Will Zen save AMD, or might Apple?

But what happens next? Will Zen chips arrive soon enough, and sell well enough, to turn the company's fortunes around? Or could it be rescued by a white knight on a charger, in which case, Apple might be a candidate.

There's no doubt that AMD has fallen behind Intel across the whole PC market. Intel dominates the high end and server markets with its Core iX and Xeon processors, and the low end with Atom-based (but Pentium- and Celeron-branded) processors. AMD may point to superior graphics capabilities, but these have not translated into sales.

The brutal truth is spelled out in AMD's latest financial results. The Computing and Graphics division (desktop and notebook CPUs and GPUs) lost $181 million on sales of only $424 million - down 45 percent year-on-year. The division that provides embedded chips and SoCs (System on a Chip) made a profit of $84 million, which reflects the fact that its SoCs are used in both the Sony PlayStation 4 and Microsoft Xbox One games consoles.

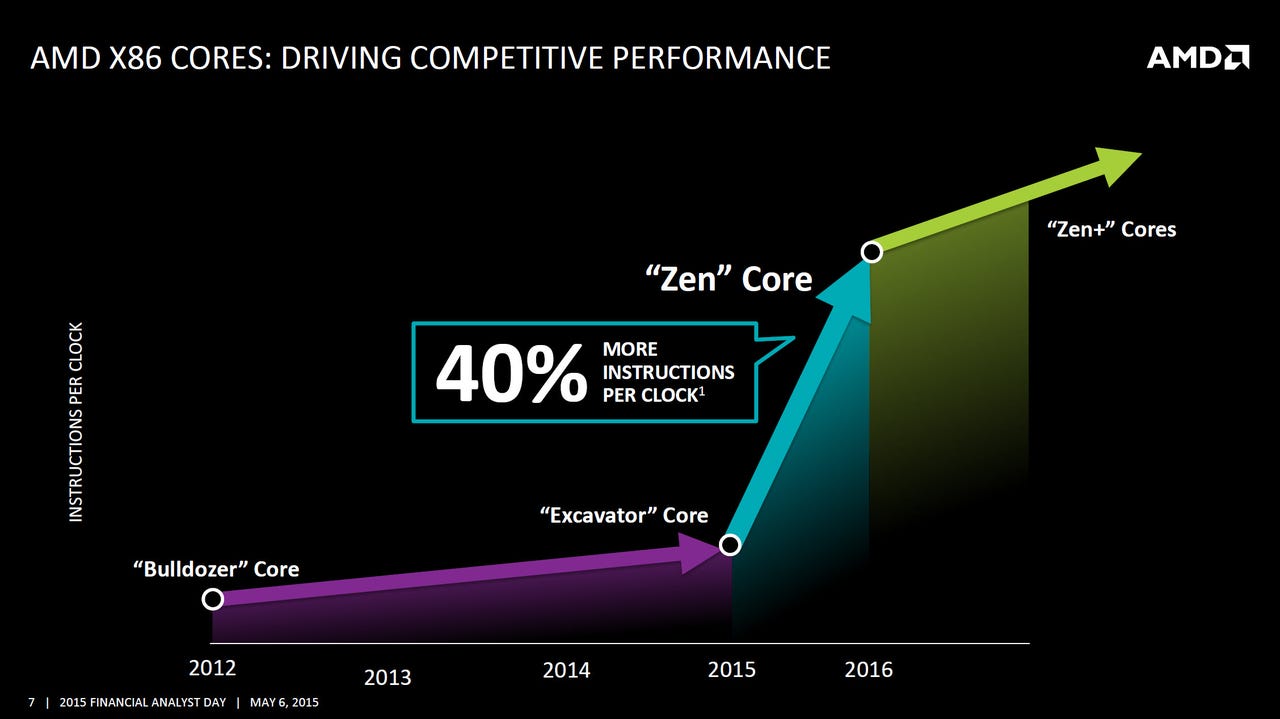

AMD responded by giving its chip designers the freedom to do whatever they wanted to create its seventh-generation CPU design, codenamed Zen. According to Lisa Su, AMD's president and CEO, this will process 40 percent more instructions per clock cycle with Simultaneous Multi-threading (SMT). Desktop processors will have up to eight cores plus a dedicated GPU, with 16- and perhaps 32-core versions coming for servers.

The problem is that the first Zen processor, code-named Summit Ridge, may not appear until October 2016. By that time, Intel should be shipping high-performance versions of Skylake, with Cannon Lake appearing in Ultrabooks and other portables. Just catching Intel won't win AMD many sales: Zen needs to deliver a significant edge, and that's hard to do.

By October 2016, AMD could be in a much worse financial position, and this might make it a tempting take-over target. The question is, who would want it? Qualcomm, Samsung and Mediatek might be possibilities, but what about Apple?

One of the tricky parts of any takeover is that AMD's agreement with Intel could be cancelled. However, Apple could negotiate a new agreement with Intel in advance, and retain the rights to make x86 processors.

With AMD under its wing, Apple could use Zen core designs and AMD's ATI graphics cores to design its own custom SoCs for Macintosh computers, with the manufacturing farmed out to Intel or Global Foundries (ex-AMD) and TSMC.

This would, in essence, repeat what Apple did with ARM processors. It bought an established ARM chip company, PA Semi (Palo Alto Semiconductor), and now designs its own ARM-based SoCs for the iPhone and iPad, with manufacturing farmed out to Samsung and TSMC.

(Incidentally, PA Semi's Jim Keller, who designed Apple's ARM-based SoCs, returned to AMD to lead the Zen development, though he left recently.)

Whether it would be worth it, given the relatively low volume of Mac sales, is another matter. If Apple views the Mac as a very profitable boutique business, it probably isn't. But the option to use cheap custom-designed SoCs to expand the Mac market might be tempting. The possibility of, perhaps, combining Intel x86-compatible and ARM cores on the same SoC might be even more tempting.

Either way, buying AMD would have five obvious advantages for Apple:

1) it would gain the ability to design its own x86-compatible SoCs to replace off-the-shelf Intel chips;

2) it would have access to advanced graphics chip designs such as FirePro (AMD acquired ATI for $5.4 billion in 2006);

3) it would get AMD's advanced ARM chip, code-named K12, which has been co-developed with Zen;

4) it would get AMD's large patent portfolio;

5) it would have more control over its own destiny, which is something Apple values highly.

If AMD keeps piling up losses, it may well be looking for a rescuer in another 12-24 months, and Apple could pay for it without even noticing. The fruit company already has $200 billion in spare cash, and will pile up even more billions in the next two years, so the price is irrelevant.

As far as I know, Apple has no plans to buy AMD, but it's still an interesting thought-experiment. Life would be more boring if Qualcomm bought it.