Wal-Mart CEO: Our e-commerce growth is too slow

Wal-Mart Stores delivered first quarter revenue growth and an upbeat outlook that made the company one of the few bright spots in brick-and-mortar retail, but acknowledged it has to turbo charge e-commerce.

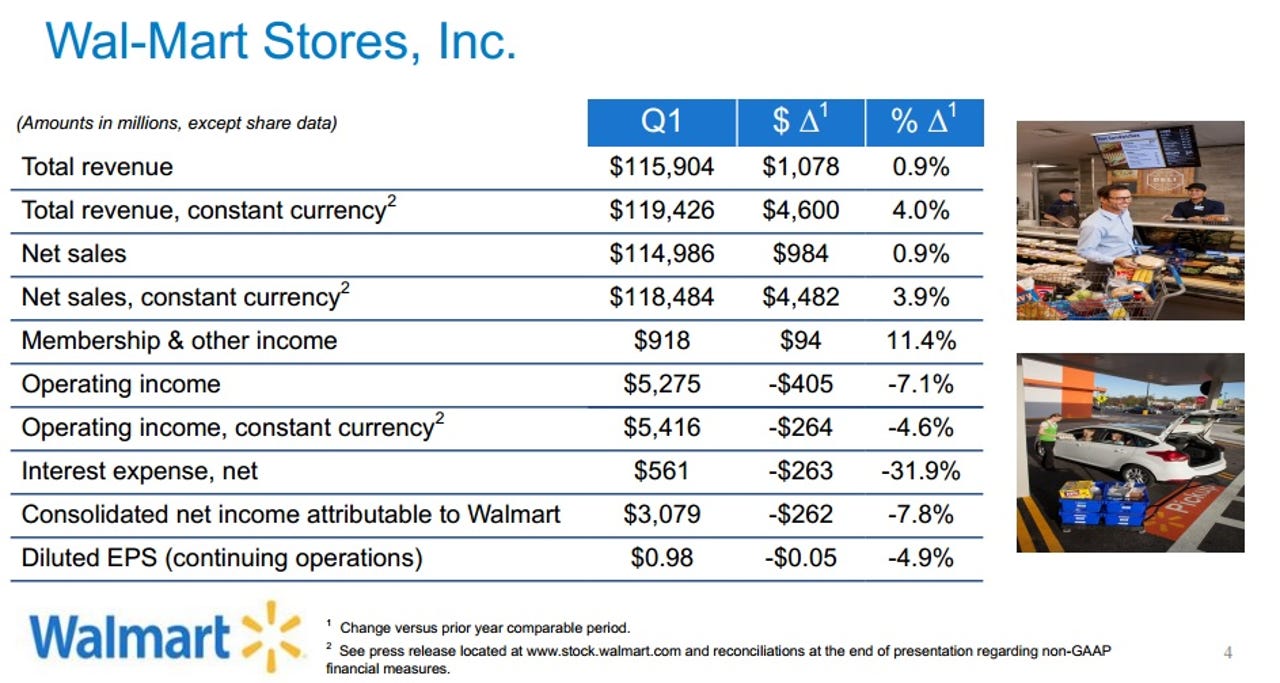

Here are the results:

As for the outlook, Wal-Mart projected second quarter earnings between 95 cents a share and $1.08 a share. The upshot here is that Wal-Mart isn't being Amazon-ed like the rest of retail. Perhaps the retailer's grocery business provides some defense against e-commerce.

However, Wal-Mart has been investing heavily in its e-commerce operations because it knows it has to close the digital loop to keep customers. On that front, CEO Doug McMillon called out e-commerce on an earnings conference call.

Globally, on a constant currency basis, e-commerce sales and GMV grew 7 percent and 7.5 percent, respectively. Growth here is too slow. The U.S. number is better than the global number but neither is as high as we'd like. We can see progress against several of the necessary capabilities we need to win in e-commerce but we're still working on a few others.

We need them all to come together to see stronger growth. For example, our marketplace is ramping up but it takes time to build the assortment to the point where customers realize the depth of assortment. We now offer more than 10 million SKUs on Walmart.com and we are growing that number through a combination of first-party and third-party items. It makes sense that perception will trail reality and we'll work on both during the course of this year.

We'll build on the successes we've seen around the world, including in the U.S., and we'll continue to work through the challenges we've experienced in key markets like Brazil, China and the U.K. where our ecommerce and mobile commerce sales are softer.

McMillon added that Wal-Mart has made progress on its fulfillment centers and e-commerce operating system, but those efforts are building blocks.

What will differentiate Wal-Mart, are e-commerce services such as grocery pickup, which will be in almost 40 markets by the end of the month, and the company's app and Walmart Pay.