Woolies cashes in on Visa, MasterCard snub

Retail giant Woolworths today said that it expected to save millions by routing all Visa and MasterCard debit card transactions through its EFTPOS network as opposed to using the Visa and MasterCard networks.

The change, which Woolworths said was likely to only affect around one per cent of its customers, would be introduced progressively across stores from 15 April. The stores to implement the change include BIG W, Woolworths Supermarkets, Safeway Supermarkets, Woolworths Liquor, Safeway Liquor, BWS, Dan Murphy's, Dick Smith, Tandy, Woolworths Petrol, Safeway Petrol, Caltex Woolworths petrol outlets, Thomas Dux and ALH.

Routing the transactions through the EFTPOS network will remove surcharges the retailer currently has to pay to Visa and MasterCard when a customer selects "credit" using those companies' debit cards at the checkout.

If customers press "cheque" or "savings" when using those debit cards, Woolworths doesn't have to pay the higher fee associated with credit transactions.

Since banks began introducing Visa and MasterCard debit cards, however, some customers have still been using the "credit" option when checking out, leaving the retailer to pick up the surcharge, leading to cost pressures.

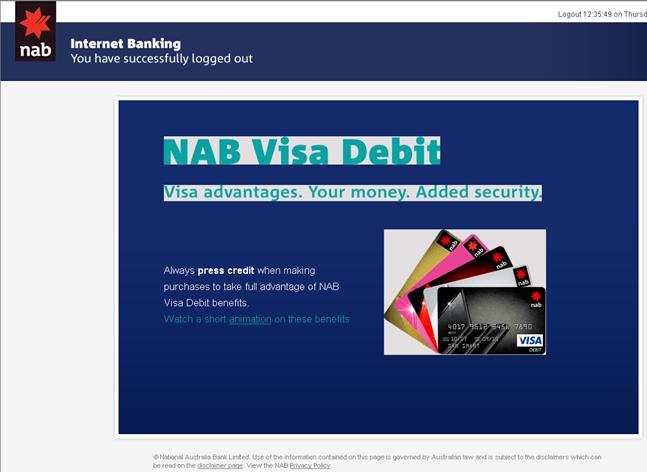

Further, some banks such as Westpac and National Australia Bank (NAB) have been actively promoting to customers that they use the credit option at the checkout (see screenshot), instead of selecting either cheque or savings, again causing a surcharge for retailers. Both banks say there are benefits with choosing the "credit" option such as fraud protection.

NAB touting that customers use "credit".

(Credit: NAB Online screenshot)

"The charges associated with these schemes are unnecessary costs for retailers, which in the end trickles down to the consumer," Woolworths' media relations manager Luke Schepen told ZDNet.com.au. "By lowering our costs we're able to invest that money back into our business to improve services for our customers."

By routing debit cards via Woolworth's EFTPOS network, he said the company would save "millions".

In a media statement, Woolworths' finance director Tom Pockett said the change was unlikely to cause inconvenience to customers as most debit users already pressed cheque or savings.

"Customers will need to ensure they know their PIN to access their funds via the cheque or savings buttons," he said.

Visa slammed the change, saying it would remove choice from consumers.

"It is extremely unfortunate that consumers will no longer have the choice to use their Visa debit cards at Woolworths," Visa said in an official company statement today. Visa corporate relations, Judy Shaw, clarified this statement with ZDNet.com.au, saying that debit cards would still be able to be used as EFTPOS cards but would not be able to be used as a Visa debit card which included fraud protection benefits and charge back rights which allowed consumers to charge back a if they did not receive the item they purchased online or if they received it damaged.

Visa also disputed in an official statement that the debit cards had been contributing to cost pressures, because interchange costs (which underpin the fee that merchants pay for the processing of card transactions) had reduced dramatically in recent years. Visa also pointed out that Woolworths had said itself that the debit cards only affected one per cent of its customer base.