Auto industry revamp as a digital business work in progress

The auto industry is being revamped by connectivity and every part of the vehicle buying cycle is being affected, according to a Capgemini report.

The report, Cars Online 2014, is notable because it highlights the intersection of the auto industry, connectivity, the Internet of things and customer experience. The report also shows how a key industry is becoming digital.

A few key points from the Capgemini survey of 10,571 global consumers in 10 countries:

- 79 percent of global consumers say they would buy an automobile with the "right connected services. In the U.S., that percentage is 60 percent.

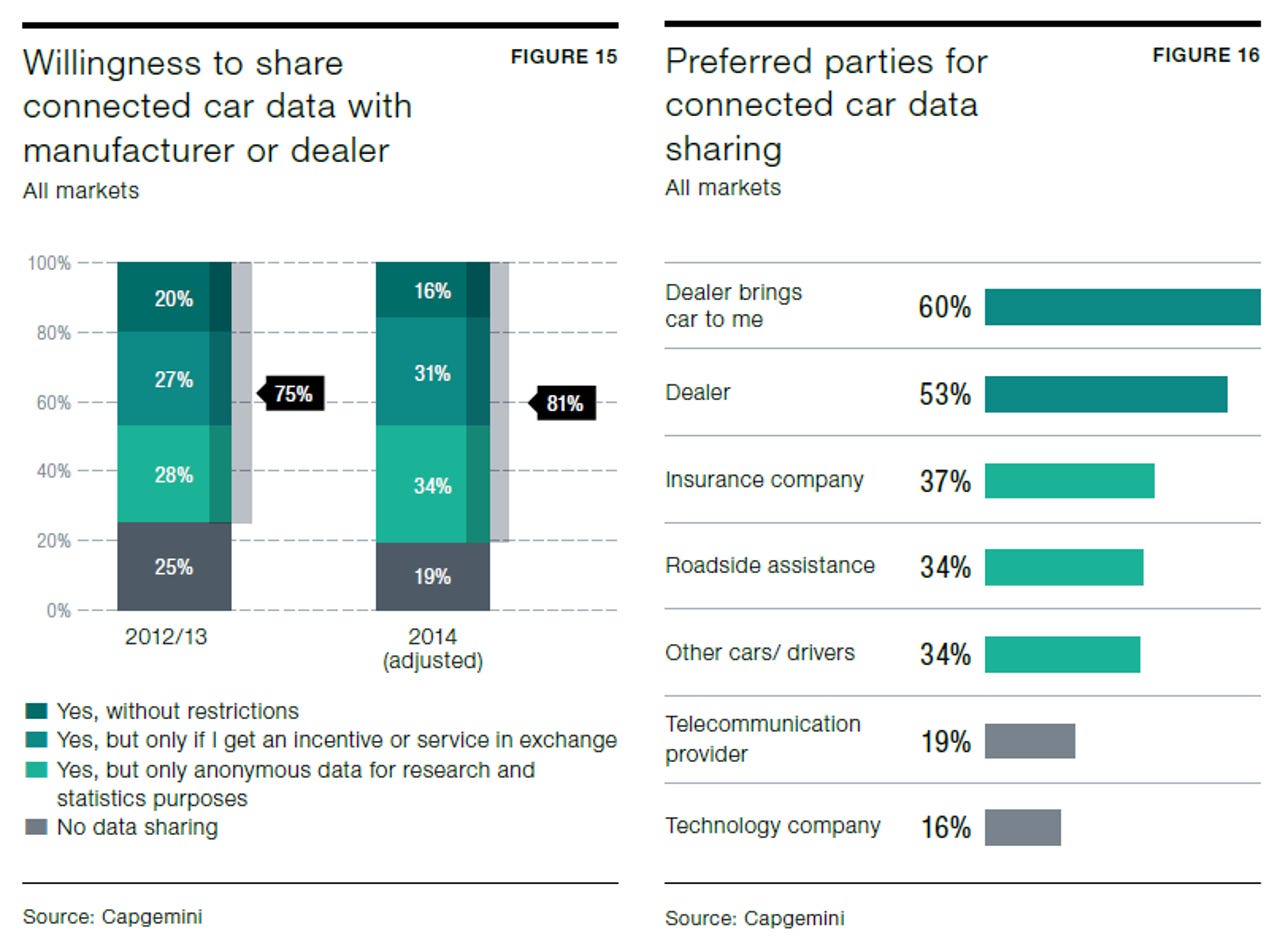

- 82 percent of global consumers and 64 percent in the U.S. are willing to share data from their connected cars.

- 44 percent of global consumers would buy a car online and 34 percent would in the U.S.

- Nearly 100 percent of consumers use the Internet for car research.

- 58 percent of global consumers expect digital services and remote diagnostics from their dealers.

- And 73 percent of global consumers (62 percent in U.S.) are more likely to buy a car if there are positive comments about it on social media.

Here are some observations based on the Capgemini data.

Technology integration and the "right" services matter and automakers are a work in progress. Connected car services are important with driving and safety being a key category (76 percent in mature markets say roadside assistance and automated warnings are important) along with vehicle management (75 percent). It's also worth noting that infotainment---that thing automakers have been yapping about for years---was only important to 44 percent of mature market consumers, but 64 percent in growth markets.

The biggest issues with connected car technology are data sharing and value for the money. Consumers also aren't too keen to share data with technology companies.

The research game. Consumers apparently want 24/7 connectivity when researching, buying and getting support from the auto industry. The catch is that transparency matters and the hard sell may not fly. For instance, only 22 percent of consumers wanted a personal online assistant for a video chat as a Web site option, but 57 percent want retail pricing displayed as well as total cost of ownership data. Google is the gateway to car buying for 52 percent of consumers. In my experience, pricing data, which remains a black box for many auto manufacturers, isn't exactly transparent.

Social media is seen as a lead generation tool. Eighty-five percent of online shoppers expect to interact with manufacturers and dealers on social sites. These consumers want interaction through the buying process. Customer service is also expected. The upshot: The auto industry is going to have to put more focus on social optimization and management.

The dealer model is under fire. Consumers are done with the middleman in the conventional sense and 44 percent of car buyers would buy online. According to Capgemini, 42 percent of buyers would purchase a vehicle directly from a manufacturer and 21 percent would buy from an independent online entity like Amazon.

Total transactions over the Internet are rare. One concept floated was for independent services that would negotiate prices, bring vehicles for test drives and inspect the car. Aggregators and third parties could threaten dealers as does online buying. Capgemini's report noted:

The reasons consumers value dealers remain constant: 72% percent said they visit a showroom to “see the vehicle in real life” and 61% go to test drive a vehicle. A significant number of respondents said they value the product expertise of a knowledgeable dealer (not surprisingly, when that knowledge is lacking, the shopping experience is less than satisfying).