Workday financials: accounting isn't real

"Accounting happens last in our system because accounting isn't real," is hardly the way you'd expect a company to describe a freshly minted financial application, but that's how Mark Nittler, vice president application strategy at Workday is pitching the company's latest offering. While it may sound bizarre, there's plenty of sense in what the company is saying.

Workday is using REA (Resources, Events and Agents), a 25 year old idea to develop modern software. In REA theory, the economic data surrounding accounting entries that gives context to those entries is captured. It goes way beyond simply recording of debits and credits. REA defines a way to capture entire processes or process parts, depending on the extent to which the process designer wishes to develop or expose process. The way Workday has interpreted REA allows them to atomize process objects so they can be assembled to represent pretty much any view a user requires.

Traditional approaches to application development create large databases with increasingly complex dependencies. You only have to read Josh Greenbaum's discussion about Oracle upgrades to recognize the prospect of hefting 2,161,603 columns in the database is not merely daunting but bordering on the insane. Workday has three database tables but makes no use of RDBMS capabilities. Most everything else for both its human capital management (HCM) and now its financial applications are held in a combination of 423 classes and around 40,000 methods inside its Object Management System. It is therefore operating a much simpler design model. That's bound to irritate Oracle which relies on database sales to fuel just about everything else it does. Workday can therefore expect considerable resistance from Oracle shops, especially if it starts to appear on Oracle's radar.

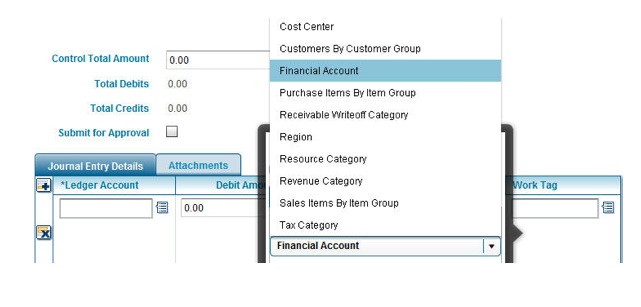

Workday's design, which currently includes a fairly basic tagging system they call Worktags, means that model changes should be relatively easy. The addition of a business unit for example won't require force fitting a coding structure as is usually the case today. More important, users can create taxonomies that are directly relevant to them. In turn, this means Workday can offer its customers a solution that is inherently flexible and agile while in flight, rather than enforcing structures that have to be concreted over as is usually the case.

Unlike a SAP or Oracle sale where there is a significant IT engagement, Workday anticipates appealing directly to business analysts with little initial IT involvement. This is a reflection of the SaaS model but I'm not totally convinced. It may reduce the initial buying cycle but it doesn't address complexity in existing IT environments. Workday knows it will likely need to operate alongside third party applications. That means integration. While the company has baked in a comprehensive integration platform, the fact is it may need to map to brittle and inconsistent data. That's not a great scenario to be working around and one the company admits is currently 'sticky.'

Go to market challenges

Workday's go to market strategy is based around a traditional direct sales channel. Details are fuzzy but Nittler described the ideal customer as:

A services organization that is fast growing, aggressive and wants to do things differently. They will typically have an inherent understanding of technology and may well be part of an emerging networked enterprise. Management will be cognizant of developments like Facebook and will likely have a good feel for things like tags. Anything tech related is going to be a good fit.

The company says its targets are the mid-sized organization trading $500 million to $2 billion and it will offer the service at a starting price of $100,000 per annum. According to my rough estimates which the company confirmed, that means businesses with at least 1,000 employees. If Workday can snag a clutch of these at that price point, they will blow a massive hole in enterprise software pricing models. They won't be alone. SAP is readying A1S for release sometime in 2008. SAP has an entire business model for its offering which, on early glimpses, appears to be much more complete than that coming from Workday. Despite founder Dave Duffield's personal wealth, SAP can outspend Workday any time it likes. At this early stage however, I'm of the opinion there is plenty of business to go around because what both companies have understood is there is a market for organizations that do not wish to invest in 20 and 30 year old software designs.

Nittler says the company is having little trouble recruiting sales people but the proof will come in 6-9 months time when we see the number of takers. At present, Workday has some 20 customers using its HCM solution and has yet to attract takers for financials.

The company makes no secret of the fact it will leverage all the capital it can from Duffield's reputation for looking after customers and that will help it in the short term. However, the current offering is thin. The available modules (see third graphic on Dan's post) represent core services required for this type of application and no amount of glad handing can get away from that. Even so, the roadmap is comprehensive which should give early adopters enough comfort to take the investment risk.

No-one can know for sure whether Workday has hit upon the formula that will define the next iteration in software development. Offering a moderately simple suite that reflects the way people work and which uses a powerful methodology is unquestionably disruptive. As always however, the market will decide. The response, if any, from SAP, Oracle and Microsoft will be interesting.