Xero adds payroll services to cloud accounting suite

Accounting software provider Xero is extending its platform with the launch of cloud-based payroll and tax software.

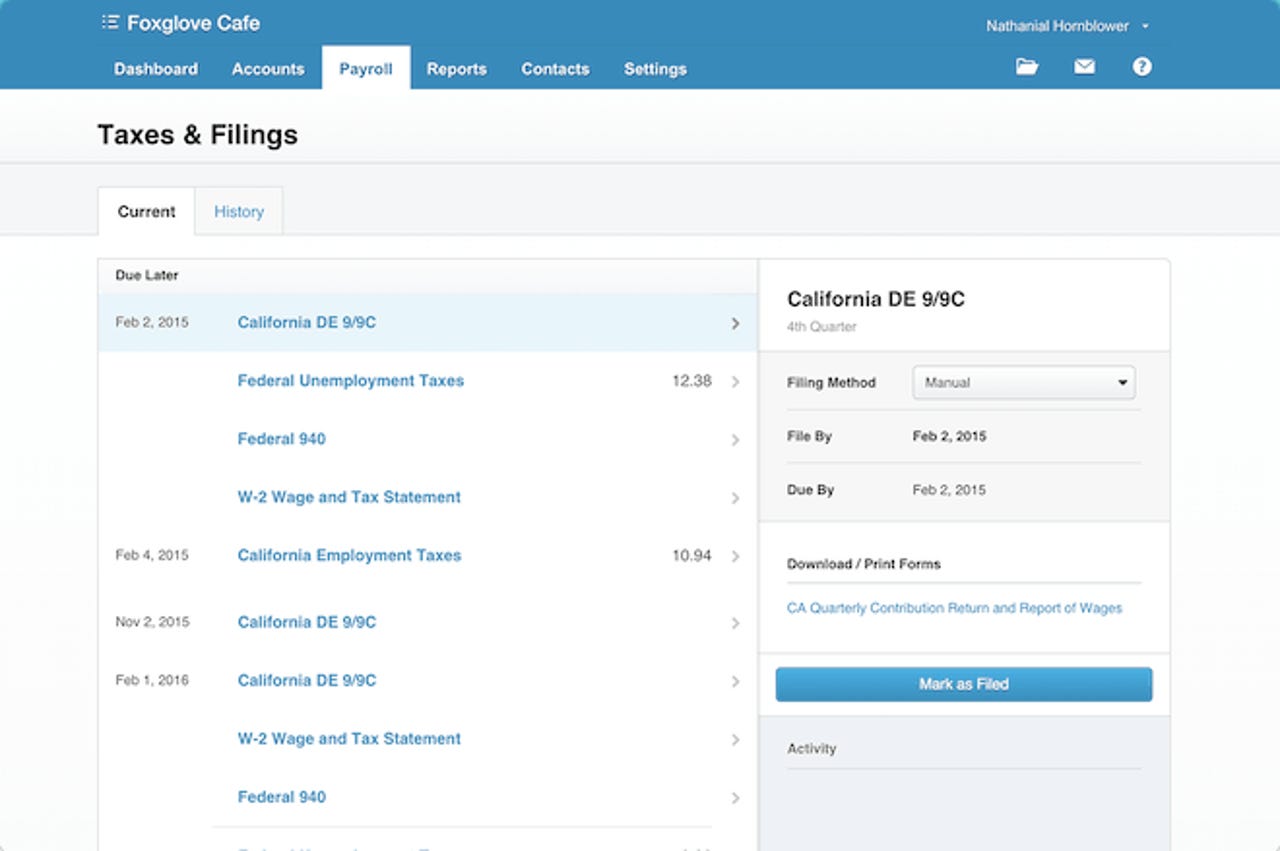

Dubbed Payroll, the service is geared toward the more than 5 million small businesses in the US with fewer than 20 employees. Its features help employers issue payroll, as well as with the electronic filling of state and federal payroll taxes.

Featured

The service integrates with the accounting side of Xero's platform, so users won't have to export information between systems.

This means that when a business runs Payroll, Xero's accounting dashboard will automatically update in real time to show cashflow balance in relation to deducted employee salaries. Other features include integrated timesheets, full Paid Time Off management and payroll scheduling.

With most of its customer base existing outside the US, Xero is hoping the Payroll addition will help it further scale in the region.

"We're building on our success in Australia where we process over AU$1.5 billion of payroll transactions monthly to over 375,000 employees," said Xero CEO Rod Drury. "Plus we're building on the recent acquisition of Monchilla in the US and the scaling of our development teams globally."

At launch, Payroll is available in just three US states - California, Florida and Texas - but the New Zealand-based company said it plans to extend the service to all 50 states by the end of 2015.