Shrewd moves: Will Adobe's 90 percent price drop on its media server wag the Flash dog?

In case you missed the episode of the Dan & David Show that my colleague Dan Farber and I recorded this past Tuesday (early, because Dan is off to Taipei), one of the news bits we discussed was Adobe's 90 percent price drop on its high-end Flash Media Server. It wasn't until we brought the topic up in the middle of the podcast that the ramifications of that price drop really hit me.

In other words, as markets go, FMIS was really only available to a small niche of customers with a lot of money to spend. Now that the price of FMIS has been slashed by 90 percent (to $4500), that niche could easily grow. When you realize at who's expense, it isn't hard to see that price drop for the brilliant power play that it really is.

For I don't know how long, Adobe's Flash has dominated the market as the go-to platform for delivering rich content to the desktop. Many of the original implementations (by content providers) delivered animation to end-users. Earlier this decade, when we invented something called the Internet X-Ray here at ZDNet (case studies that animated business processes and data flows on the networks of end-user corporations like UPS), Flash was the only developer solution on the market that could accommodate our needs. It didn't hurt to know that most of ZDNet's readers had the plug-in that was needed to consume the content. The Flash plug-in is on more desktops than any other plug-in, ahead of Sun's Standard Edition of the Java Runtime Environment (JRE) which never was a real contender for delivering Flash-type content. As platforms go (platforms that developers would target), only Microsoft's Windows enjoyed more ubiquity.

In terms of total global footprint though, Java has reigned supreme thanks to the presence of its Mobile Edition (JME) in handsets. Invariably, in public appearances, Sun CEO Jonathan Schwartz is always quick to remind his audiences that when most Internet users experience the Internet for the first time, it will be through a handset (phone, PDA, smartphone, and now, other devices like Amazon's Kindle) and how Java's presence in more handsets than developer platform greatly increases the odds that Java will play some role in most Internet user experiences. This point invariably leads Schwartz to the logical conclusion that lots of Sun-built Java infrastructure will be sold as a result, the profits of which will accrue to Sun (although I should point out that Sun's competitors such as IBM and HP have solutions that can also scalably drive large Java-based user populations).

One challenge for Sun (and Java) however is that more and more of those first time Internet experiences are rich in nature. They're either rich applications (now called Rich Internet Applications or RIAs) that involve lots of animation and graphics or they involve the delivery of video and or audio. Today for example, there's a lot of video getting delivered to handsets in a way that bypasses Java altogether. It's a spectrum of content and applications that Java was never really well-suited to. At least from the content developers point of view. But Flash is. Not surprisingly, in recognition of its market disadvantage from a functionality point of view (and looking to leverage its existing relationships and dominating global footprint), Sun is looking to fill the gap with a much more Flash-like version of Java called JavaFX. Conversely, in an effort to attain the same sort of global footprint that Java has across desktops, notebooks, and handsets, Adobe wants in on the handset business and is now driving hard on a mobile edition of Flash called Flash Lite.

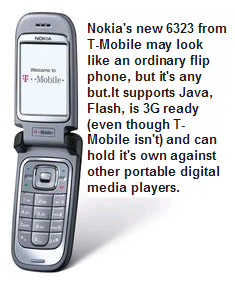

The results of this battle (where Sun and Adobe are coming from their relative positions of strength)? Handsets like the Model 6263 that Nokia just unleashed through T-Mobile may look like your run of the mill handset, but they're anything but. The 6263 has both the mobile Java and Flash Lite platforms built-into it. Not only that, even though T-Mobile doesn't yet have its HSDPA high-bandwidth 3G network in place for pumping all that rich content and applications (rich content and apps that could be consumed by either the Java or Flash runtimes on a phone), the phone is 3G-ready for when that day comes. The phone is also a music machine, supporting stereo music as well as the stereo wireless headset profile of Bluetooth and it has a microSD slot for expanding its memory.

I'm not saying that this is the only device of its sort on the market. But, clearly, we're at that tipping point where ordinary looking clam shell handsets like the 6263 are anything but ordinary. They can simultaneously support 3 distinctively separate Web applications platforms (Java, Flash, and one that I failed to mention: XHTML for Web browsing) and can connect to wireless broadband networks -- making them capable of doing most anything on the Internet and doing most of it pretty well.

But with both Java and Flash looking to steal the other's thunder (and let's not forget Microsoft, who with Silverlight, will want to join the party and probably can given how robust handsets like the 6263 are getting), who is going to win?

Enter the 90 percent price drop on Adobe's Flash Media Interactive Server.

It's a shrewd move by Adobe but it makes perfect sense if, now that Sun and Microsoft are both presenting market threats to its Flash platform, it wants to leave nothing to chance in terms of that platform's popularity. By dropping the price so dramatically on the high-horsepower version of Flash Media Server, Adobe is making it accessible as a rich content delivery platform to thousands if not hundreds of thousands of rich content providers -- especially providers of video and audio -- who might never have invested in those servers before.

In true wag-the-dog fashion, provided the price drop works and content providers buy-in, Adobe's $40,500 per server price cut will not only help guard Adobe's existing global Flash footprint (those considering Java or Silverlight for their applications will really have to think twice), it could help improve it by driving up the amount of Flash-based content being served up through the Internet which in turn will drive adoption in Adobe's weakest spot: mobile. For example, how many more Flash-based content providers would it have taken for Apple to realize it had no choice but to support Flash in the iPhone?

Shrewd move Adobe. Very shrewd.