Vocus facing proposed class action from shareholders

Vocus is facing a potential class action from its shareholders over downgrading its financial guidance in May, law firm Slater and Gordon and shareholder claim management and funding-service provider Investor Claim Partner (ICP) have announced.

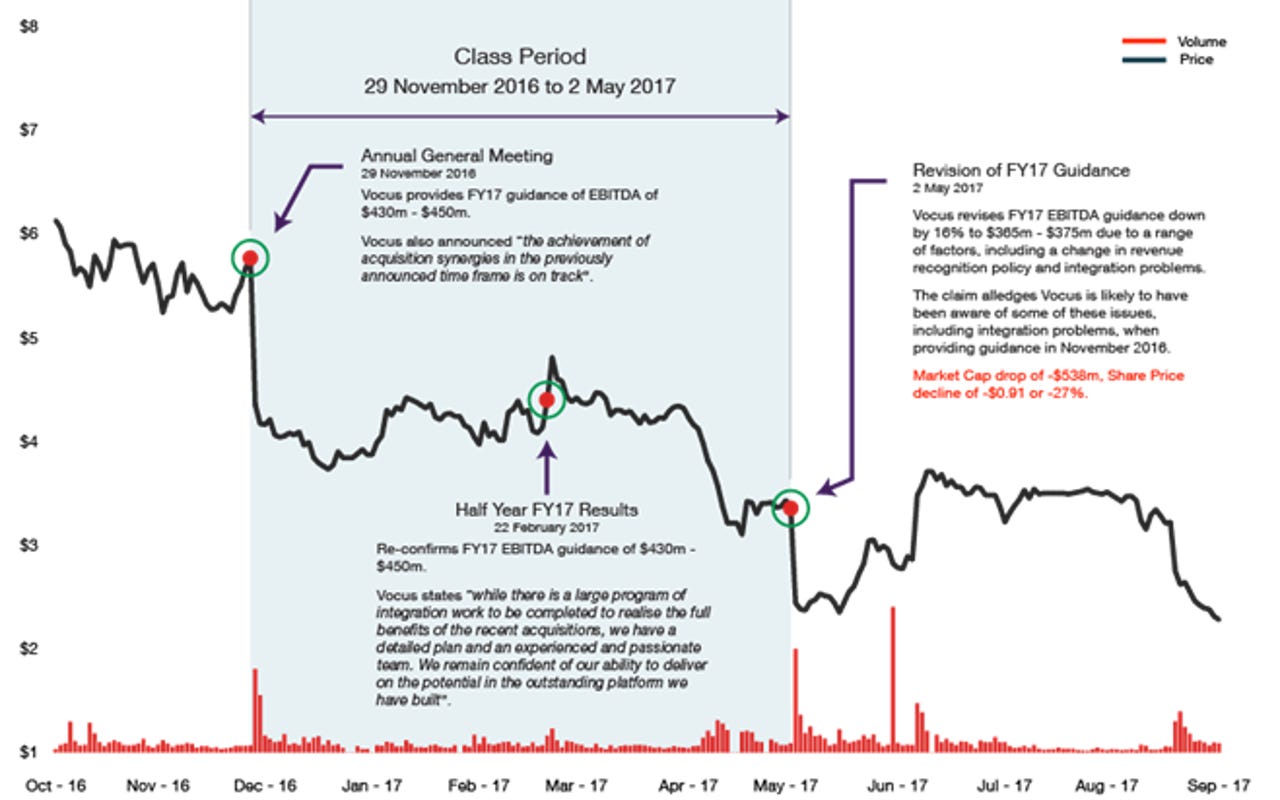

According to Slater and Gordon, the proposed class action centres around two allegations: That "Vocus engaged in misleading and deceptive conduct because it had no reasonable grounds for the original FY17 guidance issued in November 2016"; and that the telco "breached its obligations of continuous disclosure by failing to disclose that it would not achieve the FY17 guidance".

The law firm said the proposed claim will be brought on behalf of those who purchased Vocus shares between November 29, 2016, and May 2, 2017 -- which it said could be "hundreds, if not thousands, of people".

Between these two dates, the claim alleges that the company's shares traded significantly higher than their actual value due to Vocus' alleged misleading and deceptive conduct.

Mathew Chuk, Slater and Gordon principal lawyer, said Vocus' original guidance had relied on assumptions made about growing the business through its AU$1.2 billion acquisition of Amcom in June 2015, its merger with M2 in February 2016 to form the third-largest telecommunications provider in New Zealand and the fourth-largest in Australia worth more than AU$3 billion, and its AU$861 million acquisition Nextgen Networks in July 2016.

However, Chuk said Vocus' presumptions that it would consequently gain efficiencies by combining these businesses "was done without proper visibility of profitability".

"Our investigations to date suggest Vocus had unreasonable expectations about the costs involved in integrating its newly acquired platforms and technology systems," Chuk said.

