BlackBerry tries to hold enterprise software, services fort; Customers wary

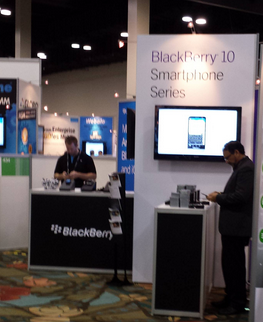

ORLANDO — Stephen Bates, chief of BlackBerry's enterprise software and services unit, had one tough job this week: Convince corporate customers that the company will be around and can be a leading mobile device management player.

You know the BlackBerry tale by now. The device division is a wreck after a new operating system and smartphones failed to become hits. The company announced a horrible quarter. BlackBerry looked like it was in a death spiral, but then Fairfax Financial stepped in with an offer to take it private. Fairfax set a floor in BlackBerry's market value and now rumors abound that enterprise giants are poking around at parts of the company.

"We're going to focus on what we’re good at." —BlackBerry's Stephen Bates

This story could be about BlackBerry's last gasp. It could also be about how BlackBerry's infrastructure will live on and play a big role in the mobile ecosystem even if the company is broken up. No one quite knows at the moment how this saga will play out, but BlackBerry's enterprise rivals appear to be benefiting.

- Good Technology CEO Christy Wyatt said inquiries from BlackBerry customers have surged in recent weeks. "We've seen a massive change in calls in the last two weeks about BlackBerry migrations," said Wyatt.

- AirWatch CEO John Marshall said his small Canadian sales team has seen leads spike since the BlackBerry woes surfaced. "Companies were willing to kick the can down the road on BlackBerry migrations, but that last earnings report scared a lot of people," said Marshall.

- Multiple mobile device management players such as MobileIron and dozens of others are seeing similar inquiries.

Bates' countermove was simple: Talk to as many customers as possible. "We're going to focus on what we’re good at," said Bates. "If we get past this phase we can connect any mobile endpoint and I'm trying to organize the company to make that vision a reality."

"In the meantime, I'm getting fit for the next round," said Bates.

BlackBerry at the moment is talking mobile device management, BlackBerry Enterprise Server 10 and network infrastructure that has security in its DNA. That infrastructure has a still strong installed base and carrier partners on the enterprise side of the mobile equation. "All I can do now is talk to customers that have been using us for years," said Bates.

Also: BlackBerry execs pitch enterprise customers: 'BlackBerry is here to stay' | Consortium offers to buy BlackBerry for $4.7 billion | BlackBerry previews new cloud-based mobile enterprise solution | Gartner: BlackBerry's dead. 'Not yet,' says phone maker | BlackBerry reports $965m loss, thanks to Z10 flop

Customers are rooting for BlackBerry in many ways because they've had a long relationship with the company. However, the upgrade from BES 9 to BES 10 is substantial and inspires tech leaders to look at other options. BlackBerry's corporate woes could not have come at a worse time. BlackBerry launched a cloud version of its device management applications that Bates is optimistic about.

BlackBerry is "just waiting to put the date on the tombstone."

Our informal checks with CIOs indicate that they want to give BlackBerry a chance and some are planning to stick around to see what develops. However, these tech leaders have to plot exit strategies too. Few wanted to go on record.

TechPro Research on this topic: Mobile Device Policy | BYOD Business Strategies - Adoption Plans, Deployment Options, IT Concerns, and Cost Savings | Analyst briefing: Managing the complexity of BYOD with attribute-based access control

There are a few pessimistic customers. A vice president of IT architecture at a financial services company said BlackBerry is "just waiting to put the date on the tombstone."

BlackBerry also has to convince defectors to come back to its mobility software at some point. A CTO at a financial institution said he transitioned away from BlackBerry two years ago. At first it was difficult to convince some heavy BlackBerry users (mainly executives) who loved their physical keyboards to switch, but that reluctance didn't last long, said the CTO. In the end, the move away from BlackBerry made IT look proactive by embracing popular iOS and Android devices.

Gartner Symposium ITXpo

Others executives were more constructive, but actively evaluating options. "BlackBerry is too late. They had the opportunity two years ago to do this," said one exec, referring to BlackBerry's gambit to manage devices. Another exec said he's staying with BlackBerry for now and added that the company's corporate woes will be resolved.

That latter course may make some sense for a few months. BlackBerry's enterprise software business could wind up with an established vendor and do fine. Also note that we're not talking a long waiting period for BlackBerry — the financial outcome of the Fairfax deal or some other option will emerge soon. It has to. And given that CIOs are working out budgets for 2014 it's unlikely they were going to make a major mobile infrastructure bet this minute anyway.

