Yahoo earnings: Revenue down as Microsoft deal rolls out

Yahoo today reported better-than-expected results for the fourth quarter, with display advertising showing growth and content properties gaining ground as the company continues its turnaround efforts.

For the quarter, the company reported net income of $312 million, or 24 cents per share, a 120 percent increase from the same quarter a year ago. Revenue, excluding traffic acquisition costs (ex-TAC), came in at $1.21 billion, a 4 percent decline from the year-ago quarter. Wall Street analysts had been expecting earnings of 22 cents per share on revenue of $1.19 billion. (Statement)

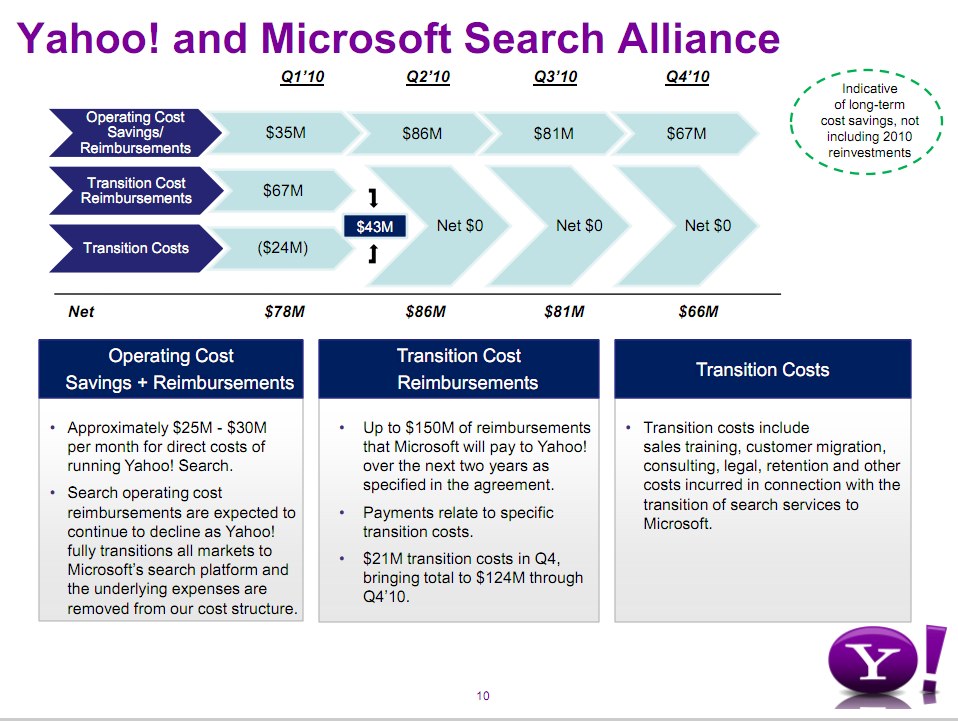

The company attributed the revenue decline primarily on the share it has in place with Microsoft over its search partnership.

In a statement, CEO Carol Bartz said:

We just completed a very encouraging quarter and year for Yahoo!, where we saw our plans to turn around the company gain momentum. For the year, operating income, margins, EPS, and return on invested capital doubled. Display advertising grew 17%. We completed the important North America Search transition to Microsoft on schedule and with high quality. We introduced new and updated products at a faster pace. And our content properties – like Yahoo! Sports and Yahoo! Finance – continued to innovate and extend their massive lead.

On a conference call, Bartz reminded analysts of Yahoo's role in the online ecosystem. Under the Bartz plan, Yahoo becomes a provider of all sorts of different content - regardless of whether that content is news, email, search or even relevant ads - and not only manages it, but also strives to personalize it for the user. She said:

It's what we're best at. It's our place in the online ecosystem. It's who we are... And we do it really really well.

She reminded them that some of these results that they're seeing were expected - and pre-warned - as the transition begins. That process, she said, can take some time. "Whenever you make big changes, as we're doing with the search alliance, you have to give the market time to adjust," she said.

Yahoo still matters - and she pointed to big brand names Wal-Mart and Macys turning to Yahoo to reach targeted markets and Toyota partnering for "an out-of-the box solution to launch the new Avalon."

Responding to a question about job cuts, she said that the company is "absolutely hiring" in 2011 but will do so in areas that fit into the new model. She said the company has been reallocating resources so that right people are working on the right new products and new strategies. She said

We are not cutting costs to grow the company. We are investing to grow the company.

Other highlights:

- Yahoo said the Q4 results reflect $66 million in search operating cost reimbursements from Microsoft under the Search Agreement, which amount is equal to the search operating costs incurred by Yahoo! in the fourth quarter.

- As of Dec. 31, 2010, the company had $3.6 billion in cash and equivalents, down from $4.5 billion at the end of the same quarter a year earlier.

- Yahoo! repurchased 119 million shares for $1.8 billion in fiscal year 2010.

- Earlier today, the company confirmed another round of layoffs.

Shares of Yahoo were down slightly in regular trading, closing at $16.02. Shares continued to decline, down more than two percent, in after-hours trading