Amazon earnings: A solid quarter but still no Kindle sales numbers

Amazon today reported first quarter earnings that beat Wall Street's estimates but investors may be concerned about forecasts for the second quarter and sent shares back down in after-hours trading.

For the first quarter, the company saw a 68 percent year-over-year gain in net income, which came in at $299 million, or 66 cents per share, on revenue of $7.13 billion, a 46 percent jump from the year-ago quarter. Analysts had been expecting earnings per share of 61 cents on sales of $6.8 billion. (Statement)

In its statement, the company once again points to Kindle as its "#1 bestselling product" but once again fails to provide any sales figures on the device - something that is becoming increasingly more relevant with the arrival of the iPad and the expectation that other tablet devices will be landing soon. In a statement, CEO and founder Jeff Bezos said:

We remain heads-down focused on customers. Amazon Prime has just celebrated its fifth anniversary, adoption of Amazon Web Services continues to accelerate, Kindle remains our #1 bestselling product, and earlier this week, Kindle selection reached 500,000 titles.

In a conference call, the company reminded analysts that the revenue reflected a change in accounting as it relates to Kindle sales - Amazon recognizes a substantial portion of a Kindle sale as hardware, recognizing it immediately - impacted the results. Likewise, this was the first full quarter with Zappos in the mix.

Looking ahead, the company forecast second quarter revenue to come in between $6.1 billion and $6.7 billion, a gain of 31 percent to 44 percent, compared to a year ago. Wall Street had been expecting an revenue forecast of $6.42 billion - a miss, in the eyes of Wall Street.

By the numbers:

- North America segment sales were $3.78 billion, up 47 percent from the year-ago quarter.

- International segment sales were $3.35 billion, a 45 percent jump from a year ago.

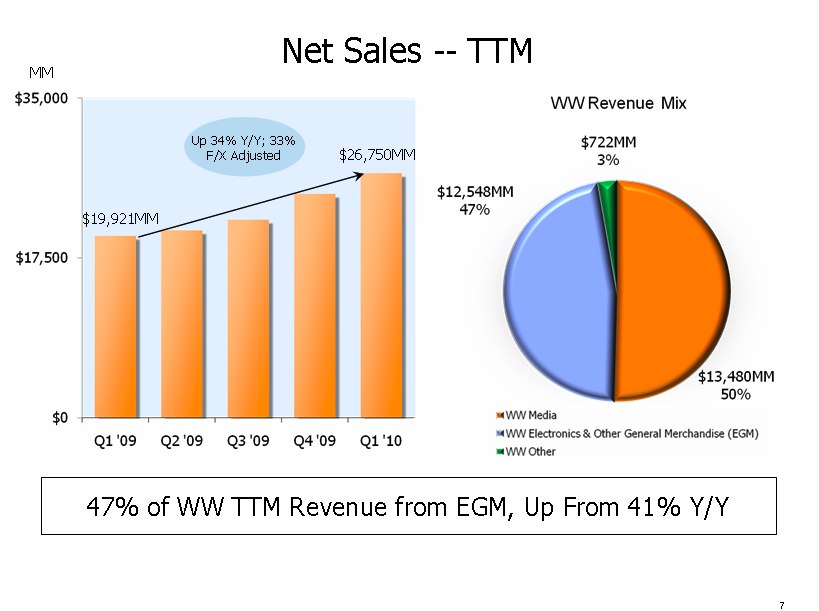

- Worldwide Media sales were $3.43 billion, up 26 percent.

- Worldwide Electronics and Other General Merchandise sales were $3.51 billion, a 72 percent jump.

Shares of the company were up more than two percent, closing at $150.09. Shares immediately dipped after the results were announced. (see chart)