UNIT4 results show regional weakness but SaaS strength

Despite regional weakness, UNIT4 managed to show a respectable improvemment in overall top line license sales for the first half of 2012 with subscription and SaaS based revenue showing the greatest improvement.

- Total revenue increased by 4% to €230.8 million (H1 2011: €222.0 million)

- Product (license) sales increased 5% to €36.0 million (H1 2011: €34.3 million)

- Recurring revenue (contracts & SaaS / subscriptions) increased by 8.3% to €118.2 million (H1 2011: €109.1 million)

- SaaS / subscription revenues grew 20.1% from €18.9 million to €22.7 million

- Services and other revenues decreased by 2.5% to €76.6 million (H1 2011: €78.6 million)

- Cloud applications specialist FinancialForce.com grew strongly with monthly revenue run rate up more than 100% (compared with June 2011)

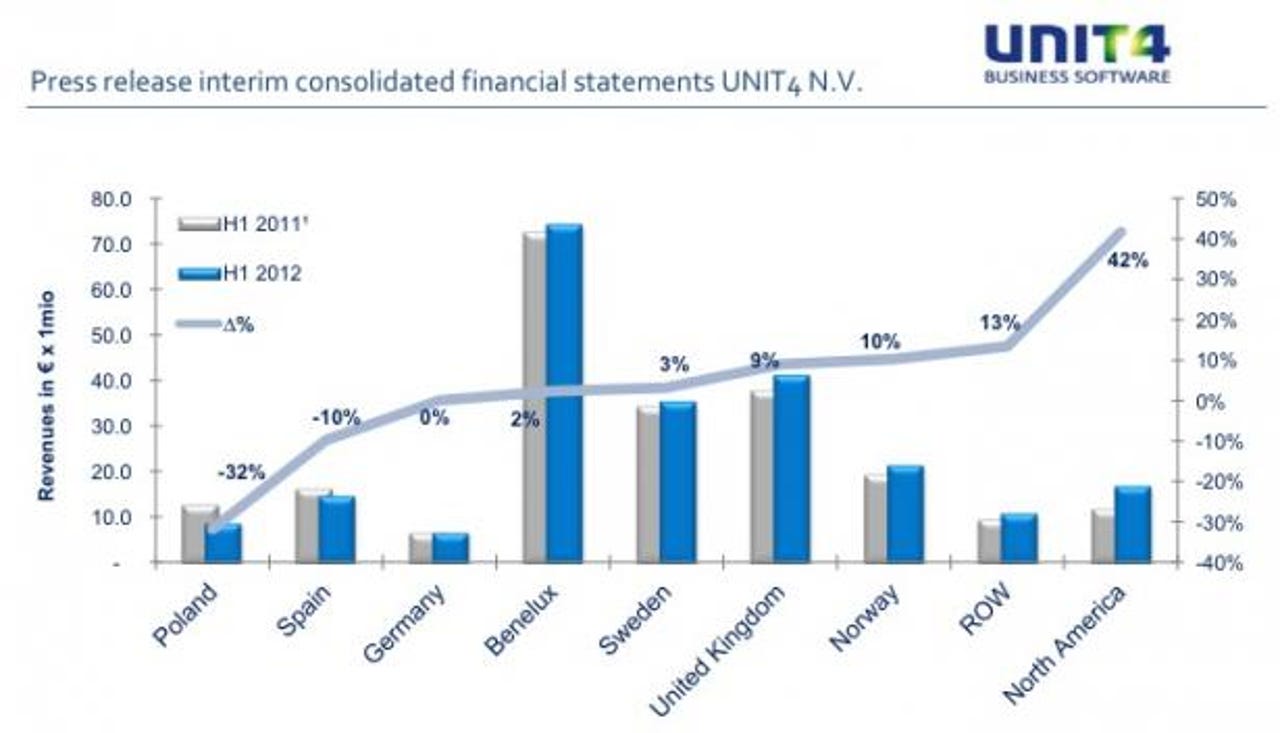

The more interesting detail comes from the regional breakdown (see image below)

With the exception of Germany which was flat, Eurozone results reflect general economic conditions. Its heavy reliance upon the Benelux masks better growth in non-Eurozone territories. The UK outcome was a surprise which reflects the company's aggressive positioning as a cost cutting provider to local and central government organisations.

FinancialForce.com, which is part owned by Salesforce.com showed a strong result:

The strong growth experienced by FinancialForce.com in 2011 has accelerated in the first half of

2012. The monthly revenue run rate in June 2012 grew over 100% compared to June 2011. The

annual revenue run rate (including services) was over $12 million by the end of June 2012.

Even so, UNIT4 is finding it has to continue investing in FinancialForce.com in order to ramp sales and product development. In the last half, the net investment recorded was €3.9 million, modest by some standards.

My sources tell me that FinancialForce.com has highly aggressive targets in 2012 that should see it hit an annual run rate in the region of $20 million by years' end. If the company is able to achieve that outcome, then history tells us that it will be well positioned to double up and more in 2013.

UNIT4 is one of the very few enterprise apps vendors that is attempting a wholesale shift to subscription based revenues. Its heavy emphasis on government contracts helps that shift as it is able to persuade local authorities and HE organisations to aggregate their IT requirements into a bundled subscription service. This helps grow UNIT4's installed base (and revenue) while allowing customers to move capex to opex at lower annualised cost. As these results demonstrate, the company experiences lower growth than it would if selling on-premise licenses but the revenue stream should be more sustainable over time.

The one blot on this report is cashflow:

Operating cash flow declined by 9.7% to €43.9 million (H1 2011: €48.6 million) due to a lower improvement of working capital in H1 2012 compared with H1 2011.

Cash position at the end of June 2012 was € -7.2 million (31 December 2011: € -10.1 million) and the net debt position was €113.0 million (31 December 2011: €117.3 million).

That is the inevitable outcome of shifting to subscription services and SaaS arrangements.

UNIT4 maintained its single digit growth guidance for the full year.