Rumors abound that major enterprise players may be interested in BlackBerry's software and services division. Bates' pitch about BlackBerry managing all sorts of smart devices would be way better if his unit was part of Cisco or IBM.

Bates acknowledges that customers are a bit mixed. "Some are holding and going to wait and see and others are moving," said Bates. "BlackBerry will still be here and could be stronger on the way out."

The competition

One nagging question for BlackBerry is whether its move to manage devices on multiple mobile operating systems is simply a case of too little too late.

Bates noted that the mobile device management market is still in its early stages. "There are billions of enterprise devices," said Bates. He's right and the rows of mobile device management vendors at the Gartner Symposium ITXpo in Orlando show how early it is. Do we really need 100 or so MDM vendors? No way.

Gartner's MDM Magic Quadrant is a bit crowded.

Nearly every mobile device management vendor executive interviewed by ZDNet thinks consolidation will occur. Wyatt also noted that it's very early in the mobility management game.

Airwatch's Marshall said the biggest question mark with the MDM space, and a potential knock on BlackBerry, is ongoing support. "When there are layoffs, support worries follow. The support people left are also looking for jobs," said Marshall.

Bates argued that support will continue and BlackBerry is well established.

Meanwhile, mobile device management is last year's news in many respects. At the Gartner conference, the big word was container. Roughly speaking, a container is software that can keep corporate data segmented and secure from personal items.

Samsung's Knox software is a container that segments personal and work. Samsung's Jae Shin, vice president of the company's Knox business unit, which focuses on the enterprise and securing Android, said the consumer giant's B2B division has 29 pilots underway in corporations and actively targets key verticals — financial services and government — that also happen to be BlackBerry strongholds.

Airwatch's take on container revolves around content and collaboration. Marshall's said MDM is a commodity and content is what matters. In that respect, Airwatch is starting to look more like Box.

Citrix is on everyone's radar as a mobile device management and mobility player. Citrix's focus is on data and applications. The approach from Citrix is to bring virtualization approaches to mobility via its Receiver software. Citrix has also layered in collaboration tools.

Sunil Potti, vice president and general manager of Citrix's cloud networking group, said the company's mobility tools are becoming more of an architecture consideration. Potti said MDM is table stakes and the mobility win is apps, productivity tools and protecting data. "Our focus is on the apps and data," said Potti.

When asked about the competition, Citrix said VMware, Airwatch and even Box are today or could be mobility rivals.

The catch is that Citrix's approach will require constant connections over mobile networks to work well. The approach from Citrix is strong assuming networks cooperate.

As for Good, the pitch is that the company has been around for a long time and right now looks very stable relative to struggling BlackBerry. Good also manages multiple devices and platforms.

Bates acknowledges the competition, but argues BlackBerry's security DNA makes it different. BlackBerry's response to the container buzzword is its Balance software. Bates said Citrix is an interesting mobile device management player and Microsoft can always matter given its resources.

BlackBerry's biggest MDM issue will be if the mobility market moves closer to the collaboration approaches eyed by Citrix and Airwatch.

The shrapnel over devices

Perhaps the biggest challenge for BlackBerry's enterprise mobility management efforts is distancing itself away from a device unit that's nearly worthless.

As Bates spoke at the Gartner powwow to ZDNet, a BlackBerry device was on the table along with an iPhone. BlackBerry's software executives make a point to say they have iPhones and carry around other devices. After all, BlackBerry is hoping to see as the go-to manager of all mobile platforms.

The problem: BlackBerry is associated with its devices business, which has imploded. Would those BlackBerry Enterprise Server deployments be in corporations if BlackBerry devices weren't handed out like Chiclets from companies' years ago? Probably not. "Crackberries" enabled the company to build a healthy back-end software and services business.

It's also unclear whether BlackBerry infrastructure can stick around if there are no devices on the other end. The MDM market is crowded to say the least and BlackBerry's real ambition — manage new device categories connected to the Internet of things---will take years to unfold.

CIOs deciding to keep BlackBerry infrastructure will also have a tough sell ahead even if they want to help Bates' cause. CEOs and CFOs read the headlines. These executives also used to carry BlackBerry devices and now tote iPhone and iPads around. Years ago, a CIO would never be fired for buying BlackBerry. Today, a CIO would have to convince the higher ups that BlackBerry has staying power no matter what form it ultimately takes.

Bottom line: BlackBerry's stability — even though it has no debt — is an open question largely due to its device business. The challenge will be to make sure the enterprise software and services unit doesn't get tarred by those Z10s that never sold.

TechPro Research's Bill Detwiler contributed to this report.