Will Android and Windows Mobile get squeezed as smartphone market shakes out?

While the iPhone has shown that there is a large consumer market for smartphones, the primary market-driver for the smartphone is - and will remain - enterprises and small businesses.

This dynamic is similar to the PC operating system market. Think about Windows Vista. It has largely been adopted by consumers as they've purchased new PCs over the past two years. But since most businesses have snubbed Vista and stuck with Windows XP, Vista has failed to become the predominant OS in the market and has been labeled a failure.

Businesses will play a similar role in deciding the winners in the forthcoming battle of the smartphone platforms. While consumers will be driven by price, product design, and brand-recognition when buying smartphones, businesses will be driven by platform issues: applications, security, and manageability.

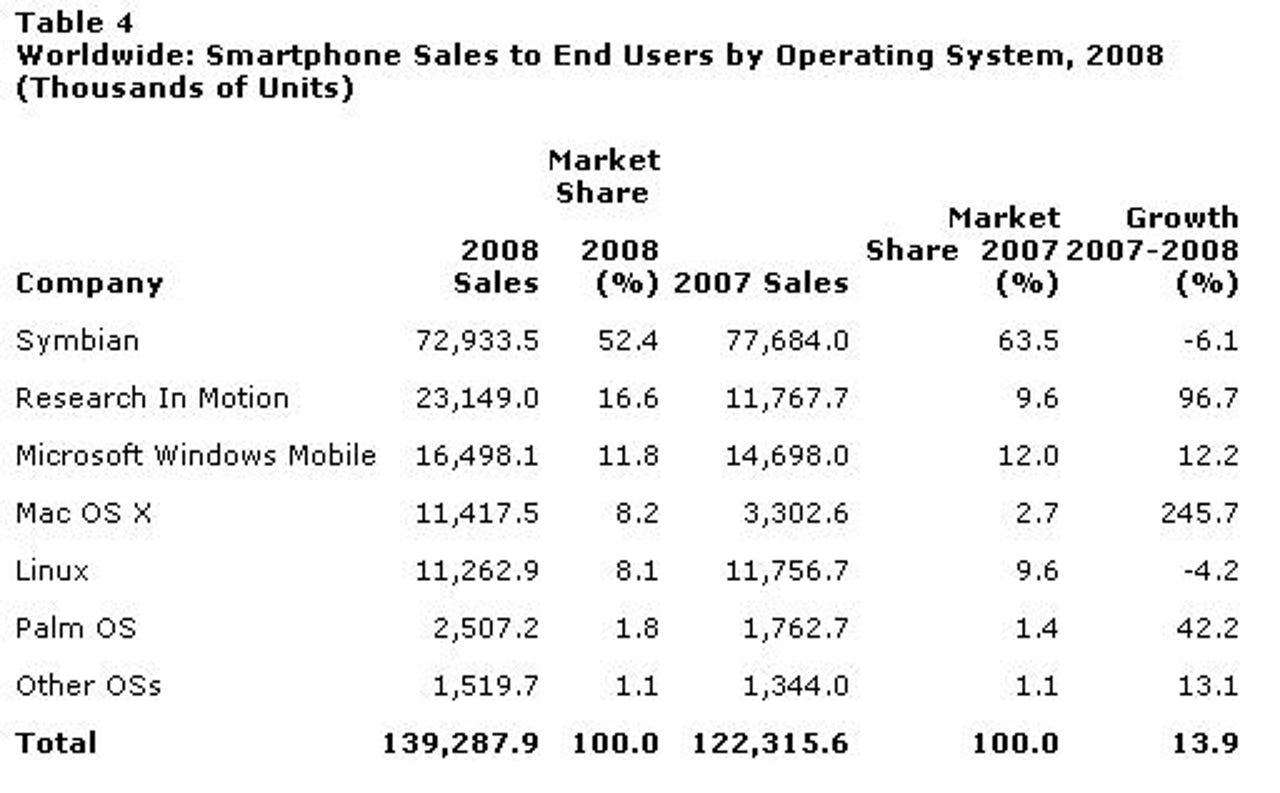

Let's look at who the current market leaders are. Gartner just released its figures on the worldwide smartphone sales by operating system (see chart below). Keep in mind that Research in Motion=BlackBerry, OS X=iPhone, Symbian=Nokia, and Linux=Google Android (for the most part).

While the smartphone market will not consolidate down to just two or three significant platforms like the PC market has, there will definitely be major consolidation in smartphone platforms over the next three to four years. There's no way that there's enough room for six big players in the market, even though this market is going to be huge - eventually even bigger than the PC market.

