By the numbers: iiNet and TPG get it on

The most telling chart in the iiNet 2012 financial results, released last Thursday, was the one showing the difference in costs for an on-net and off-net customer. They acquired an extra 167,000 on-net customers last year, each creating a gross margin of AU$34 per month. That's the equivalent of 811,000 off-net customers adding just AU$7 per month each.

A customer using their own DSLAM infrastructure costs iiNet AU$20 per month, half the cost of providing a service to an off-net customer (usually someone connected to a Telstra DSLAM). To make matters worse, an off-net customer provides less revenue potential, because it's harder (or impossible) to sell value added services (like VoiP) when you're using someone else's infrastructure.

The combination of higher costs and lower revenue mean off-net customers create that gross margin of just AU$7. Add on company overheads and it's doubtful that anything at all is made from them.

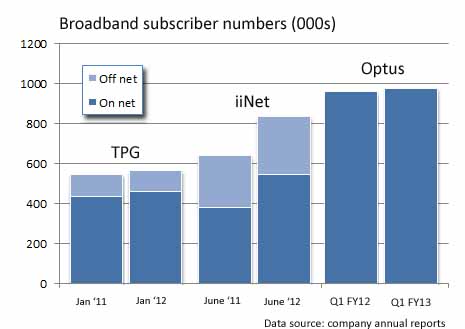

This chart demonstrates how, even though iiNet has grown its customer base — thanks to a company acquisition or two — there are still a lot of off-net customers, pulling down the average margin per customer.

You can also see from the chart that, even though TPG has far less DSL customers than iiNet, they don't fall far short in the number of on-net customers. That makes TPG very well positioned — none of the high costs associated with servicing off-net customers and all the flow-on potential of additional services.

So, whilst iiNet reported another strong result last week (revenue up 19 per cent, EBITDA up 47 per cent) the company faces two challenges going forward. First, it has to reduce the number of customers who are still off-net (still around one third of the total base). Smart localised marketing could help here — focusing on exchange areas where organic customer growth could make the case for a DSLAM investment. They could also buy up strategically positioned local ISPs (who can't be making any money) with customer densities that would push them over the on-net viability tipping point.

The other challenge will be satisfying shareholders that it can deliver customer growth, without acquiring companies. After all, there aren't many left. TPG and Optus, who have mainly relied on organic growth, have shown that they are heading in the right direction, even if growth is slow in a saturated market. There's always the 2.6 million Telstra DSL subscribers ripe for the picking.

If the next year shows slow growth and little movement in the ratio of on-net subscribers, iiNet could lose ground against TPG and Optus. Growth in the next 12 months has to come from clever and effective marketing. I hope Finn is up to it.