Amazon earnings: Strong Q4 on holiday season sales

A day after Apple announced a new device that some say goes right at the heart of the Kindle e-reader, Amazon - the maker of the Kindle - reported fourth quarter net income of $384 million, or 85 cents per share, up from 52 cents a year ago. Revenue was $9.52 billion, a 42 percent increase over the year-ago quarter. (Statement)

Wall Street analysts had been expecting earnings of 72 cents per share on revenue of $9.01 billion.

During the quarter, which included the holiday season, the company said that November was its "best sales month ever" and that the Kindle was the "most gifted item ever" on Amazon.com. The company has yet to break out hard numbers for Kindle says, leaving all references vague, including in a prepared statement issued by Amazon founder and CEO Jeff Bezos today:

Millions of people now own Kindles. And Kindle owners read, a lot. When we have both editions, we sell 6 Kindle books for every 10 physical books. This is year-to-date and includes only paid books -- free Kindle books would make the number even higher. It’s been an exciting 27 months.

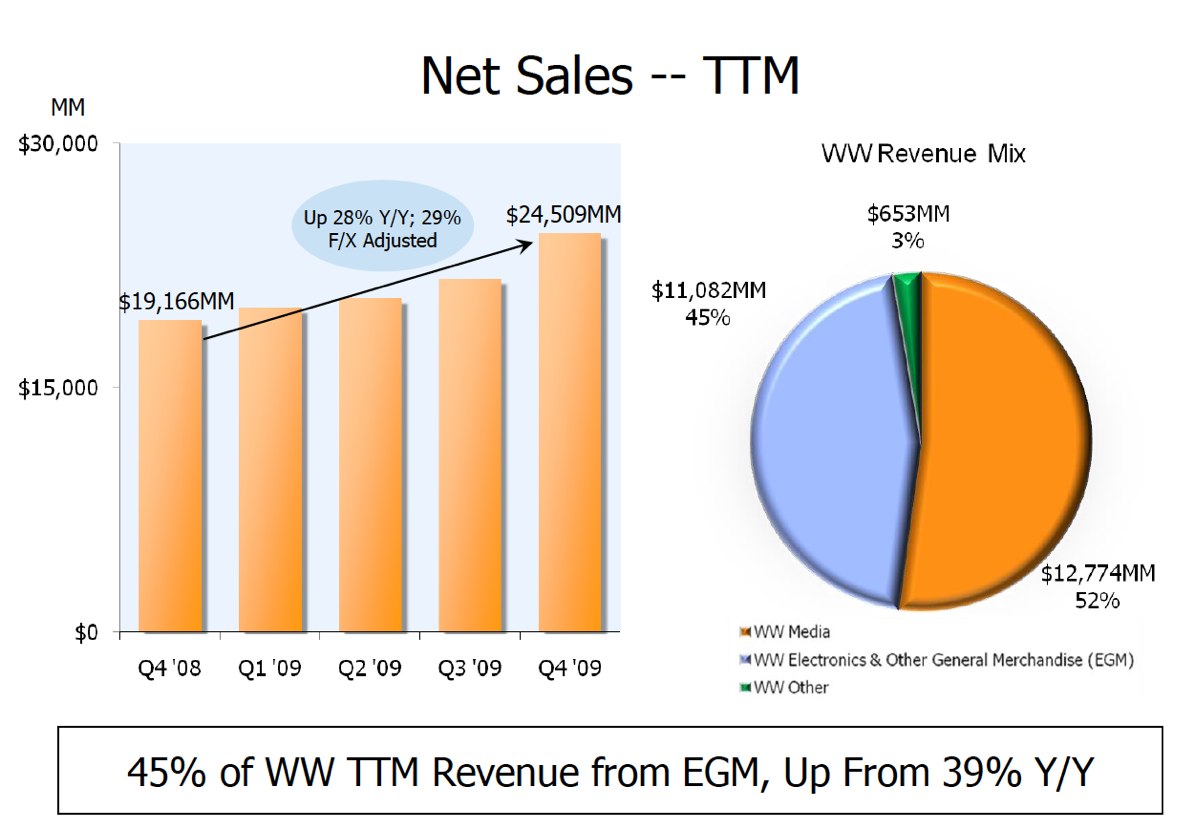

For the full year, the company reported earnings of $2.04 per share on net sales of $24.5 billion. Looking ahead, the company's first quarter forecast is between $6.45 billion and $7 billion, an increase of 32 percent to 43 percent over the year-ago quarter.

In addition, the company announced a $2 billion stock buyback, replacing a $1 billion buyback that was authorized in 2008.

During a call with analysts, the company said it was utilizing a change in the accounting standards as it relates to how it counts revenue for the Kindles, which are tied to wireless and software services. This is similar to a change that Apple also announced in its most recent earnings quarter, as it related to the iPhone for that company. Simply, Amazon will now recognize a substantial portion of a Kindle sale as hardware, recognizing it immediately. A small portion, reflecting the software and wireless, will continue to be recognized over two years.

The accounting change is in effect as of Jan. 1, which means the guidance reflects changes to the accounting, include $500 million in deferred revenue that would have been part of the older revenue recognition model. The company has maintained that it will not be breaking out sales of Kindle separately. During the last quarter call with analysts, Bezos - who was not on today's call - was asked what threshold the company might have to cross before it starts sharing specific sales numbers on Kindle. His answer, which really wasn’t much of an answer, was that when something gets to a certain size, it makes sense to break out the numbers by countries.

The iPad's impact on the Kindle is obviously still an unknown and will be for some time, as the iPad won't even hit shelves until near the end of the current quarter. And the company confirmed that Apple will continue to support the Kindle app for the iPhone. Piper Jaffray analyst Gene Munster issued a report this morning that said the two products can co-exist. He writes:

... we believe the iPad and Kindle can comfortably coexist for the next year given their different functionality and price points. We've taken a look at the iPad and believe Amazon's Kindle is superior as a dedicated reading device because of its eInk technology, whereas Apple's iPad is better suited as a multimedia device. That being said, we believe the devices will compete more directly in 2011 as their functionality evolves and prices come down.

Analysts have noted that Amazon has a nice head start in the e-reader game, which is still relatively young, but that Apple could emerge as Amazon's first real competitor. And we should remind everyone that the iPod, which has more than 70 percent share of the mp3 market, wasn't the first mp3 player. Other analysts have questioned whether a stock buyback is the right use of cash, considering that the company should be using it to invest in advancing the Kindle to stay competitive. The company reported free cash flow of $2.92 billion for the quarter.

Among the other highlights from the release:

- Worldwide Media sales grew 29% to $4.68 billion. Excluding the favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, sales grew 23%.

- Worldwide Electronics & Other General Merchandise sales grew 60% to $4.61 billion. Excluding the favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, sales grew 54%.

- The Company completed its acquisition of Zappos.com on November 1, 2009. Zappos.com contributed approximately $200 million to fourth quarter revenue.

Shares of Amazon were up more than 2 percent in regular trading, closing at $126.03. The company will host a call with analysts this afternoon.