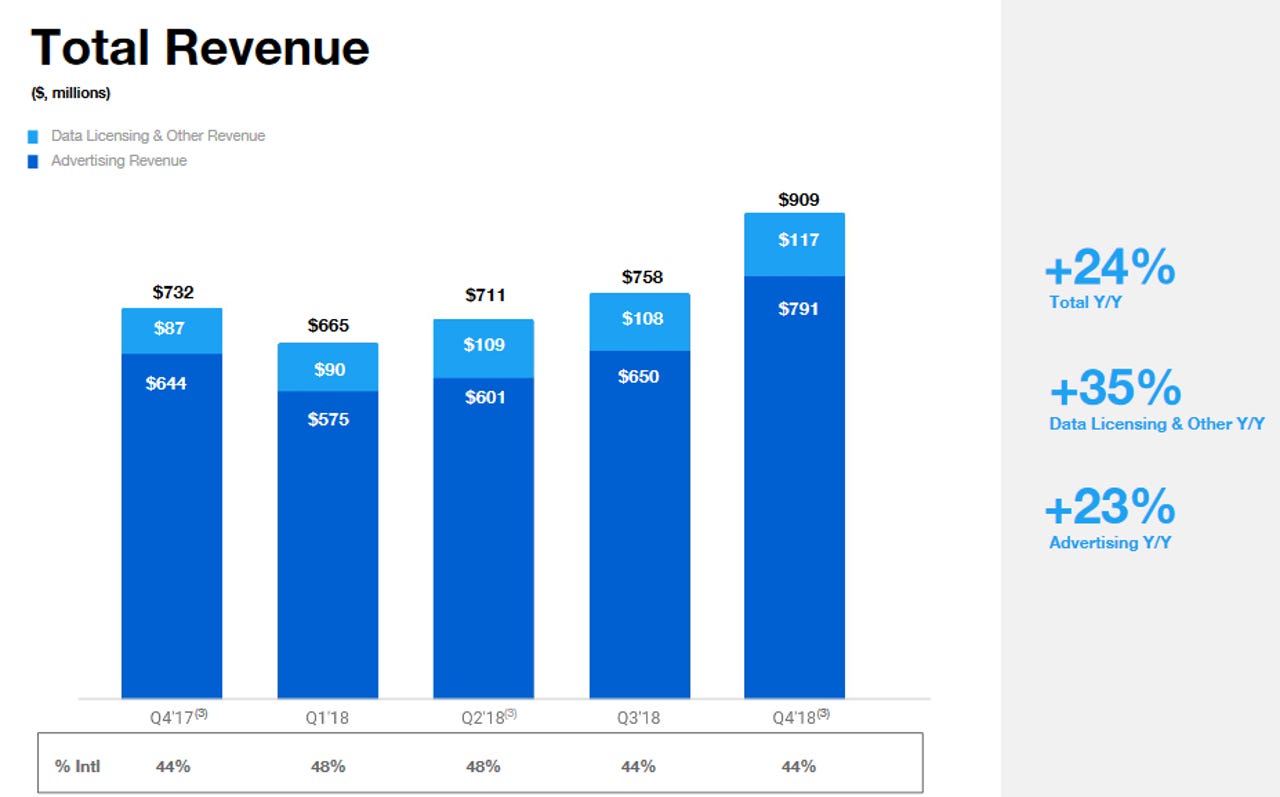

The company reported fourth quarter net income of $255 million, or 33 cents a share, on revenue of $908 million, up 24 percent from a year ago. Ad revenue in the quarter was $791 million with data licensing and other delivering $117 million in sales. Non-GAAP fourth quarter earnings were 31 cents a share.

Wall Street was looking for fourth quarter non-GAAP earnings of 25 cents a share on revenue of $867 million.

Also: 10 things to know about Facebook's Q4

For 2018, Twitter reported net income of $1.2 billion, or $1.56 a share, on revenue of $3.04 billion, up from $2.44 billion in 2017.

As for the outlook, Twitter said it expected revenue between $715 million and $775 million. For the first quarter, Wall Street was expecting revenue of $765 million.

Twitter disclosed monetizable daily active users as a metric. According to Twitter, mDAUs represent users who are logged in and able to see ads. In the fourth quarter mDAUs were 126 million, up 9 percent from a year ago.

However, monthly active users in the fourth quarter fell 9 percent from a year ago.

In a shareholder letter, Twitter said its enterprise business could slow.

Data licensing and other revenue totaled $117 million, an increase of 35%. We saw continued year-over-year growth in data and enterprise solutions (DES), while MoPub had its highest revenue quarter ever. Looking ahead, while DES continues to benefit from customers developing new use cases and smaller customers adopting self-service APIs, we are now largely through our multiyear enterprise renewal cycle. As a result, with many of our largest partners now at market pricing, revenue growth is likely to moderate in 2019.

On the advertising business, Twitter noted:

By sales channel, large to mid-tier customers continue to represent a sizable majority of our advertising revenue. Our self-serve channel, while considerably smaller, continues to grow. We see a large opportunity in self-serve, which is generally used by smaller and local businesses, with additional product investment needed to fully capitalize on the opportunity to help these businesses reach their customers on Twitter.