AT&T boasts 'record' smartphone sales as Q3 lines up with estimates

AT&T shares started to climb after the telecommunications giant published its third quarter earnings after the bell on Wednesday.

Tech Roundup: 4G

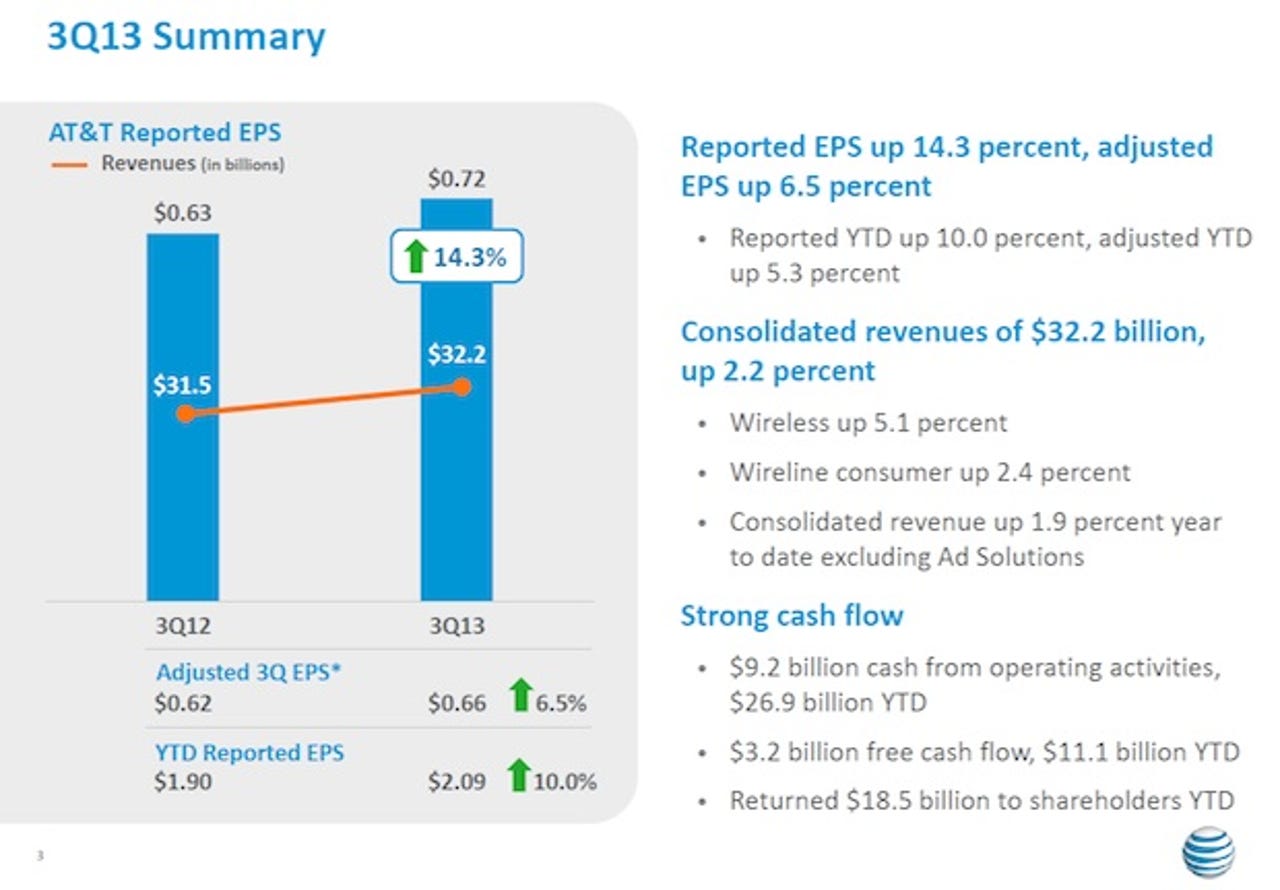

The nation's second largest mobile provider reported a net income of $3.8 billion, or 72 cents per share (statement).

Adjusted earnings were 66 cents per share on a revenue of $32.2 billion.

Wall Street was looking for earnings of 65 cents per share on a revenue of $32.19 billion.

Touting "record" results for both the U-verse and smartphone units, AT&T also affirmed that U-verse is the telco's fastest-growing part of the business.

AT&T added 655,000 high speed Internet subscribers in Q3 with another 265,000 for U-verse TV, turning out to be the second-highest net add quarter ever and the best quarter in almost five years for the department.

With the unit's first billion-dollar revenue month to boot, U-verse's subscriber base now stands at approximately 10 million total for both TV and high-speed Internet service.

On the business customer side of U-verse, AT&T added 97,000 customers for broadband, twice the number additions during the same quarter last year.

Citing 4G service expansion as the primary driver, AT&T added 1.2 million new smartphone subscribers during the quarter.

Overall, AT&T sold 6.7 million smartphones during the quarter, representing 89 percent of postpaid phone sales -- both record stats for the company.

Chairman and CEO Randall L. Stephenson reflected on the quarter in prepared remarks:

We’re setting the standard for 4G LTE speeds and network reliability. Our fiber and U-verse expansion projects are ahead of schedule bringing high-speed broadband to millions more customers. With these initiatives, we’re seeing excellent growth across our major platforms — mobility, U-verse and strategic business services.

Nevertheless, it wasn't all smiles on the Q3 report. Total revenue from business customers declined by approximately 2.6 percent on an annual basis to $8.8 billion. Business service revenues also dropped two percent annually.

However, AT&T tried to put a positive spin on things by declaring legacy product declines were at least partially offset by growth in strategic business services, such as VPN, Ethernet, hosting and other IP services. That side of the business grew grew 15.7 percent annually, representing $8.6 billion in annualized revenue.

For the fourth quarter, Wall Street expects AT&T to deliver earnings of approximately 50 cents per share on a revenue of $33.07 billion.

Slides via AT&T Investor Relations