What Vonage's wild stock ride and appeal of Verizon patent judgment tells us

I know this isn't a financial blog, but after assessing Vonage's stock price over the last several days, I've come to some conclusions.

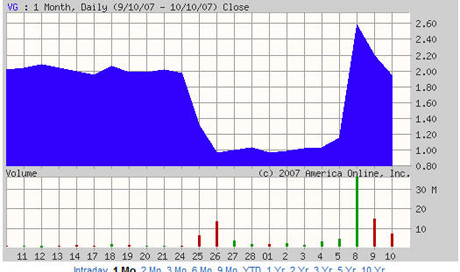

Over the last few weeks, the stock had been trading at or around $1 a share. Then, following the patent infringement settlement with SprintNextel, Vonage's stock climbed up to $2.57 a share on a record-setting pace of nearly 35 million shares traded.

The implied euphoria among Vonage investors was short-lived, however. On Wednesday, Vonage stock had rolled back to $1.93 a share. I think these perturbations were short-term blips that tell us more about investor psychology than any true assessment of Vonage's prospects.

The investor psychology shown by the scenario I just described suggests that once Vonage's shares descended below $1, many first-time investors participated in what they thought was a bargain. Then, after the post-settlement spike, some of these same investors decided that Vonage's stock wasn't going to go much higher, and they sold off quickly.

Vonage must be thinking similar thoughts. That's why they appealed the Verizon patent infringement decision yesterday.

Good place here to note what Vonage said about this appeal:

Vonage announced today that the company has filed a motion for a review by the original three-judge panel or the full panel of the U.S. Court of Appeals for the Federal Circuit sitting en banc of the September 26 decision in its patent litigation with Verizon. En banc signifies a decision by the full court of all the appeals judges in jurisdictions where there is more than one three- or four-judge panel.

On September 26, the U.S. Court of Appeals for the Federal Circuit partially remanded a March 8 jury verdict in the U.S. District Court in Alexandria, Va. that the company infringed on three Verizon patents. The U.S. Court of Appeals for the Federal Circuit remanded the infringement verdict on the 880 patent and affirmed the verdict on one patent claim in each of the 574 and 711 patents. Further, the Court of Appeals vacated the entire award of $58 million in damages and the 5.5 percent royalty. The Court of Appeals remanded the case to the U.S. District Court and directed that the court retry those aspects of the original case.

"This move represents the next logical step for Vonage in managing this litigation and continuing to move our business forward," said Vonage Chief Legal Officer Sharon O'Leary. "We recently settled our case with Sprint, and continue to explore all legal options available to put the Verizon litigation to rest."

My overriding impression here is that Vonage must think that for their stock price to significantly bounce back, investors must be convinced that all this infringement-related unpleasantness is but a memory.

Of course even if Vonage and Verizon do a Sprint-Vonage Kum-bay-ya, that isn't going to fix Vonage's plight as a pure play VoIP provider competing against monopolistic service bundlers.