Venture capital is a tough business. No, really

Think venture capital is an "easy business"? Think again. According to one VC, over the last decade, payoffs from venture capitals deals have failed to match those from investing in the stock market

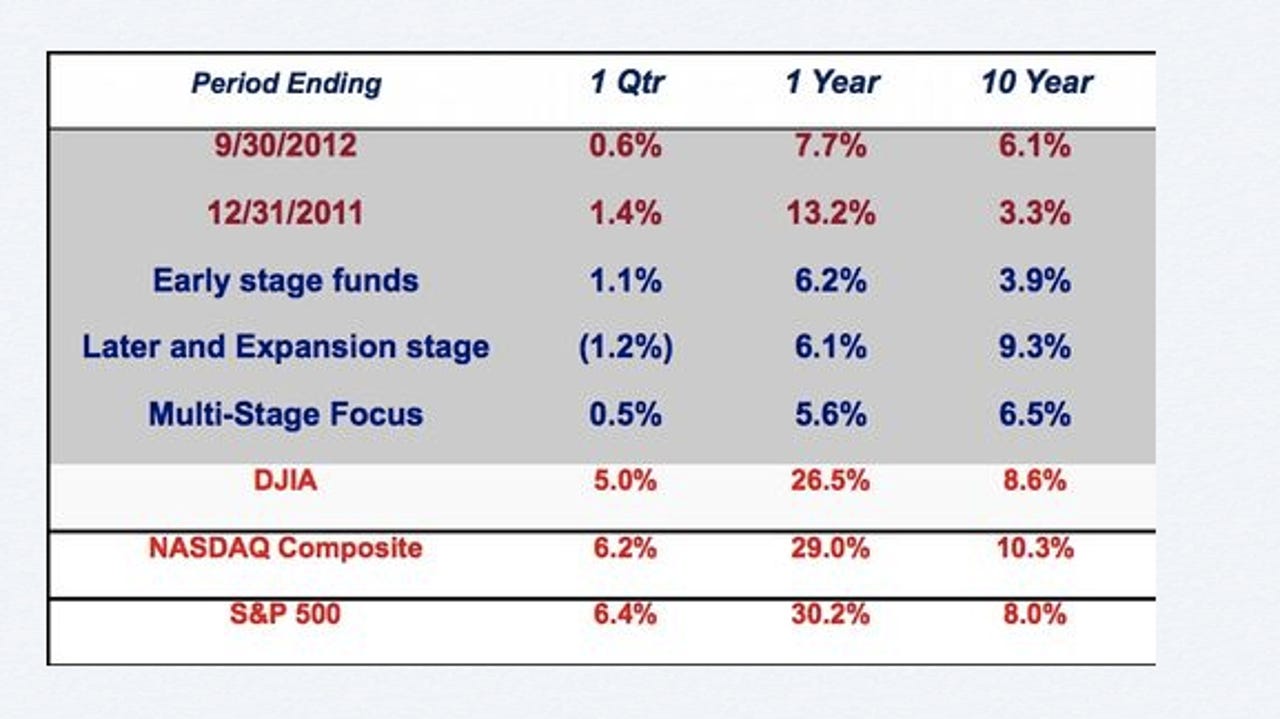

According to figures from Union Square Ventures' principal Fred Wilson, who writes on the A Venture Capitalist blog, short and long term private equity returns have been lower over the past decade than US public markets such as the Nasdaq.

In fact, they've been low over the 10-year timeframe, they've not reached double digits, according to Wilson.

"When I got into the business in the mid-80s, I was schooled that you needed to produce at least 20 percent annual returns net to the limited partners to stay in business," Wilson writes.

Using data from Cambridge Associates covering VC performance in various tech sectors, Wilson compares the Nasdaq Composite ten-year return rate of 10.3 percent to the 9.3 percent return of "later and expansion stage" VC investments — a stage that should be easier to pick winners, but also commands higher prices, since the company's potential is more visible to investors and their rivals.

Early stage funds performed particularly poorly, returning on average 6.2 percent after one year, but only 3.9 percent after 10 years — so low that it may seem to defy the logic of taking higher risks.

"Ten years out, you would expect to see early stage outperform multi- and late-stage. More risk should produce more return," said Wilson.

"Early stage investing is hard. You lose more than you win. And when you win, you need to win big. Later stage investing is a bit easier. You can pick winners in that business more easily. But so can everyone else. Each deal is an auction and the winner pays the highest price."

"So the next time you are bidding one VC against another, maybe you can feel just a bit of empathy for us. We are in a tough business, trying to make a buck to live to fight another day. Just like everyone else."

While it maybe a tougher business than it appears, Cambridge Associates' notes its report for the quarter ending September 30 2012, that 10 year VC return rate (including all stages) has improved 10.7 percent since 2010, thanks to dotcom bust investments falling out of the 10-year equation.

The report also notes that VC returns are lower than public markets until the 10 year period, after which VC returns have returns triple those of public markets.