A closer look at Microsoft's "lost decade"

Last week, everyone who normally covers technology became a stock market expert. At least for a day, while they marveled over Apple's market capitalization, which passed that of Microsoft for the first time. That inspired the predictable wave of Apple-versus-Microsoft posts, along with an amazing amount of advice for Microsoft CEO Steve Ballmer on what he needs to do to "turn the company around."

Now, I don't claim to be an expert on the stock market and I don't offer investment advice. But I do know how to read a stock chart and how to compare the performance of publicly traded companies in the same industry. And after looking at the evidence, I'm amazed at the number of people who got this story completely wrong. Yes, the first 10 years of the 21st Century have been a lost decade for Microsoft shareholders (including its employees), but that's been true of the entire PC industry during that time. If your big company makes PCs or PC components, your last 10 years have probably sucked, too.

The most egregiously wrong-headed analysis I've read in the past few days came from Jean-Louis Gassée, who was an executive at Apple during the 1980s and is now a venture capitalist. After the obligatory reference to Apple's market cap, Gassée argues, at length, that Microsoft's stock-market performance is a crushing indictment of Ballmer's management skills:

Over the last decade, Wall Street has declined to reward Microsoft for its superior profit. The explanation is simple: Professional investors don’t believe Ballmer, and they don’t see bigger profits in Microsoft’s future. [...] January 2000 was when Steve Ballmer was made CEO of Microsoft. Yes, we can discount the year 2000, that’s when the Internet Bubble burst causing most high-tech shares to collapse. Still, since the end of 2000, Microsoft stock has stagnated, hovering between $25 and $30.

And indeed, if you look at Microsoft's stock chart for the period in question, you see a nearly flat line, up only about 6%. The analysis is a little more favorable if you use the proper measure, adjusted closing price, which accounts not just for splits but for dividends and distributions. If you invested $1000 in Microsoft stock on January 2, 2001, and reinvested all your dividends, you have roughly $1,468 today, or a 47% return over nearly 10 years. By contrast, $1000 in Apple stock purchased on the same day is now worth $34,526.88, for a return of more than 3300%.

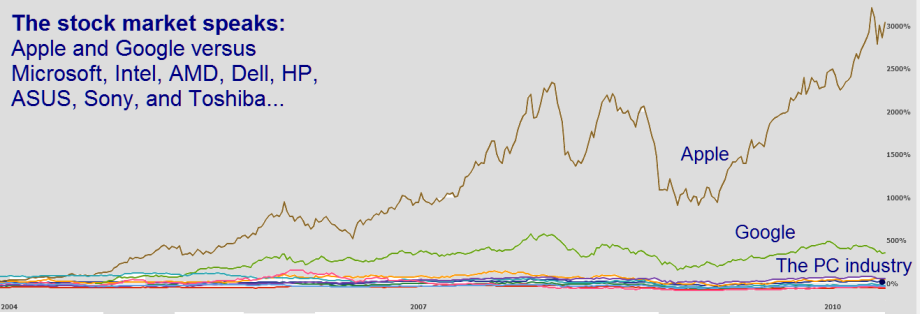

But that simplistic analysis misses the real story, which is the PC industry in general. Here's a chart that explains the story quite crisply. It starts in 2004 and runs through last week. The top line is Apple, the one in the middle is Google, and that cluster of flat lines at the bottom represents Microsoft and its biggest OEM and chip-making partners: Dell and HP, Acer and ASUS, Sony and Toshiba, Intel and AMD.

It's no accident that the two tech companies that have performed best in recent years are several steps removed from the commodity PC business. Right at the midpoint of Apple's spectacular growth curve, in 2007, the company famously dropped the "Computer" from its name and became just Apple, Inc. Meanwhile, all those companies that build and sell PC hardware, components, and operating systems have been butting heads in a business characterized by commodity products and low margins. If you take Apple and Google out of the picture, here's what the stock-price chart (adjusted for splits but not for dividends) looks like up close. The green line at the top is Nvidia; everyone else is clustered neatly around the 0% line:

Still too hard to tell? Maybe a close-up will help. That big blue dot in the middle is Microsoft, with some of the biggest manufacturers of PCs and PC parts just above and below it.

Over the "lost decade" that began in 2001, IBM and HP have outperformed Microsoft modestly in terms of adjusted returns, up 65% and 70%, respectively, compared to Microsoft's 47% return. Nvidia was delivering Google-like returns for a while but has since given much of those gains back. Still, at 163% it's the best performer of any company in the PC industry over the past ten years. Meanwhile, the chipmakers are way, way down. If you bought Intel or AMD in 2001, you've lost 20% and 40%, respectively. Your Dell stock took a 24% haircut, and Sony stock has lost more than half its value (53%) in that time.

It's easy to pick on Ballmer's performance and especially easy to identify the big mistakes and the missed opportunities. But it's hard to argue credibly that he has failed at his number-one job, which has been to keep making a profit on Microsoft's enormous core businesses of Windows and Office. Back at the beginning of the decade, Steve Jobs decided to transform Apple into a high-end consumer electronics company. Moving away from the commodity PC business was one of many smart decisions Jobs made with Apple. Ballmer didn't have the luxury of giving up on the PC business, which meant that Microsoft's attempts to move into other markets were often halfhearted and poorly thought out. But even after that lost decade, Microsoft is more profitable than Apple, whether you measure in raw numbers or by profit margin.

Meanwhile, it takes a certain amount of panache (and perhaps some amnesia) on the part of M. Gassée to criticize Ballmer's performance. This is, after all, the guy who left Apple in 1990 to found Be Inc. Six years later he turned down Apple's offer to buy the company, reportedly for an amount between $110 million and $200 million. In 2001, Be Inc. closed its doors, and Palm, Inc. wound up buying the company's assets for $11 million. Now that's a lost decade.