There were 162 million smartphones sold globally in 2008, which according the research firm Informa, actually surpassed the unit sales of laptops for the first time. Informa predicts that smartphone sales will buck the global recession and grow by 35% in 2009 (while total handsets fall by 10%). Still, smartphones will only make up 13.5% of global handset sales in 2009. Informa sees that number increasing to 38% by 2013.

Vendors see numbers like that and get bullish about their chances of grabbing a piece of that market. However, developers are not going to spread their efforts over six different platforms, as my colleague Larry Dignan recently discussed. As long as there's a plurality - with no vendor owning more than 50% of the market - then there's probably room for about four vendors at the most. That means two of the current vendors are going to get squeezed out. Which two will it be? Let's take a closer look at each of the six and evaluate their chances.

BlackBerry

Let's face it, BlackBerry has the lead in almost all of the factors that matter most to businesses, because BlackBerry has catered to business from its inception. It would be fair to say that BlackBerry helped create the smartphone phenomenon by building a backend infrastructure that provided smartphones with the kind of security and manageability that gave businesses and their IT departments the confidence to deploy smartphones.

BlackBerry is the runaway leader in smartphone security. That can be witnessed by the fact that it is the de facto standard in both the financial and government sectors - two high security environments. With its BlackBerry Enterprise Server (BES) on the backend, BlackBerry has also enabled centralized device management for IT departments.

And last but certainly not least, BlackBerry has a large ecosystem of third party vendors building line-of-business applications and enterprise-class services to run on its smartphones. Even without the forthcoming BlackBerry App World store, BlackBerry has enough legacy apps and business mojo to stay relevant for years to come. Plus, unlike Apple, Microsoft, and Google, smartphones is the only business that Research in Motion is in, so it doesn't risk taking its eye off the ball and loosing momentum.

iPhone

The iPhone started out as a consumer device, and it used the Apple marketing juggernaut along with a breakthrough user interface to sell lots of phones and generate a ton of positive buzz. But it wasn't until iPhone 2.0 when the software added Exchange support and business-friendly features that iPhone sales really took off.

The biggest thing that the iPhone has going for it is that it is the easiest smartphone on the market to use. It requires very little explanation or instruction. Most users can pick it and started tapping the screen and become productive within the first hour. This is big for IT because it translates into fewer help desk calls and decreases the need for training and tutorials.

And now with its App Store, the iPhone has created a lot of momentum around its software as a platform for mobile programs. Granted, most of what's selling in the App Store today are games and lots of silly applications that have no business use. But the fact that so many applications have been created so quickly shows that developers like the platform, and that is a good sign that it could eventually be a strong platform for the enterprise, especially since Apple has been moving in the right direction to deliver the kind of security and manageability that IT departments require.

The biggest drawback to the iPhone is its on-screen keyboard, which simply does not measure up to a hardware qwerty keyboard for speed of data entry. It also tends to result in more entry errors. For users who do a lot of typing with their smartphones, this can be a show-stopper.

Apple will also need to cater to the enterprise in terms of volume discounts if it wants to compete for the top spot in the smartphone market. Nevertheless, along with BlackBerry, the iPhone is the only other sure bet to survive the smartphone platform shakeout. That leaves four other platforms to duke it out, with only two of them to survive as major players.

Symbian

Only a year ago, Symbian had nearly two-thirds (62%) market share in the worldwide smartphone market, due to its popularity on smartphones in Europe and Japan, both of which have much higher smartphone penetration than the U.S. market. However, Symbian has not been able to make strong inroads in the U.S. smartphone market and internationally hardware makers have put software on top of Symbian that has resulted in various Symbian smartphone platforms being incompatible with each other

I'm not sure if Symbian can put the genie back in the bottle and unify its platform across multiple vendors and carriers, but it is trying to do just that and if it can pull it off then it could take advantage of the huge head start that it has in terms of user reach. If not, then it will struggle as a platform and is in danger of continuing to bleed away market share to its competitors.

The Symbian software itself is not as user-friendly as either iPhone or BlackBerry, but it is better then Windows Mobile and is quite usable with adequate training. It is also capable of strong security and manageability, which endears it to CIOs. In fact, companies like Cisco tend to prefer Nokia phones running Symbian to show off the full capabilities of unified communications and fixed mobile convergence solutions. The fact that these forward-looking enterprise apps work best on Symbian is a good sign of its future viability.

Nokia officially acquired Symbian in June 2008, promising to unite the various interfaces, combine it with Nokia's S60 platform, and release it as an open source project under the auspices of a new non-profit organization called Symbian Foundation.

