Will Apple split its stock?

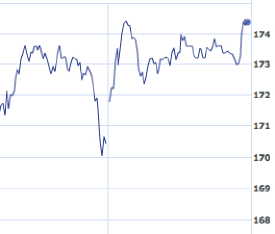

Apple Q4 results announced on Monday were beyond the inflated expectations of analysts and in after-hours trading the stock price rose to a new high: $184.39, up from the Nasdaq closing record of $174.36. The company reported revenues of $6.22 billion, up from $4.84 billion in the year-ago quarter.

Apple sold more than 2 million Macs, a 34 percent growth over last year, although the growth rate for iPods was 17 percent. Still, gross margins are up almost 5 percent.

The company's stock price has climbed almost $100 this year. Usually, companies like to have the stock prices where ordinary investors can buy into the stock with an easy-to-calculate 100 shares.

A Forbes.com story earlier in the month quoted one analyst as saying Apple could do a 3-for1 split. That isn't impossible. That would put the price more in the affordable range.

The last two-for-one split of Apple stock was in February, 2005. During that year, the stock rose from 21.89 to as high as 81.99. That marked the rise of the iPod and the introduction of the Apple Music Store.

Before that, the previous stock split was in June, 2000.

In its Monday press release, Apple highlighted that international sales made up some 40 percent of the quarter’s revenue. But it neglected to point out that Apple Japan still is a sore spot. Only 72K Macs were shipped there in the quarter. A decade ago, the Japanese market was strong, selling more than 200K units per quarter (or so I remember).

I pinged a buddy of mine living in Tokyo and he had a few fun observations about the Mac in the Japanese market. This computer consultant declined attribution.

"The Apple Stores in Tokyo, Ginza and Shibuya, always have a disproportionate number of non-Japanese in the store. I don't believe they reflect the real retail market in Japan very well," he said. "The big-box electronics retailers do carry Macs, so the channels are there regardless."

However, he mentioned to the greater success selling Macs that Eiko Harada, the former general manager of Apple Japan, is having now that he's out of the company. He moved from selling Mac technology to running Japan's Golden Arches fast-food joints. Check out the new McPork and 4-pattie Mega Mac.

"The McGriddles are the a horrible 180-degree turn from what is probably the world's healthiest breakfast tradition — miso soup, broiled fish, vegetables and a small bowl of rice," he bemoaned.

However, he said that Harada's earlier sales problem may be due to Apple's tight grip on the development reins.

"I don't know what the financial arrangement is with the US McDonalds, but one big difference with Apple is that the Japanese fast-food operation is likely an independent company. This gives them freedom to create local product, something Apple absolutely does not do," he said.