With Apple's U.S. dominance, smartphone race heads overseas

The big four of the United States mobile phone industry all reported their 4th-quarter earnings in the past few days. Apple and Google (with its Android hardware partners) have the smartphone category locked up. Meanwhile the combo of AT&T and Verizon own a combined 70% or so of the U.S. mobile carrier market.

I've been reading through those reports, which tell a clear story about the current state of the U.S. market. But an offhand comment by Apple CEO Tim Cook suggests that big changes could be ahead:

"I wouldn't say it's a two-horse race. There's a horse in Redmond that always suits up and always runs, and will keep running, and there are other players we can't count out."

Is he serious? Yes. Remember, though, Cook's perspective is that of a jockey turning his head to see how far back the other runners are.

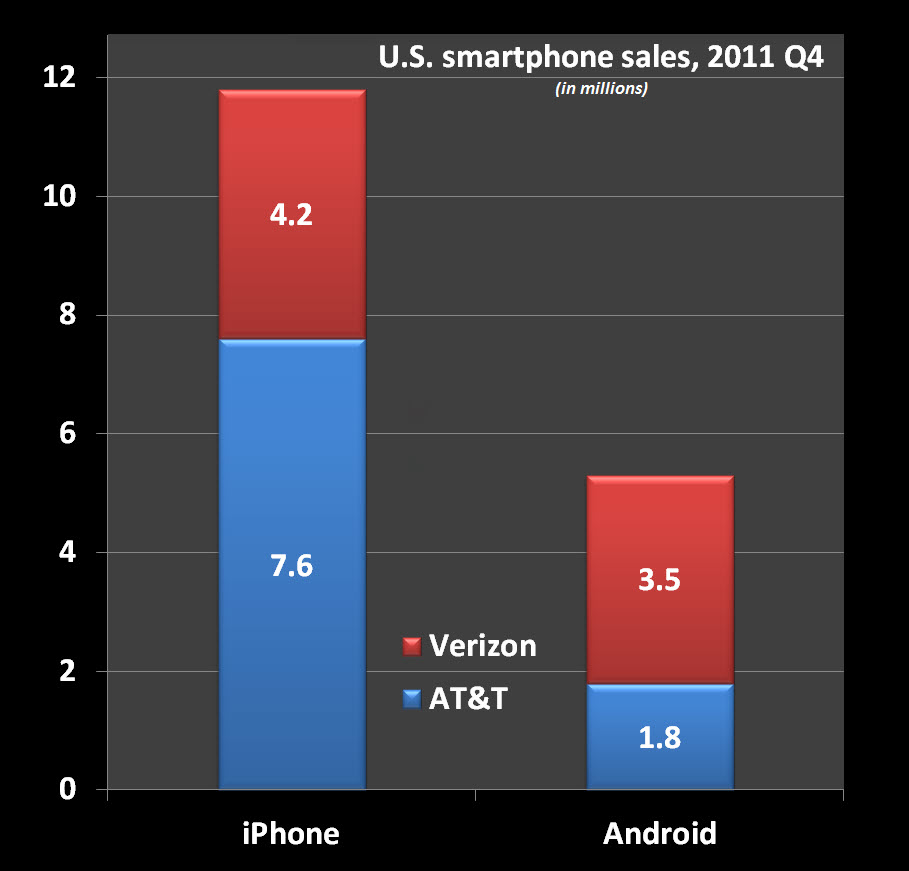

In the United States smartphone market, Apple has already won. Decisively. Here's how complete the domination is among this country's top two carriers:

With only three models, Apple sold more than twice as many units as all Android handset makers combined in that segment in Q4.

Apple is also dominating among enterprise customers. Survey results released last week by Good Technology, a maker of enterprise mobile software, show Apple with an impressive lead:

Despite Android's overall market share growth and steady absolute growth among Good's customers, just 35 percent of all Good smartphone activations were on Android, compared to iPhone's 65 percent.

That number wasn't an anomaly caused by the launch of the iPhone 4S. The Good Technology report notes that collectively, "iOS devices accounted for over 70 percent of all activations in Q4, roughly the same as Q3 2011."

And the win is even more staggering when measured in dollar terms. Apple has done as well as it has by capturing the hearts and minds of the most affluent. Those customers don't just pay a premium for hardware, they also pay a premium for monthly service, which puts more money in carriers' pockets. That's the reason Apple reported a staggering 44.7% gross profit margin (up from 38.5% a year ago) in its recent quarterly results.

Related:

- AT&T's business model: why your mobile bill keeps going up

- Verizon can't wait for LTE iPhone

- AT&T's Q4: 7.6 million iPhones activated, 9.4 million smartphones sold

- Enterprise iPhone 4S activations spike, highlight Apple's halo effect

Google still has an edge in other parts of the developed world, but it's eroding. A report last week from Kantar Worldwide Tech said "Apple sales are now growing at a faster rate than Android across the nine countries we cover." The list includes Great Britain, where iPhone's share is up nearly 10% in a single year, to 30.9%. (Germany is a bedrock of Android strength at 61%.)

I suspect that Apple's success will continue in Japan and Western Europe and among the emerging well-to-do in China. Worldwide, the iPhone will continue to appeal to the top of the economic pyramid and to information workers who can bring their own devices to work. Android will be the phone of the huddled masses.

The Kantar Worldwide Tech study counted Windows Phone at less than 2% worldwide. This year, with the Nokia partnership finally taking off, Microsoft has an opportunity to compete against Android for market share outside the developed world, with a special emphasis on emerging markets. Nokia has deep supply chain and manufacturing advantages in those countries, not to mention great brand value and operator billing relationships with carriers worldwide that Google and Apple don't.

By this time next year, Windows Phone will probably have picked up a few percentage points in the U.S. market, but it could easily swing to double-digit shares in places like Russia, Brazil, and India, where Nokia has historically had strong market share. And China, of course, where it will face a head-on fight with Apple.

The other opportunity for Windows Phone to make inroads is in the enterprise. In a bring-your-own-device environment, Windows Phone could end up ahead of Android if Microsoft beefs up the enterprise capabilities of the Windows Phone OS. And RIM's ongoing troubles also create tremendous opportunity to reach disenchanted BlackBerry owners.

But make no mistake about it, in the high-margin markets that matter, the battle is for second place behind Apple's iPhone.