"We have also identified an accounting issue relating to recognition of ongoing costs associated with the execution of long term, multimillion-dollar service contracts."

ICP COO Simon Weeks alleged that Vocus had been aware of these technology and platform integration and accounting and cost issues while continuing to reiterate its original guidance.

"There appears to be evidence that Vocus was aware of most of these issues when the FY17 guidance was originally issued in November, thus misleading the market," Weeks said.

"Based on initial interest, Vocus shareholders are perturbed by this, as it is yet another example of a listed company not following the listing rules that exist to protect shareholders.

"Adverse, price-sensitive information needs to be disclosed immediately, otherwise shareholders overpay."

In a statement to media, Vocus said it has always complied with its reporting obligations.

"We understand that Slater and Gordon have issued a release indicating they are seeking interest in a possible class action," Vocus said.

"At all times, Vocus has complied with its continuous disclosure obligations and will continue to do so."

Vocus' revised guidance saw forecast revenue reduced by AU$100 million, underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) reduced by between AU$65 million and AU$75 million, and net profit reduced by between AU$45 million and AU$50 million.

CEO Geoff Horth had said underlying EBITDA was then expected to be between AU$365 million and AU$375 million, net profit between AU$160 million and AU$165 million, and revenue of AU$1.8 billion.

The company had attributed AU$12 million of its EBITDA reduction to higher expenses than expected, particularly on technology; AU$33 million to an accounting review of "the negotiated contract terms on a number of large projects"; AU$10 million to the impact of lower-than-expected billings and an increased headcount across its Enterprise and Wholesale division; AU$5 million to low earnings in its mass market energy business due to "volatility created by extreme weather events in 3QFY17"; and AU$10 million to other trading variances.

The drop in expected net profit was due to pre-tax expenses of AU$113 million, including AU$26.4 million from the amortisation of acquired software; AU$21.4 million from acquisition and integration costs; AU$61 million from the non-cash amortisation of acquired customer intangibles; and AU$5.6 million from the non-cash book loss on the divestment of the Connect 8 joint venture and the Cisco HCS voice platform.

Revenue, meanwhile, was said to be lower than previously forecast thanks to a AU$40 million take-back as a result of the accounting review, as it was found that revenue from the projects involved would be earned in future periods; AU$12 million from lower billings across its Enterprise and Wholesale division; and AU$20 million from the divestment of the Aggregato Australia business and the Cisco HCS voice platform.

Vocus' net debt was updated to an expectation of between AU$1 billion and AU$1.1 billion, with CFO Mark Wratten expressing confidence that Vocus would be able to hit its revised guidance.

As a result of its downgraded guidance, the company in June received a takeover proposal from Kohlberg Kravis Roberts & Co (KKR) to acquire 100 percent of its shares at a price of AU$3.50 per share via a scheme of arrangement, with Vocus then allowing KKR to conduct due diligence to explore whether a binding transaction could be agreed upon.

KKR had said its preliminary, indicative, and non-binding proposal would be subject to whether Vocus' net debt did not exceed AU$1.1 billion as of June 30; EBITDA was between AU$365 million to AU$375 million for FY16-17, and not driven by any abnormal or one-off items; and Vocus' existing asset base was maintained.

Shortly afterwards, Affinity Equity Partners submitted a takeover proposal in July to acquire 100 percent of Vocus' shares at a price of AU$3.50 per share via a scheme of arrangement to be paid in cash.

Two days before Vocus was due to announce its FY17 full-year financial results, however, both takeover proposals were terminated.

"Throughout the due diligence process, the bidders indicated support for management's strategic plans and transformation program," Vocus said in August.

"However, the bidders have now advised that they are unable to support a transaction on terms acceptable to the board. Accordingly, all discussions have now ceased."

Vocus' full-year results announced late August saw a turnaround in its FY16 net profit of AU$64.1 million to a net loss of AU$1.5 billion for FY17 due to "higher than forecast net finance costs and a higher effective tax rate", along with what Horth called "a more competitive business environment" in both Australia and New Zealand.

Statutory EBITDA was AU$335.5 million, up 72.7 percent.

Underlying net profit was AU$152.3 million, while underlying EBITDA, not including significant items during the year, was AU$366.4 million, up 70 percent.

Revenue grew by 119 percent year on year to AU$1.8 billion, and the company's net debt increased by 35 percent to AU$1.03 billion and is expected to climb even higher, to up to AU$1.06 billion for FY18.

"The underlying result reflects another strong year of growth for Vocus; however, it was not at the level we anticipated at the beginning of the financial year and we are working through a number of projects to address this," Horth said last month.

"The FY17 year and in particular 2HFY17, has been a period of transition as the business has focused on the completion and integration of Nextgen, and the implementation of business plans that will maximise returns and leverage the infrastructure platform and operational scale that has been created through recent acquisitions."

Updated at 11.30am AEST: Added comment from Vocus.