Wal-Mart's Q1: A look at the e-commerce moving parts

Wal-Mart said its first quarter e-commerce sales were up 17 percent and that the retailing giant will continue to invest as it aims to create a mobile, social, Web and brick-and-mortar revenue cycle.

The company doesn't divulge a lot about its e-commerce business beyond its annual shareholder meeting, which will happen in June.

However, Wal-Mart's first quarter report is instructive on how the company is thinking about e-commerce as a way to generate foot traffic. E-commerce may never be completely broken out since the business has a long way to go to be material.

Previously: Wal-Mart's e-commerce sales to hit $12.5 billion as investment continues | Wal-Mart's e-commerce business: Can it move the needle, be material? | Wal-Mart's Q2: 16 technology, operations and e-commerce takeaways

For instance, Wal-Mart's first quarter sales were $114.83 billion with net income of $3.34 billion, down 7 percent form a year ago.

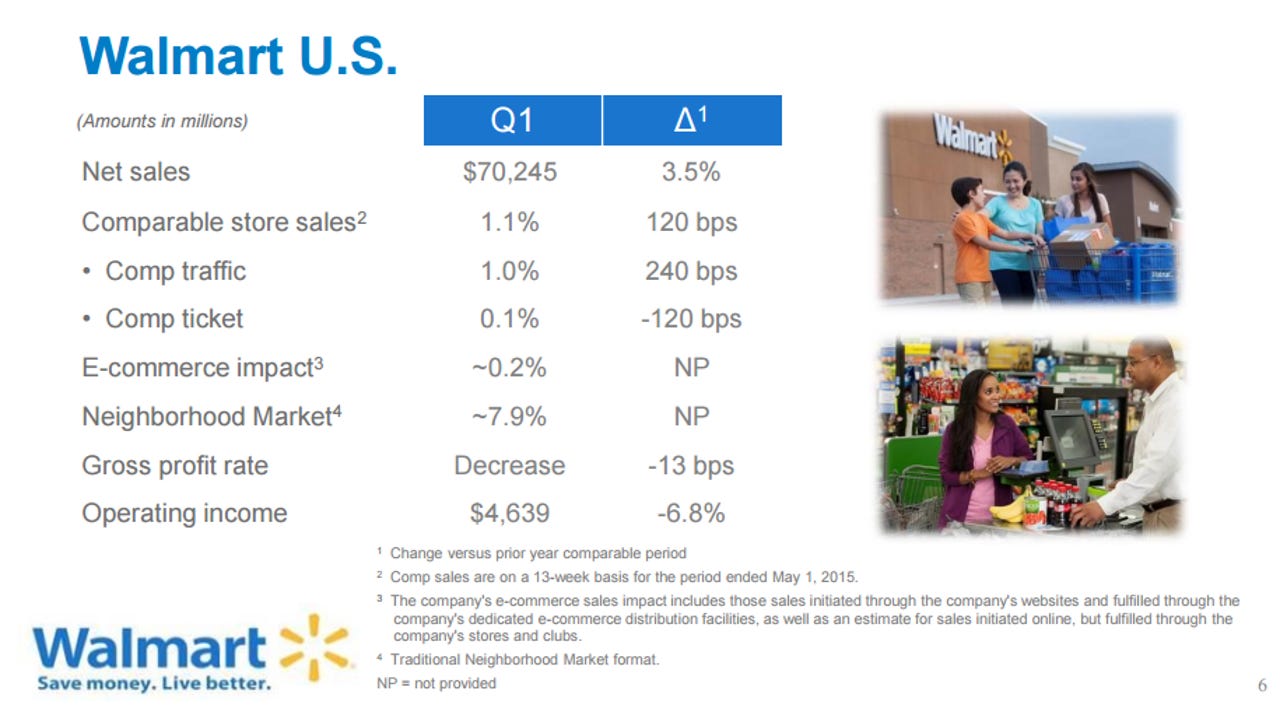

As for the omnichannel bump, Wal-Mart said that the e-commerce impact on sales in the U.S. was about 0.2 percent.

Here's how Wal-Mart defines e-commerce impact:

The company's e-commerce sales impact includes those sales initiated through the company's websites and fulfilled through the company's dedicated e-commerce distribution facilities, as well as an estimate for sales initiated online, but fulfilled through the company's stores and clubs.

Based on that definition, e-commerce had about $140.5 million of impact on Wal-Mart's $70.24 billion in U.S. sales in the first quarter.

For Sam's Club, e-commerce had a .4 percent impact on sales.

Wal-Mart CEO Doug McMillon said:

In the U.S., we're rolling out a more simplified checkout process on Walmart.com, which is based on our global technology platform, Pangaea. An important part of this platform is that it delivers a better experience on mobile devices.

Mobile is increasingly the driver of our ecommerce business. Sam's recently launched new services that have promise for improved member acquisition and retention, and investments in Club Pick-up and e-commerce are starting to pay off.

Globally, Wal-Mart's e-commerce plan is to invest this year with returns coming in 2016. Wal-Mart is also looking to centralize knowledge and best practices around the world from projects such as Asda's home grocery shopping venture.

Among the key points from Wal-Mart execs:

- Mobile traffic on Walmart.com is up more than 100 percent in the first quarter with higher conversion rates.

- The company is testing grocery home shopping in Huntsville, Alabama.

- The company is revamping its customer experience for its pickup at store program.

- Home grocery in the U.K. is reporting double digit growth and the company plans to move to a common platform to expand.

- Wal-Mart is launching a new app in China to pick up from store or get goods delivered.

- Mobile was more than 40 percent of orders in China in the first quarter.