Upgrades the panacea for IT debt? Think again.

Having been on the road seemingly forever and then attempting to recover from the inevitable jetlag I am late to the Gartner and IT debt discussion. Be that as it may.

Whenever Gartner puts out one of its polemics I cringe. The numbers are almost always unimaginable for many and put out a message that scares the bejeezus out of CXOs. Vinnie Mirchandani knows better than most when he says:

Gartner made a name starting in the mid-90s forecasting the estimated cumulative cost of Y2K remediation. I was there – and the big numbers it bandied about helped focus enterprises on the core problem. But it also led to hype, panic buying (and exaggerated market declines on the other side of the peak) and many, many poor IT investments. Since then Gartner has picked on many events – such as the introduction of the Euro between 1999 and 2002 - and piled up potential costs to come up with a single, usually scary, related aggregated IT project cost forecast.

adding in that:

The problem is there are many good reasons to NOT upgrade/modernize many applications, and I believe Gartner is out of line using words like “debt” which have guilt associated with them.

I suppose the one good thing that can be said is that in using such inflammatory terms, Gartner is setting the stage for a wake up call to at least examine the applications portfolio. Frank Scavo takes that line in his analysis, pointing out that:

...it appears that Gartner is using this statistic to highlight the state of disarray in the applications portfolios of many organizations and to "make the problem bigger."

With that in mind, let's stipulate that application proliferation and unsupported versions is a big problem in many organizations.

Frank then goes on to provide six broad categories of potential candidate: retirement, consolidation, freeze, 3PM, SaaS and upgrade. In doing so, he is mirroring some of what Vinnie proposes, especially in the consolidation and retirement categories. As a starting point it is a good way to look at the portfolio but as he and others have questioned: do CIOs know what the portfolio matrix looks like? When was it last inventoried? And what about all those rogue apps creeping under the door via credit card deals? It is a topic that many of us talk about but don't necessarily trumpet sufficiently loudly except when relating some client horror story.

I have strong sympathies with Vinnie's point about not upgrading. The last week I was on a platform where I declared: Book-keeping is dead. Our good friend Pacioli died almost 500 years ago and yet still we worship at the altar of double entry book-keeping as the cornerstone of ERP. If we agree that debits are still on the left and credits are still on the right then why would I wish to upgrade unless I am going to get significantly improved automation that cuts cost out of administration?

I recall being faced with the same dilemma back in 1989 for what was then a specialist solution for accounting. The supplier wanted to introduce progressive maintenance fees but didn't have a persuasive story against which to sign up. I calculated that since the software worked well enough, the only thing I was likely to need was support for 'legs and regs.' That was worth something but not what they were charging. We went onto self-maintenance and didn't look back.

If you want proof that sticking with the same software is OK then check out how SAP has recently extended support for R/3 4.6c though 2013. It was due to be sunsetted at the end of 2011.

If I can achieve the same result with SaaS in the knowledge the service will be enhanced over time at little or no cost to my business then I am starting to create candidates for a switch that could yield huge benefits. In one case I saw recently, a switch to SaaS could potentially carve out up to 50% of existing cost. That runs millions of dollars and would not represent a significant change management problem. Why? Because the principles of accounting have not changed and so provided there is like for like or improved functionality then staff should not experience a significant wrench. And therein lies the FUD weapon vendors like to pull out. Ever heard the: 'Well, you've got to train them on the new system and that could be a problem,' argument? Guess what, the same holds true when the UI gets renovated so why wouldn't I consider an alternative?

When I think about this topic and apply it more broadly to HR and the like I then recall something Safra Catz, president of Oracle once said. It goes something like this in regard to the 'legs and regs' upgrades: 'We'd do it anyway.' If that's the case - and it sure is for all software vendors I've come across - then the case for slicing out a good chunk of the portfolio maintenance to the likes of RiminiStreet makes immediate sense. But you can't realistically contemplate that without having a clear understanding of the portfolio and its place in providing value back to the business.

Dennis Moore approaches this with the notion that:

...another way to look at this is as technical debt owed BY enterprise software vendors to their customers. After all, if these updates, upgrades, and patches had enough value in them, and cost little enough to apply, then the ROI (benefit/cost ratio) would be sufficient to justify keeping up with the vendor's software releases. The gap between the ROI needed and the actual ROI for each release is a form of technical debt - but its a debt owed by software vendors to their customers.

He then goes on to compare and contrast the different approaches of on-premise and SaaS providers. It is a useful analysis when taken against Frank's '6 Candidates' approach to the apps portfolio. What we now need is a way of measuring the different impacts that remaining on-premise to SaaS switching, going to 3PM etc will bring. Each needs to be examined on a case by case basis but I remain surprised that SaaS vendors expend so little effort in providing potential customers with the bare bones of a model against which they can start that assessment.

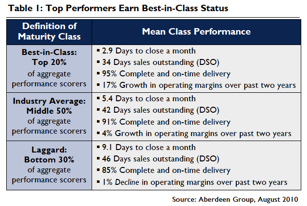

Having said all that, I came across an Aberdeen paper that discusses the merits of SME's being on the latest ERP release. It argues that (registration required) best in class companies:

- Close in 2.9 days

- Have an average 34 days DSO

- 95% complete and on time delivery and

- 17% increase in operating margins in the last two years

Ascribing the whole of these performance figures to being on the latest ERP release is, to my mind, something of a stretch. There are plenty of reasons beyond IT why best in class companies do well. However it is when you see the comparison with what Aberdeen calls 'industry average' and 'laggards' that one can be more easily persuaded (see illustration below.)

It is arguably easier for SMEs to assess the worth of upgrading since they likely have less by way of bloat in their portfolios and a simpler IT landscape. Even so, I would still argue that Frank's approach should provide a starting point for any business considering their upgrade options.

So while I welcome Gartner for bringing the 'debt' problem to our attention, it is a pity they did not at least consider offering the alternative perspectives my colleagues bring to the table. But then I guess when you are looking at this through the eyes of a consultancy hoping to cash on induced fear, bolstered by an industry that is only too eager for more of those maintenance dollars then where's the incentive to go further than the teaser Gartner put out?