This is a bold move - in a market where bold moves are needed - but Symbian will have to go toe-to-toe with Google Android to fight for the hearts of open source software developers. I tend to think those developers will eventually gravitate toward one platform or the other. Due to the current reach of Symbian, the strong open source overtures made by Nokia, and the fact that Android hasn't been a slam dunk with the open source community, I think Symbian has the advantage over Android.

Windows Mobile

In terms of current business applications, the Windows Mobile platform is the only one that can rival BlackBerry in terms of the breadth and depth of its line-of-business apps and enterprise software. Most mobile software vendors and enterprises tend to choose either Windows Mobile or BlackBerry to focus on.

Windows Mobile (which Microsoft recently renamed "Windows Phones") is also solid in terms of security and IT central manageability. If not quite as strong as BlackBerry in those areas, it is definitely much less expensive to deploy using Windows Server as a backend.

However, the biggest weakness of Windows Mobile is its interface. It is maddeningly difficult to use. I once handed my wife a Windows Mobile phone that I was testing for TechRepublic and told her to make a phone call. It took her about five minutes to figure it out, and she's pretty tech-savvy. That's how unfriendly Windows Mobile is. It is the worst user interface in the smartphone market, and that ends up putting a lot of pressure on the IT help desk for companies that deploy Windows Mobile devices.

Because of the interface problem, Windows Mobile has the most to lose to iPhone and Palm, which have much more user-friendly devices for the masses. If those two make inroads with their software to create platforms that are friendly to business apps, I think you'll see them take market share directly from Windows Mobile.

Even if Windows Mobile does lose market share, don't look for Microsoft to abandon it. I just don't know if Microsoft is focused enough on the smartphone business to give its smartphone platform the kind of dramatic overhaul it will need to compete and be a market leader. Without a change in direction to improve the interface and the application platform, Windows Mobile could go the way of Microsoft's search business, which continues to receive attention and funding from the company even as it fades further into obscurity every month.

Android

Next to the iPhone, no smartphone platform has more positive buzz right now than Google Android. Most of that is due to the fact that it is from Google, and not related to the Android software or the first Android-based smartphone, the T-Mobile G1 - both of which are pretty mediocre.

However, the big problem with Android is that it is not a business-ready smartphone, unless you are running your company e-mail through Gmail and your productivity suite is Google Apps. The rest of the world - and that's most of us - are out of luck because Android requires a Google login and basically ties only to Google software. There's no Exchange support, and advanced IT security and manageability are lacking.

Google has also had a difficult time wooing developers to Android, despite the fact that it made the software open source. One of the problems is that Google angered some of its Android developers by only releasing the software development kit (SDK) to an exclusive group of developers at one point during the preparation to bring the G1 to market.

For all of those reasons, I think Android is likely to get squeezed and open source mobile developers are much more likely to jump board with Symbian or even Palm. However, Android could become a big hit on netbooks, where it doesn't have to bother with Exchange or enterprise security, but can simply focus on delivering a strong Web experience out-of-the-box. That's where Android would make the most sense.

Palm webOS

While the old Palm OS, which powered the pioneering Treo smartphone, is long in the tooth and has been in a prolonged market share decline, we should set that aside to consider Palm's place in the future of the smartphone market.

That's because at the beginning of 2009 at the Consumer Electronics Show, Palm unveiled its new platform, the Palm webOS and the first product built on that platform, the Palm Pre. Both demonstrated significant innovation, powered partly by former Apple employees such as Jon Rubenstein. When the Palm Pre is released in mid-2009, it will be the first legitimate challenger to the iPhone in terms of its interface and ease-of-use and it will likely be accompanied by iPhone-like buzz.

Meanwhile, it will launch with better business features than the iPhone 1.0 did two years ago. At launch, the Palm Pre will support Microsoft Exchange integration and business-class security, but its IT manageability features are still unclear at this point. However, the Palm webOS also has the potential to attract developers because its new application framework, Mojo, is based on HTML5, CSS, and JavaScript. That could make it one of the easiest and fastest platforms to develop applications for, and Palm knows a little something about creating a platform for developers. The company did a great job of it in the 1990s with the Palm Pilot.

After seeing the Palm Pre up close at CES, I'm expecting the Pre and its webOS to make a big impact on the smartphone market in 2009, even though it's going up against some deep-pocketed competitors. The Pre will likely be one of the most innovative devices in 2009, as its touch-based interface extends the functionality of the iPhone while also offered both a slide-down and an on-screen-keyboard.

So keep an eye on Palm and watch for the company to start nibbling away at the market share of its competitors during the second half of the year. However, if the Palm Pre is delayed or the new Mojo application framework isn't very easy for building Apps, then Palm could stumble and quickly find itself marginalized.