Xero launches mobile tax product for freelancers

Cloud accounting software provider Xero is launching a new product aimed at on-demand freelancers like Uber drivers and GrubHub couriers.

Featured

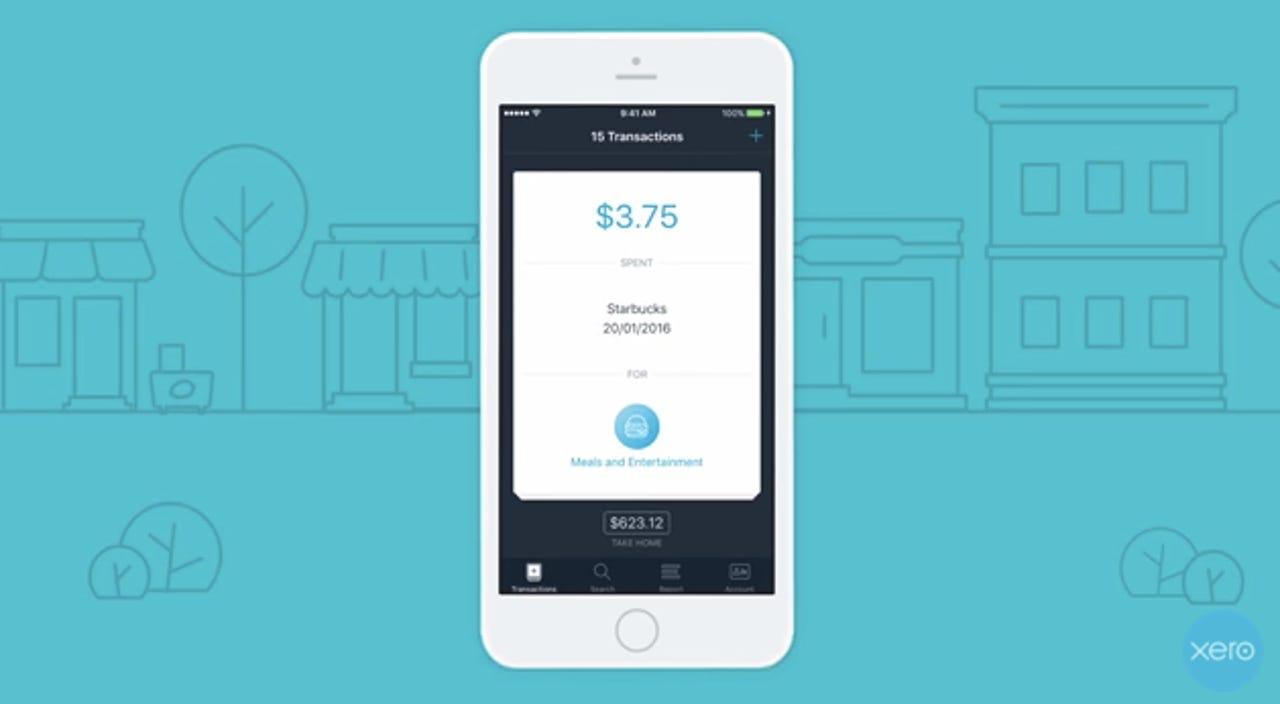

With TaxTouch, users can automatically download bank and credit card transactions and use the data to complete a Schedule C form with their tax filings.

Xero is releasing TaxTouch as an iOS-based mobile app. In a nod to its target user base, TaxTouch prompts users to swipe right to designate something as a business expense or swipe left for a personal expense.

TaxTouch is priced at $5.99 per month or a flat fee of $29.99 for the first year.

For Xero, TaxTouch can be seen as another attempted push into the U.S., where the Australian company's main rival Intuit commands a firm grip on the tax software market.

Intuit already offers a similar product for freelancers and independent contractors that aims to simplify tax details and compliance requirements. Since its launch a year ago, QuickBooks Online Self Employed has gotten quite a bit of attention from its makers as well as industry partners, such as payments processing platform Stripe.

As for Xero's efforts, the company rolled out a payroll service last year for the U.S. market for businesses with fewer than 20 employees. Its features help employers issue payroll, as well as with the electronic filling of state and federal payroll taxes.

In September Xero inked a partnership with Shopify, enabling the platform's online merchants to automatically track their sales and other business financial data using Xero's software.