Workday delivers solid Q4, fiscal year, but Q1 outlook light

Workday reported a better-than-expected fourth quarter, noted customer wins and surpassed the $1 billion mark in annual revenue, but the outlook for the first quarter was a bit light.

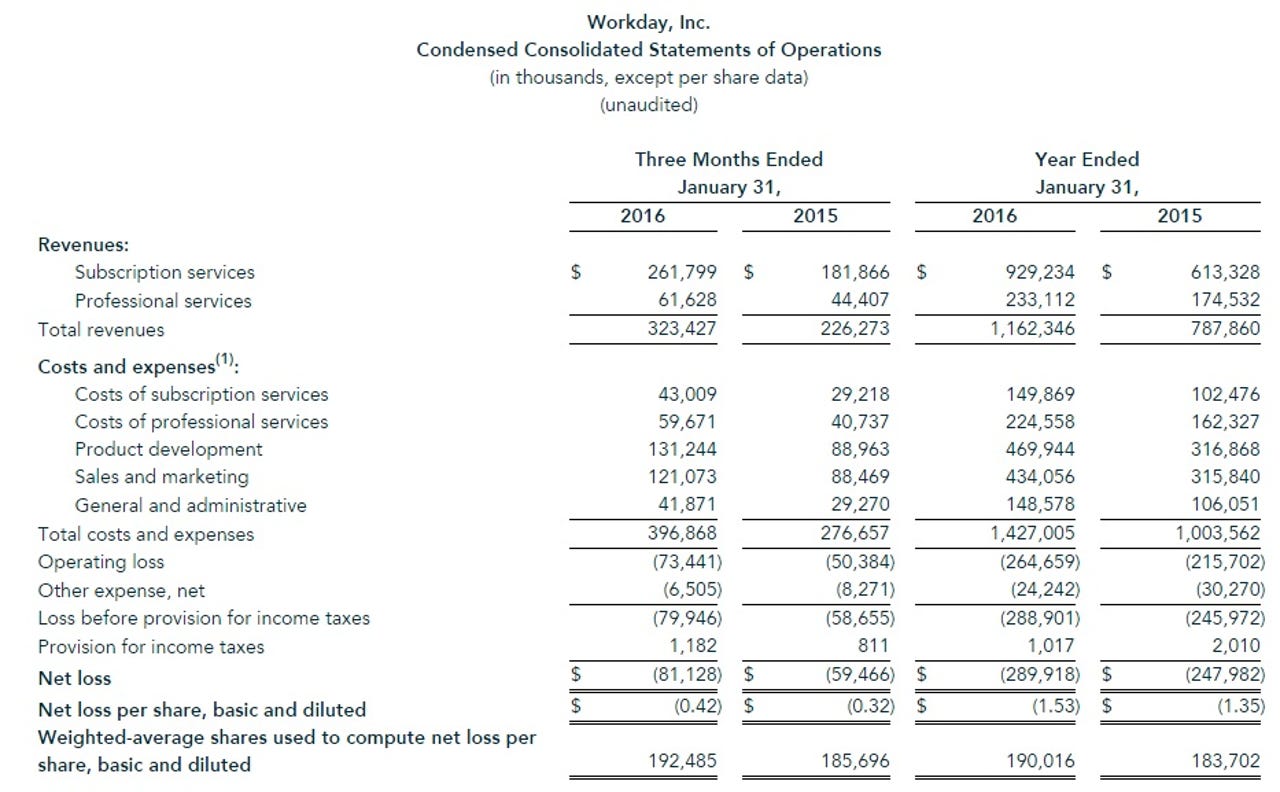

The company reported a net loss of 42 cents a share for the fourth quarter on revenue of $323.4 million, up 43 percent from a year ago. Workday's non-GAAP earnings for the fourth quarter were a penny a share.

Wall Street was expecting a non-GAAP loss of 4 cents a share on revenue of $319.6 billion.

On the customer traction front, Workday said Bank of America has gone live on HCM with J.B Hunt Transport Services deploying Financial Management. Workday also added wins at GoDaddy for HCM and financials and Ohio State University for Financial Management.

Workday, SAP and Oracle are in a race to tout customers wins as the latter two try to define Workday as a mid-market player at best.

Aneel Bhusri, co-founder and CEO of Workday, said J.B. Hunt is the company's largest financial management customer and highlights the ability to target the Fortune 500. He added that Workday has more than 100 companies life on Workday's financial software.

Bhusri said on a conference call:

On the competitive front I am pleased to report that our win rates in Q4 were the highest we have seen over the past eight quarters. We fared very well against all of the major vendors in our market and enjoyed historically strong win rates against both of our legacy competitors, SAP and Oracle--legacy competitors who continue to struggle to provide live customer references at scale.

When SAP and Oracle moved into the cloud they were given a bit of a hall pass. They marketed the right terms. They used the same buzz words. At the end of the day we all get measured about getting customers successful and in production and they failed.

I do think that referencability is much more important today than it was 12 months ago.

For fiscal 2016, Workday reported a net loss of $1.53 a share on revenue of $1.16 billion, up 48 percent from the previous year.

As for the outlook, Workday projected annual billings of $1.85 billion and $1.87 billion and revenue between $1.54 billion and $1.55 billion. For the first quarter, Workday projected revenue of $337 million to $339 million.

Wall Street was looking for revenue of $343.3 million for the first quarter and $1.55 billion for fiscal 2017.