Vultures circle RIM management: BlackBerry 7 devices as savior?

Research in Motion's co-CEO structure is under fire and the vultures are starting to circle. After BlackBerry product miscues and a vacuum of new devices, RIM's fate is increasingly looking murky.

RIM's shareholder meeting is worth a listen just to gauge the line between the realities of co-CEOs Jim Balsillie and Mike Lazaridis. In many respects, RIM's shareholder meeting was a replica of the most recent earnings call. Many questions and few answers---at least until RIM gets new devices rolling.

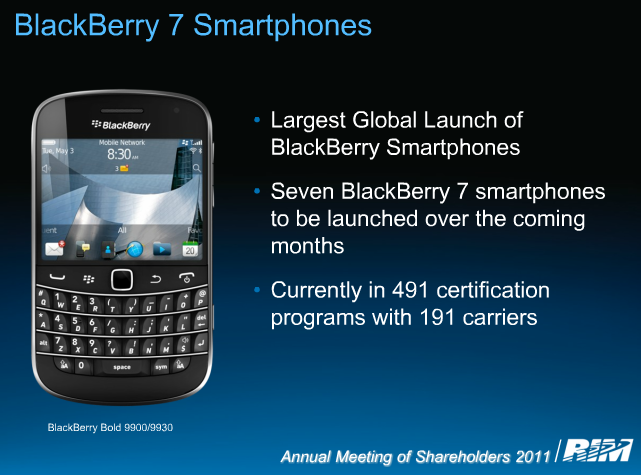

According to Balsillie and Lazaridis the largest product launch in BlackBerry history is on deck to allay concerns. Some shareholders bought it. One shareholder bashed analysts who were panning RIM shares yet typing up notes on their BlackBerrys. He got applause, but most folks were disappointed with RIM. One shareholder decried the lack of marketing for RIM at retailers.

Nevertheless, concerns mount. To wit:

- Boy Genius Report has a nice tale of mismanagement inside of RIM. Publicly, management is defensive and has a "What me worry?" approach. Behind the scenes RIM is a mess and missed key product curves dating back to 2005.

- Bloomberg reports has six-months to prove the need for a joint Chairman-CEO role. The push is to break up those roles to get better governance and potentially right the ship.

Through the entire hubbub, RIM's management has told customers to just hang tough because the best is yet to come. The jury is still out on that theory. "We are passionately engaged in what's best for this company," said Balsillie.

Here are the key points to watch going forward:

- BlackBerry 7.0 sales. If the largest launch in RIM history stops the bleeding and bolsters market share the peanut gallery will shut up in a hurry. If sales are strong, RIM observers may even start cheering those QNX superphones on deck. If sales stink, RIM will have new management.

- Who will lead RIM? Balsillie and Lazaridis have noted that changing leadership would be too disruptive now. RIM's dynamic duo can lead RIM's rebound. To say these two execs are on a short lease is an understatement.

- Can RIM's co-CEOs keep the company's employees on plan? To hear Balsillie talk about leaked memos and whether they were even real was a bit jarring. Balsillie said employees were focused, but you have to wonder.

- Takeover talk. If RIM is rudderless, it will look like an appealing takeover target. RIM could go private (most likely scenario) or acquired by Microsoft (less likely).

On that final point, National Bank Financial analyst Kris Thompson said RIM would fetch about $23 billion if acquired. The valuation behind RIM---intellectual property, capital, products and future growth---would be tricky. Meanwhile, there's a short list of companies that could buy RIM.

Thompson wrote:

We expect RIM’s global smartphone market share to fall below 10% from about 14% today. We’re not confident that RIM will ever regain global smartphone market share above 10%. Based on this assumption, our cursory analysis is that the company may be able to operate a successful niche enterprise business and own a small percentage of the consumer market generating about $1.5 billion of operating cash flow per year...Only a handful of potential acquirers that we have identified have enough net cash & investments to acquire RIM: Apple, Cisco, Google and Microsoft.

And that short list of potential RIM buyers has flaws. Cisco is too distracted to buy RIM. Apple doesn't need RIM. Google is a possible acquirer, but fixing RIM would mean work (and three mobile OS flavors). Microsoft has Nokia.

In the end, RIM could either change leadership as Wall Street circles or go private. One thing is clear: The pressure on RIM is intense.

Related:

- BlackBerry PlayBook vs. HP TouchPad: A tale of two failures

- RIM confirms new BlackBerry Bold 9900 "will be available this summer"

- Apple's iOS zips past RIM as Blackberry product vacuum continues

- AT&T finally approves BlackBerry Bridge app, slaps on $20/month for tethering

- AT&T releases BlackBerry Bridge for the PlayBook over 2 months after release

- Alas, poor RIM and BlackBerry, we knew them well

- RIM’s conundrum: Convincing you to buy a BlackBerry 7.0 device?